Surface Transforms plc (LON:SCE) has provided a brief pre-close and operational update. Revenue for 2021a grew by 20% to £2.4m (2020a: £2m and versus guidance of “under £3m”). Gross cash was a healthy £13m (in line) but with drawdown for further capex spend due shortly. On the production ramp-up, the Group has reported that daily assembly volumes have reached management targets. The specific production issue on the furnace described in the announcement on 14 December has been fixed, with “satisfactory” production batches produced in late December and January. Recent contracting news has been positive with Surface Transforms announcing in December a £45m contract award with existing customer OEM 6. This award brings the total order book from major customers to over £115m. We calculate that the annualised run-rate for sales, when all current contracts fully kick-in, will be c.£20m, with a net margin of 25%-30%. As with scaling-up of any manufacturing operation there is execution risk, but Surface Transforms is firmly on-track to becoming a profitable volume supplier to OEMs. Our DCF-based valuation is 85p. Full results are due in April.

Trading update – Revenue for 2021a grew by 20% to £2.4m (2020a: £2m and versus the Zeus estimate of £2.8m, and guidance from the Group of “under £3m”). Cash at the year-end was £13m; however, this includes a £3.1m letter of credit for a furnace manufacturer which will be progressively drawn down as manufacturing milestones are met. Other interest-bearing loans and asset finance were £1.8m (2020a: £0.7m). A solid performance in a transitional year.

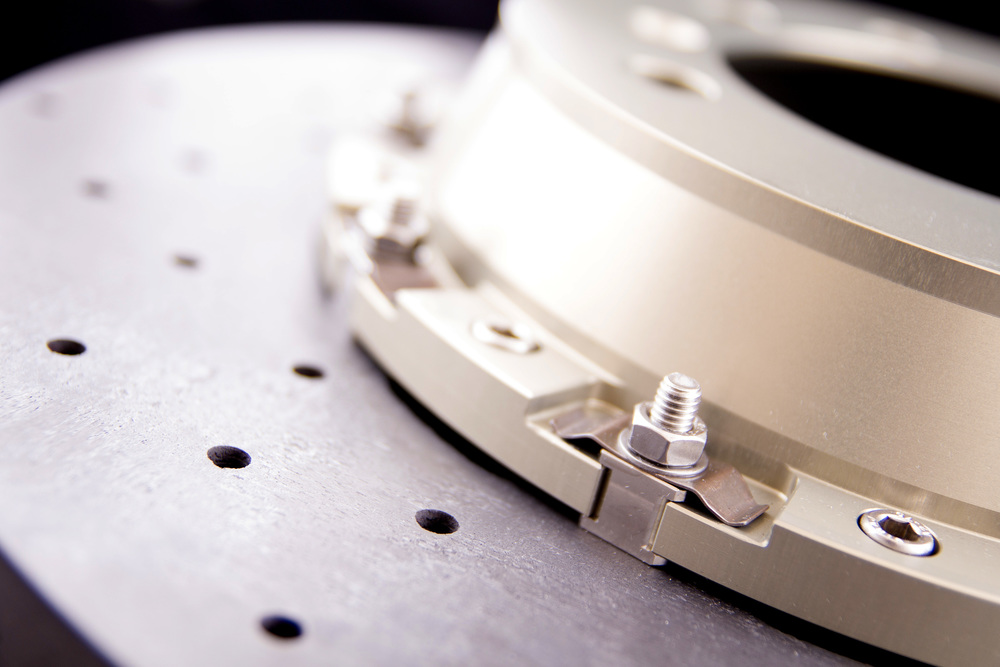

Furnace issues fixed – Surface Transforms has addressed the specific production issue on the furnace described in the announcement on 14 December 2021. Several satisfactory production batches have now been produced, in late December and January. Generally, by the end of January daily assembly volumes had reportedly reached management targets. We have discussed this issue with management and the run-rate mentioned is in line with our expectations. The production ramp-up to fill new contracts is now in line with management targets and manufacturing activity will continue to build through Q1 and Q2 2022e.

There are no updates on customer activity and contracts at this time, but we expect to hear more details at the full results event. There are also no changes to Zeus estimates pending the full statement.

Planned Capital Markets Day at Knowsley factory – Surface Transforms intends to invite shareholders to see the new manufacturing equipment on-site at a Capital Markets Day to be held shortly after the full 2021a results have been announced.