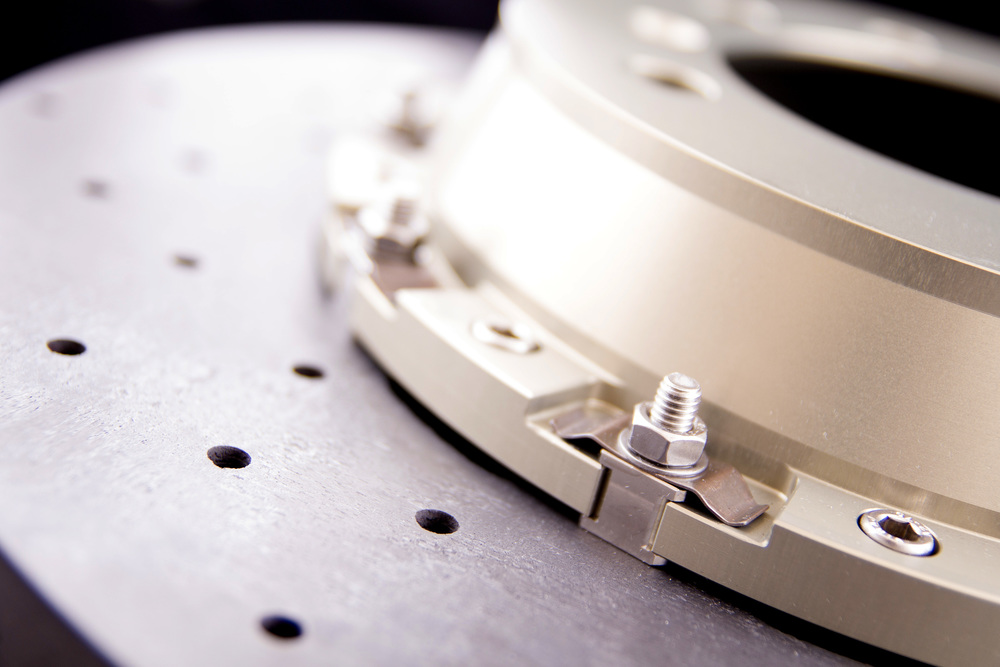

Surface Transforms plc (LON:SCE) manufacturers of carbon fibre reinforced ceramic automotive brake discs, has announced the following unaudited trading and operations update for the year ended 31 December 2025.

Trading update

· Revenue – increased circa 120% to £18.0m (FY24: £8.2m) representing further ongoing improvement with a record second half revenue of £9.9m, up from £8.1m in the first half of 2025.

· Operating loss before interest and tax- reduced nearly threefold to approximately £8.7m (FY24: £23.4m), with second-half losses improving significantly to £3.5m (H1-25: £5.2m loss).

· Gross cash – £1.0m1 as at year end (FY24: £0.5m) which continues to be actively managed.

· Capital expenditure – increased to £8.6m (FY24: £6.1m) with the £13.2m ERDF loan now fully utilised for capital investment in line with management expectations.

· Outlook – revenue expectations of approximately £27.0m for FY26.

· Customer prepayments – £13.3m at the year end, marginally higher than the £12.9m as at 30 June 2025.

1 Includes £0.2m restricted for capital expenditure

Operations update

The Company has continued integrating new equipment, automation, and process improvements during Q4 25. As expected, this temporarily impacted yield, which was 77% in Q4, up from 70% in Q3 and a marked improvement from 49% in Q1. This was below management’s internal 80% target which remains for Q1 2026. The range of weekly yield performance continued to improve during the second half, indicating that the transformation and experience applied to the issue is taking effect. Except for additional furnace capacity, all major improvement programs are now nearing completion, and no further significant changes are planned in the near term. Installation and commissioning of the new furnace is well advanced, and it is expected to be operational by the end of Q2 2026, supporting increased revenue and production output thereafter.

Summary and outlook

FY25 has been a transformative year, marked by substantial progress in scaling production and improving processes. The business has moved meaningfully closer to substantial and profitable operations, with materially higher output and revenues. Demand for our product remains strong. While challenges persist, customers are encouraged by the improvements underway. Cash remains tight but manageable.

Surface Transforms is well positioned for growth in 2026, and management expects to deliver FY26 revenue of approximately £27.0m with an EBITDA breakeven.