CyanConnode Holdings plc (LON:CYAN) has announced a non-binding Memorandum of Understanding (MOU) with IntelliSmart, a partially state-owed entity that is at the centre of the smart meter rollout programme in India. Under the terms of the MOU, CyanConnode will utilise its hybrid RF/cellular technologies for existing and new IntelliSmart smart meter contracts amounting to millions of units. In the context of the Indian Government’s programme to deploy 250 million smart meters, this is likely to be a leap forward for CyanConnode in securing a significant share of the Indian opportunity. Our DCF-implied equity fair value is £71.8m (equating to £0.38 per share).

- Support for Indian utilities: IntelliSmart was formed by EESL and the National Investment & Infrastructure Fund (which has $4.5bn under management) to support the Indian utilities with the financing, procurement, deployment and operation of smart metering infrastructure. EESL is itself a JV between four of the largest Indian power companies.

- Smart meters still to deploy: We estimate IntelliSmart has in excess of ca.10 million smart meters still to deploy from existing contracts, of which up to 3 million may require CyanConnode’s RF mesh connectivity to meet service level agreements (SLAs). At conservative pricing assumptions, 3 million units equate to ca.$50m of revenue.

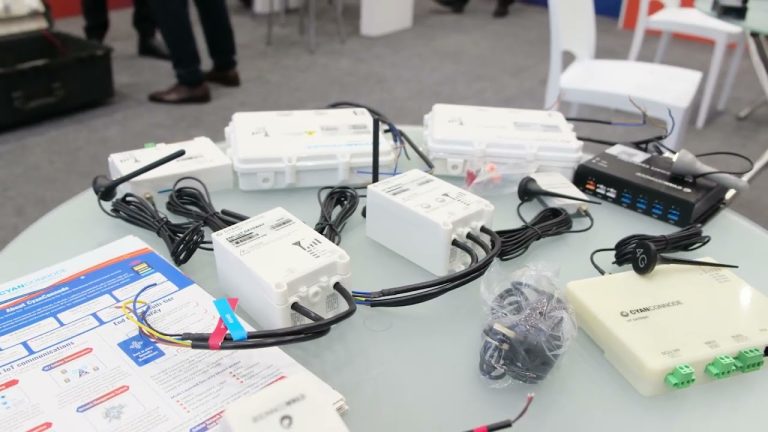

- Successful implementations: Cyber security concerns have resulted in an aversion on the part of the Indian Government to physical devices manufactured in China. In addition, it transpires that few smart meter technology providers are meeting stringent connectivity SLAs. CyanConnode has delivered many successful implementations.

- Provision of capex funding to utilities: An important aspect of IntelliSmart’s role is the provision of capex funding to utilities in order that large-scale smart meter rollouts can be funded on an opex basis, i.e. per meter per month. Removing the upfront capex burden will help to accelerate the pace of the overall programme.

- Investment summary: Our FY’22 revenue estimate of £8.83m is based largely on existing contracts. The announcement confirms that the Indian business continues to perform in line with expectations, despite the COVID-19 escalation in India in recent months. The IntelliSmart relationship will contribute to revenue in FY’22 and beyond. Our DCF-implied equity fair value is £71.8m, versus the current market capitalisation of £15.1m.