India’s power sector is undergoing a transformative shift, with smart meters at the forefront of this evolution. As the nation accelerates its adoption of advanced metering infrastructure, investors are presented with a compelling opportunity to engage in a rapidly expanding market poised for significant growth.

The Indian government’s ambitious goal to install 250 million smart meters by 2027 is a testament to its commitment to modernising the energy sector. This initiative, part of the Revamped Distribution Sector Scheme (RDSS), aims to enhance grid efficiency, reduce power theft, and provide consumers with real-time energy consumption data. As of October 2024, approximately 117.7 million meters have been sanctioned, with 14.5 million already installed, indicating substantial progress and a robust pipeline for future deployments.

The financial implications of this rollout are substantial. The smart meter market in India is projected to reach USD 3,179.5 million by 2032, growing at a compound annual growth rate (CAGR) of 34.57% from USD 219.7 million in 2023. This growth is driven by the need for efficient energy management, reduction of aggregate technical and commercial (AT\&C) losses, and the integration of renewable energy sources into the grid.

Key players in the industry are capitalising on this momentum. Companies like IntelliSmart are actively installing millions of smart meters across the country, while others are exploring innovative financing models to support large-scale deployments. The integration of smart meters is also facilitating the development of smart grids, enabling better demand response, load forecasting, and integration of distributed energy resources.

For investors, the smart meter revolution in India offers a multifaceted opportunity. Beyond the immediate hardware installations, there is potential in software development for data analytics, cybersecurity solutions to protect grid infrastructure, and services related to customer engagement and energy management. Additionally, the push towards smart metering aligns with global sustainability goals, making investments in this sector not only financially rewarding but also socially impactful.

India’s aggressive push towards smart metering is reshaping its energy landscape, offering investors a dynamic and lucrative avenue for engagement. The convergence of government policy, technological advancement, and market demand positions the smart meter sector as a cornerstone of India’s energy future.

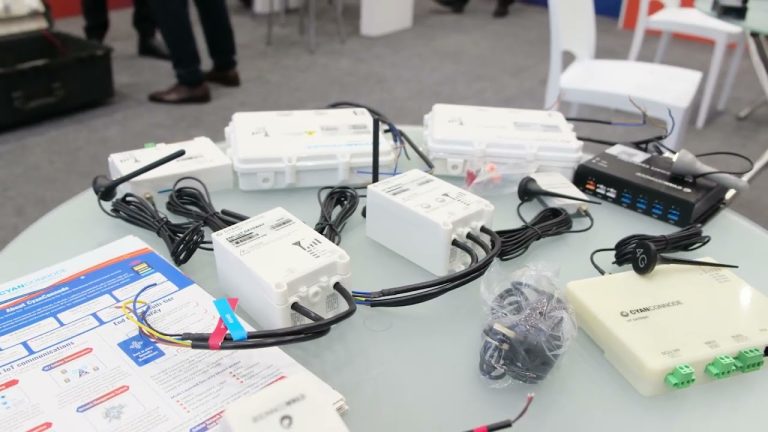

CyanConnode Holdings plc (LON:CYAN) is a world leader in the design and development of Narrowband RF mesh networks that enable Omni Internet of Things (IoT) communications.