India’s move to modernise electricity infrastructure is gaining momentum as a state government announces a phased rollout of smart power metres. Rather than a sweeping deployment, the plan carefully replaces conventional meters with smart variants in selected zones, aiming to streamline implementation, maintain grid stability, and offer consumers real‑time insights into their electricity consumption.

Under this approach, traditional meters will be substituted gradually, beginning with areas deemed high priority, such as those with billing irregularities or frequent outages. This segmentation allows utilities to focus resources effectively, monitor progress, and fine‑tune the system before broader expansion. From an investor’s lens, the step‑by‑step rollout offers prudent risk management: it facilitates phased capital expenditure and provides performance checkpoints signalling whether the programme is meeting targets in data accuracy, customer adoption, or regulatory compliance.

Smart metres, integral to this infrastructure modernisation, transmit half‑hourly consumption data to providers and display near‑real‑time usage to households. This transparency empowers consumers to make tactical energy choices, reducing peak usage, responding to variable tariffs, and spotting inefficiencies. For utilities and regulators, benefits include enhanced billing precision, improved demand forecasting, quicker fault detection, and better integration of renewables. Over time, these capabilities can translate into lower operating costs, tighter margins, and potentially new revenue models linked to smart services.

Still, this phased method also hints at macroeconomic advantages: by avoiding wholesale infrastructure replacement, governments and utilities can smooth out investment cycles and reduce dependency on upfront subsidies. This is especially relevant since central grant support under schemes like the Revamped Distribution Sector Scheme (RDSS) often comes with caps or timelines. A staggered rollout aligns better with grant disbursement schedules and allows for benchmarking across regions to optimise cost efficiency.

The policy also recognises the importance of consumer readiness. Gradual deployment enables time for stakeholder engagement, educating customers, addressing privacy or cybersecurity worries, and building the channels needed for effective meter-to-consumer feedback loops. Early adopters will essentially serve as pilot cohorts, their experience refined before the transition reaches larger populations.

That said, phased implementation is not without its complexities. Intermittent coverage may generate temporary disparities in data sophistication across regions, and careful energy accounting will be required during the transition. Regulators will need robust oversight to ensure tariff consistency and confirm that early‑phase regions are delivering promised outcomes before moving on.

Nonetheless, the long-term picture is compelling. Upgraded infrastructure paves the way for smart grid capabilities, dynamic tariff models that encourage peak load shaving, and potentially a decentralised energy economy supported by distributed generation such as rooftop solar. Investors may perceive opportunities not only in telecom integrations and data analytics but also in the new services layer built atop these smart metres, whether in predictive maintenance, energy-efficiency advisory, or even peer-to-peer energy trading over time.

By methodically rolling out smart metres, the utility sector is embracing a path that controls risk, enables proof-of-concept at scale, and optimises public funding. It is the groundwork for an evolved energy network offering both operational gains and new customer-facing services. Early indicators from initial deployment zones, on metrics like consumption patterns, demand flexibility, and grid reliability, could be reliable predictors of broader rollout success.

This phased metering upgrade systematically replaces old metres with smart ones, equipping homes and businesses with devices that report energy usage every half hour and relay data in real-time. It improves billing accuracy, helps detect grid faults faster, and gives consumers tools to manage electricity costs more actively.

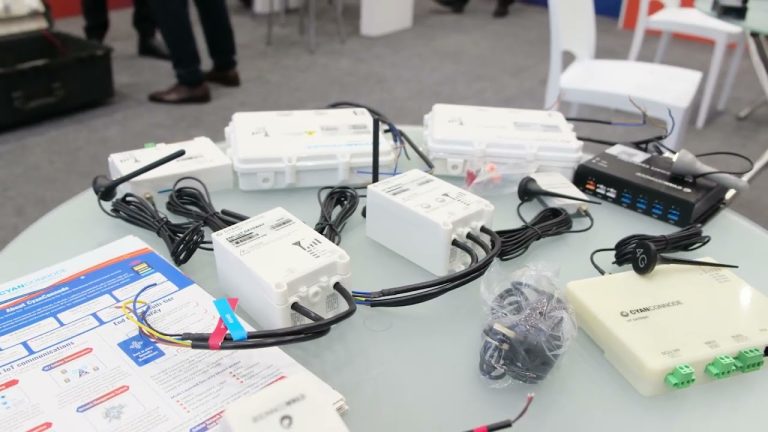

CyanConnode Holdings plc (LON:CYAN) is a world leader in the design and development of Narrowband RF mesh networks that enable Omni Internet of Things (IoT) communications.