A quiet shift in India’s power distribution landscape is gathering pace, ushering in a wave of network modernisation that promises to redraw the lines between utility management and investor opportunity. In the background of policy deadlines and procurement cycles, a confluence of financing, technology partners and regulatory nudge is setting the stage for a transformational upgrade, one that could redefine value in India’s sprawling electricity sector.

The story begins with a government mandate that seems innocuous at first glance: the phased installation of smart meters across urban and rural distribution networks. Yet behind each metre lies a network of data flows, revenue assurance mechanisms and consumer engagement channels that utilities have long struggled to optimise. With targets now firmly in sight, distribution companies are racing to secure partnerships that deliver both reliability and scale. In Goa, for instance, a recent agreement has emerged as a bellwether for how state regulators and private suppliers can converge to meet national electrification goals while opening avenues for capital providers to take a stake in the modern energy ecosystem.

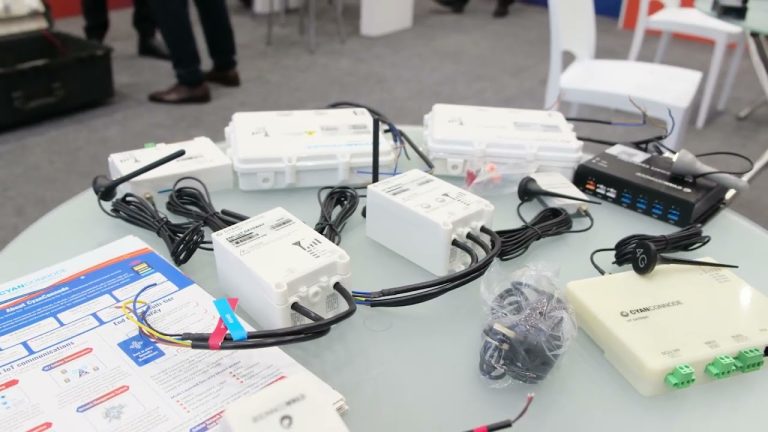

At the heart of this movement are technology enablers specialising in radio frequency mesh systems, low-power wide area networks and edge connectivity that bridge meter endpoints with central control centres. These systems address the perennial challenge of reaching dispersed consumers, from high-rise blocks in Mumbai to remote hamlets in the Himalayas, without the prohibitive costs of dedicated cellular links. One such specialist has just secured project finance to underpin its operational rollout in Goa, illustrating how private equity and debt instruments are now being marshalled to de-risk what were, until recently, pilot undertakings. By aligning repayment schedules with the phasing out of manual meter readings and the onset of data-driven billing cycles, financiers are carving out investment products tuned to the cash-flow profiles of distribution utilities.

What makes this transition especially compelling for long-term investors is the interplay between policy certainty and technology maturity. New regulations stipulate that all consumers must migrate to prepayment or smart billing arrangements by a fixed date, and industry sources suggest that compliance levels in several states are already surpassing initial projections. More than compliance, however, this push is reshaping the revenue line items for utilities, reducing losses from pilferage and manual estimation, a chronic pain point in many regions. As smart meters begin to relay interval data in near real time, utilities gain the ability to segment load curves, offer dynamic tariffs and even explore demand response mechanisms that were previously the preserve of more developed markets.

The funding structures behind these ventures warrant close attention. In Goa’s latest contract, a consortium of lenders has underwritten the full capital expenditure for network rollout, while technology providers have agreed to performance-linked fees. This model shifts the bulk of implementation risk away from state utilities, creating a framework where technology partners and financiers share the upside of improved operational efficiencies. For investors, the key takeaway lies in the replicability of this template across other states, each with its own mix of consumption patterns, regulatory nuances and grid-loss baselines.

Beyond the direct implications for electricity distribution, the smart-metering acceleration has knock-on effects across India’s broader infrastructure finance landscape. Project bonds, green financing instruments and blended-finance vehicles are all being repurposed to support what is effectively a national efficiency drive. As environmental, social and governance criteria assume greater prominence among international fund managers, the carbon-reduction narrative bolsters the appeal of financing energy-use optimisations at scale. Furthermore, with smart meters enabling granular carbon accounting at the consumer level, new compliance markets could emerge for utilities or retail electricity providers catering to corporate clients with stringent sustainability targets.

From a technology standpoint, open standards and interoperability are emerging as potential differentiators in contract awards. Utilities are scrutinising proposals not just on price per meter installed, but on the long-term agility of data platforms, cybersecurity protocols and integration with existing supervisory control systems. Vendors that can demonstrate field-proven mesh networks, robust edge analytics and seamless cloud-based dashboards are capturing the lion’s share of tenders. In parallel, state-level pilot projects have begun exploring applications beyond billing, such as fault detection, outage management and even integration with distributed renewable generation, underscoring the broader digitalisation trajectory.

In the months ahead, attention will turn to how quickly other states replicate Goa’s funding approach, how technology vendors navigate the shift from pilot schemes to large-scale deployments, and how utilities leverage real-time data to introduce differentiated tariffs or value-added services. The unfolding of this ecosystem will offer investors fresh entry points across the project finance, equity and secondary debt markets, all anchored to a regulatory roadmap that, for once, shows few signs of wavering.

CyanConnode Holdings plc (LON:CYAN) is a world leader in the design and development of Narrowband RF mesh networks that enable Omni Internet of Things (IoT) communications.