GSK plc and IDRx, Inc. has announced that they have entered into an agreement under which GSK will acquire IDRx, a Boston-based, clinical-stage biopharmaceutical company dedicated to developing precision therapeutics for the treatment of GIST. Under the agreement, GSK will pay $1 billion upfront, with potential for an additional $150 million success-based regulatory approval milestone payment. The acquisition includes lead molecule, IDRX-42, a highly selective KIT TKI being developed as a first- and second-line therapy for the treatment of GIST.

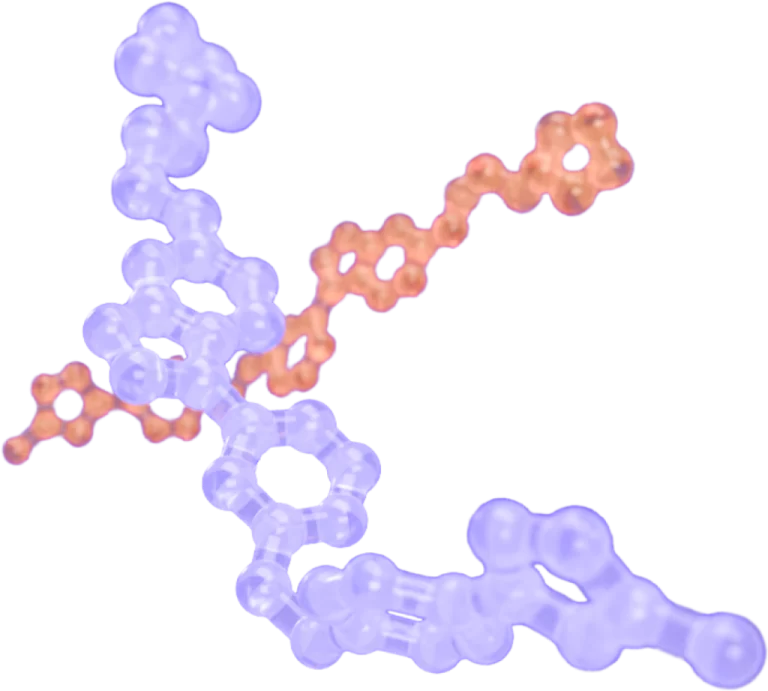

· Acquisition includes IDRX-42, a highly selective KIT tyrosine kinase inhibitor (TKI) designed to treat gastrointestinal stromal tumours (GIST)

· IDRX-42 offers potential to address all key KIT mutations in GIST that drive tumour growth and progression and improve tolerability, gaps in current therapies

· Acquisition adds to GSK’s growing portfolio in gastrointestinal (GI) cancers

· GSK to pay up to $1.15 billion

GIST typically presents in the GI tract with 80% of cases driven by mutations in the KIT gene that lead to the growth, proliferation, and survival of tumour cells (primary or activating mutations).1 90% of patients treated in the first-line develop new KIT mutations (secondary or resistance mutations) that typically lead to relapse with limited therapeutic options.2 Currently, there are no approved TKIs that inhibit the full spectrum of clinically relevant primary and secondary mutations in KIT.

IDRX-42 has demonstrated activity against all key primary and secondary KIT mutations, designed to improve outcomes for patients with GIST. This breadth of mutational coverage, in addition to high selectivity which could improve tolerability, provides potential for a best-in-class profile.

Luke Miels, Chief Commercial Officer, GSK, said: “IDRX-42 complements our growing portfolio in gastrointestinal cancers. This acquisition is consistent with our approach of acquiring assets that address validated targets and where there is clear unmet medical need, despite existing approved products.”

Tony Wood, Chief Scientific Officer, GSK, said: “We are excited by the early data from IDRX-42 and its unique ability to target all clinically relevant KIT mutations present in GIST, a major gap in the current standard of care. We look forward to accelerating its development in 2025 to redefine treatment.”

Updated clinical data from StrateGIST 1, an ongoing phase I/Ib trial of IDRX-42 in patients with advanced GIST, were presented in an oral presentation at the Connective Tissue Oncology Society (CTOS) 2024 Annual Meeting. These data show promising anti-tumour activity of IDRX-42 in patients with advanced GIST with a manageable safety profile. Across patients with second-line or greater GIST, and amongst all KIT mutation subsets, the objective response rate (ORR) by modified RECIST v1.1 in the total efficacy evaluable population was 29% (n=87), including one complete response (CR) and 24 partial responses (PRs). Amongst patients who have had one prior line of therapy, the ORR was 53% (n=15) including one CR and 7 PRs.3

Across all patients, two of the PRs were awaiting confirmation at the time of the data cut, both of which were subsequently confirmed. The emerging durability data from StrateGIST 1 was also favourable. IDRX-42 was generally well-tolerated and treatment-related adverse events (TRAEs) were mainly low grade at the recommended phase Ib dose.4

Tim Clackson, CEO, IDRx, said: “We are looking forward to working with GSK to advance IDRX-42 for patients with GIST given there have been no major advances to the standard of care for almost 20 years. Combining our experience to date with GSK’s expertise in GI cancers, global clinical development capability, and strong commercial presence in oncology will help to accelerate the development of this novel medicine for patients.”

GSK has a growing portfolio in development targeting the significant medical need in GI cancers, including ongoing trials with dostarlimab and GSK5764227 (GSK’227), a B7-H3-targeted antibody-drug conjugate. This agreement reflects GSK’s portfolio approach of identifying potentially best-in-class molecules with targeted mechanisms of action. The transaction supports GSK’s ambitions for growth through 2031 and beyond.

Financial considerations

Under the terms of the agreement, GSK will acquire one hundred percent (100%) of the outstanding equity interests (including all options and other incentive equity) in IDRx for up to $1.15 billion of total cash consideration, comprising an upfront payment of $1 billion with potential for an additional $150 million success-based regulatory approval milestone payment. GSK will also be responsible for success-based milestone payments as well as tiered royalties for IDRX-42 owed to Merck KGaA, Darmstadt, Germany.

This transaction is subject to customary conditions, including applicable regulatory agency clearances under the Hart-Scott-Rodino Act in the US.

For IDRx, Centerview Partners LLC is acting as exclusive financial advisor and Goodwin Procter LLP as legal counsel. For GSK, Leerink Partners LLC is acting as the exclusive financial advisor.