CyanConnode Holdings plc (LON: CYAN), a world leader in narrowband radio frequency (RF) mesh networks, has announced its unaudited interim results for the six months ended 30 September 2025 (H1 FY 2026).

John Cronin, CEO, commented:

“This has been a successful period for the business. In April, we secured our first Advanced Metering Infrastructure Service Provider (AMISP) contract to deliver a major smart metering rollout in Goa – our largest contract to date – which nearly doubled our contracted order book to £157 million at 30 September 2025. This milestone win has significantly increased our scale and strengthened our ability to win additional AMISP contracts, alongside ongoing subcontracting opportunities. In India alone, our Serviceable Obtainable Market (SOM) is £231 million.

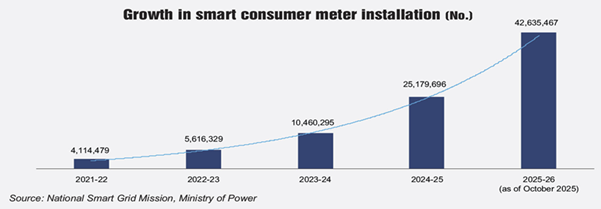

India is our largest market, and the Indian Government remains very focused on reversing approximately $15 billion lost annually to electricity theft and inefficiencies. To address this, the revised national smart metering programme (RDSS), launched in 2022, is now accelerating, as shown in the graph below. This is creating a positive tail wind which is reflected in our revenue performance up by 32% in the period to £7.4 million (over 40% on a constant currency basis).

We also strengthened our financial position by raising $15 million through two convertible loan notes, supporting both working capital and our ability to win further contracts. Outside India, performance remains strong, including winning a £1.2 million cellular gateways order in the Middle East and North Africa.

With 17 live smart metering projects and revenue generation from the Goa project expected to begin in earnest shortly, the business is well-positioned for sustained growth through the remainder of FY 2026 and into FY 2027.”

Financial Highlights

· Revenue grew to £7.4m (H1 FY 2025: £5.6m), driven by increased shipments of hardware

· Gross profit of £1.9m (H1 FY 2025: £2.3m), reflecting a lower gross margin of 25% versus 41% in H1 FY 2025, due to lower software and services revenue as a proportion of revenue (8% versus H1 FY 2026 20%) and to lower than usual pricing on certain contracts agreed in anticipation of new higher margin products coming through such as FG28 module, cellular modules and In-Meter Gateways, which have significantly lower costs. The Group is targeting overall project margins of upwards of 35% following commencement of deployments using the new products, with this margin varying across the course of each project (driven by lower margin hardware being shipped in the first two years of a project). With the use of In-Meter Gateways, gateway installation and maintenance costs will be substantially reduced.

· Increase in operating costs from £4.4m in H1 FY 2025 to £5m in H1 FY 2026, driven by £0.9m of foreign exchange losses in translation of accounts

· Operating loss of £3.0m (H1 FY 2025 loss: £2.1m), driven primarily by the £0.9m of foreign exchange losses

· Cash received from customers of £7.4m (H1FY 2025: £7.3m)

· Cash and cash equivalents at end of period £1.6m (FY 2025: £3.7m). In addition, £6 million is held in a fixed deposit at ICICI Bank in London, securing an overdraft facility in India for the same amount.

Operational Highlights

· £70 million AMISP contract won in April 2025 from the Government of Goa

· Under an innovative agreement with a sector specialist multi-national contractor in July, the Goa contract has been fully funded and resourced without any further capital requirements from the Group

· £157 million Group order book as of 30 Sept 2025

· 893,000 Omnimesh Modules were shipped compared with 377,000 in the same period in the prior year, reflecting strong market momentum

· £1.2 million follow-on order secured for cellular gateways in the Middle East and North Africa (MENA) region

· $15 million raised through two convertible loan notes for $7.5 million each supporting the Group’s working capital requirements and ability to pursue further contract tenders

· Chair and CEO roles separated with the appointment of Bjorn Lindblom as Non-Executive Chairman increasing Board independence and enabling John Cronin to focus more on his operational role as Group CEO

Post-Period Highlights

· In November, successfully raised $5.25 million through a convertible loan note, to provide additional capital for use as deposits for AMISP contract tenders

· Key operational metrics remain positive, with Q3 2026 shipments of Omnimesh Modules positioning Cyanconnode well for sustained growth through FY 2026 and beyond

CEO’s Statement

Introduction

I am pleased to present our results for the first six months. It has been a successful period for the business with the Company’s contracted order book standing at £157m at the end of the period. In India the Government’s determination to reduce electricity theft and roll-out its national smart metering programme is creating positive trading conditions for CyanConnode, evidenced by the sharp increase in Omnimesh Modules being shipped to customers and the 32% increase in group revenue versus the same period last year. Winning the £70 million AMISP Goa contract and subsequently securing full funding and resourcing for the project may well come to represent an important inflection point for the business marking the start of a period of long-term expansion. To that end, in India alone, the Group is pursuing a mix of potential AMISP and sub-contractor communications projects worth approximately £231 million.

India

Market

The Indian smart metering market, the Company’s principal focus, continues to demonstrate strong growth, with over 40 million smart meters deployed across various states as of October 2025.

The government’s long-standing target to deploy 250 million smart meters under the Revamped Distribution Sector Scheme (RDSS) remains the primary driver of the market. As of mid-2025, approximately 223.7 million consumer smart meters have been sanctioned under the RDSS.

While the RDSS experienced a slower pace of installation than initially anticipated, and the scheme’s completion date has been revised to 2027-28, additional efforts have been made to accelerate progress. The Union Budget 2025-26 allocated approximately £1.32 billion to support ongoing infrastructure upgrades and meter deployments. In addition, the basic customs duty on smart meters was reduced from 25% to 20%, easing the cost burden on both Distribution Companies (DISCOMs) and manufacturers.

Installation rates have improved significantly from an average of 11,000-12,000 meters per day, to a milestone pace of 80,000 meters per day in January 2025, with expectations to reach 100,000 meters per day, as recently reported by the Ministry of Power. The increase in installation and further funding commitments provides a significant opportunity for suppliers, whilst the extended RDSS timeline to 2027-28 provides better medium-term visibility for CyanConnode.

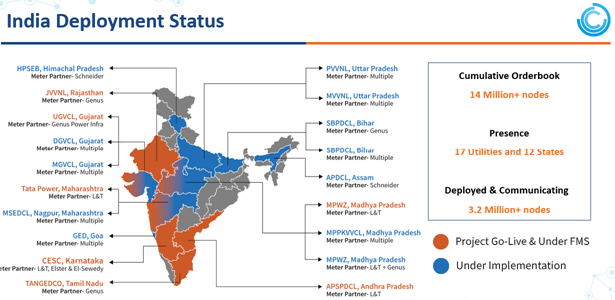

Sub-contractor for smart metering projects

CyanConnode currently has 17 projects where it is acting as a sub-contractor providing smart metering communication systems. During the period, shipments of Omnimesh modules increased sharply to 893,000 compared with 377,000 in the same period last year. This is a clear indicator of operational momentum, reflecting the rate of smart meter installations across our projects.

The Company is well placed to bid for further smart metering projects as a sub-contractor providing communication systems and is targeting an estimated £45 million worth of these project overs the next 18 months.

AMISP (Advanced Metering Infrastructure Service Provider)

In May 2024, CyanConnode India’s subsidiary, DigiSmart Networks Private Ltd was successfully empanelled as an AMISP for both RF and cellular, making it eligible to bid for smart metering contracts under the Revamped Distribution Sector Scheme. This was a key milestone for the Group which enabled DigiSmart to win its first AMISP project in April 2025, a circa £70 million contract in Goa, which has been fully funded and resourced through an innovative agreement with a sector specialist multi-national contractor. The project is shortly expected to become revenue generating and be a key contributor to Group sales going forward.

Having established a track record, in November 2025, the Company raised $5.25 million through a convertible loan note to be used to secure Earnest Money Deposits (“EMDs”) for AMISP tenders on which DigiSmart intends to bid. EMDs are refundable deposits required when submitting bids under the RDSS, demonstrating a bidder’s commitment to proceed with the project if selected. The deposits are typically returned following the tender process, except where a bidder withdraws or fails to complete contractual formalities after being awarded the contract.

Key Active Projects in India

Source: CyanConnode Holdings plc

MPWZ – 4 (Jabalpur) | AMISP – MCL – one of CyanConnode’s largest RF-based smart metering deployments, with over one million smart meters successfully installed and operating on the Omnimesh RF mesh communication network.

MPWZ – Phase 2 | AMISP – IPCL – involves deploying CyanConnode’s Omnimesh RF communication network across Indore, Madhya Pradesh, with approximately 320,000 meters installed.

SBPDCL – 1 (South Bihar) | AMISP – Genus – supports the rollout of CyanConnode’s Omnimesh RF communication network across South Bihar, with approximately 120,000 meters deployed to date.

SBPDCL – 2 (South Bihar) | AMISP – IntelliSmart – involves deploying CyanConnode’s Omnimesh RF communication network to support AMI operations in South Bihar, with approximately 34,000 meters deployed to date.

MSEDCL – Nagpur | AMISP – MCL – involves deploying CyanConnode’s Omnimesh RF communication network across the Nagpur region, with approximately 316,000 meters installed to date out.

DGVCL (Dakshin Gujarat) | AMISP – IntelliSmart – involves deploying CyanConnode’s Omnimesh RF communication network across parts of South Gujarat, with approximately 277,000 meters deployed to date.

MGVCL (Madhya Gujarat) | AMISP – IntelliSmart – involves deploying CyanConnode’s Omnimesh RF communication network across parts of central Gujarat, with approximately 116,000 meters deployed to date.

PVVNL (Paschimanchal Vidyut Vitran Nigam Limited) | AMISP – IntelliSmart – marks the initiation of CyanConnode’s Omnimesh RF communication deployment across Western Uttar Pradesh. Approximately 11,000 meters have been deployed to date.

MVVNL (Madhyanchal Vidyut Vitran Nigam Limited) | AMISP – IntelliSmart – represents the initiation of CyanConnode’s Omnimesh RF communication deployment across central Uttar Pradesh. Approximately 5,500 meters have been deployed to date.

Goa – Statewide Smart Metering Project | AMISP – Digismart Networks – the Goa statewide smart metering project is a flagship AMI deployment covering approximately 750,000 consumers across the state. DigiSmart Networks Pvt. Ltd., a wholly owned subsidiary of CyanConnode, is implementing the project as the Advanced Metering Infrastructure Service Provider (AMISP), with CyanConnode delivering the Omnimesh communication network and core AMI technology.

Projects under FMS (Field Maintenance Services) – in addition to the active deployments, CyanConnode is currently providing Field Maintenance Services (FMS) for multiple completed and operational smart metering projects across India.

APAC and Middle East

As smart metering adoption progresses in the APAC and Middle Eastern regions, substantial opportunities are emerging for CyanConnode.

In August 2025, the Company announced a follow-on order for a project in the Middle East North Africa (“MENA”) region for £1.2 million, which was delivered and revenue fully recognised during the period. The Company continues to pursue near-term opportunities in its Rest of World (“ROW”) markets.

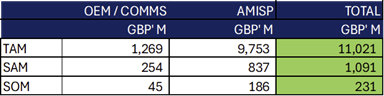

Addressable market in India

Looking ahead, the pipeline of opportunities in India remains substantial. The Total Addressable Market (“TAM”) for AMISP projects currently stands at approximately 104.9 million smart meters, representing an estimated value of £9.8 billion, which have been sanctioned but are yet to be awarded. DigiSmart’s Serviceable Available Market (“SAM”) comprises around 9 million meters, with an estimated value of £837 million. Within this framework, CyanConnode’s SAM for just communications (i.e. as a subcontractor) is estimated at approximately £254 million.

CyanConnode’s Serviceable Obtainable Market (SOM) over the next 18 months for communications alone (i.e. acting as a subcontractor) is expected to be approximately £45 million. For DigiSmart AMISP, the SOM over the same period is expected to be approximately £186 million, providing a substantial £231 million near-term pipeline to support continued revenue growth.

Based on an estimated market size of approximately 250 million smart meters, the values in the table below represent potential order values and are in addition to the Company’s existing contracted order book.

1. TAM (Total Addressable Market) – The total addressable market in India in relation to the Company’s products and services. 2. SAM (Serviceable Available Market) – The maximum portion of the TAM that the Company could serve, taking into account practical and operational constraints. 3. SOM (Serviceable Obtainable Market) – The share of the SAM that the Company is targeting to capture within the next approximately eighteen months. 4. AMISP values are based upon the Goa project per-meter price.

Board Changes

In May 2025, the Company made the decision to separate the positions of Chairman and CEO, welcoming independent Non-Executive Director Björn Lindblom to the role of Non-Executive Chairman. John Cronin transitioned from Executive Chairman to Group CEO, allowing him to focus on driving the operational development of the business. This separation enhances the Company’s governance, as well as Board independence.

Industry Events

During the period, CyanConnode showcased its solutions internationally at key industry events, including Enlit Africa in Cape Town. The Company also co-sponsored the 8th Annual Conference on Smart Metering in Utilities in New Delhi, and exhibited at Middle East Energy 2025 in Dubai, where it acted as Silver Conference Sponsor at the Leadership Summit.

Outlook

The successful execution of existing projects, positions CyanConnode for a period of sustained growth and market expansion. In H2 2026, the Goa AMISP contract is expected to become revenue generating, which is likely to have a positive impact on trading for the year. Overall, while recognising that the precise timing of revenue recognition remains dependent on project schedules, the Board is encouraged by the Group’s strong contracted order book standing at £157 million at the period end and pipeline visibility.

Financial review

Key figures

| H1 FY 2026£’000 | H1 FY 2025£’000 | % Change | |

| Revenue | 7,443 | 5,629 | + 32% |

| Gross profit | 1,859 | 2,336 | – 20% |

| Operating costs | (4,978) | (4,424) | – 13% |

| Other operating income | 134 | – | +100% |

| Operating loss | (2,985) | (2,088) | – 43% |

| EBITDA | (2,658) | (1,901) | – 40% |

| Adjusted EBITDA | (1,894) | (1,597) | – 19% |

| Cash | 1,625 | 3,714 | – 56% |

| Basic and diluted loss per share | 0.86p | 0.71p | + 21% |

Revenue, Gross Margin and Operating Costs

Revenue for H1 FY 2026 increased compared to the revenue for the same period of FY 2025, driven largely by increased deployments (893,000 modules shipped in H1 FY 2026 compared to 377,000 in the same period of FY 2025). Reduction in gross margin percentage from 41% in H1 FY 2025 to 25% in H1 FY 2026 (FY 2025: 35%) was partly due to the decreased software and services revenue as a proportion of total revenue and partly due to lower than usual pricing on certain contracts which were agreed to in anticipation of the Company’s new product suite. Margins will improve substantially once the Company commences shipping of its new products such as FG28 module, cellular modules and In-Meter Gateways, which have significantly lower costs. We are targeting overall project margins of upwards of 35% following commencement of deployments using the new products, with this margin varying across the course of each project (driven by more lower margin hardware being shipped in the first two years of the project). With the use of In-Meter Gateways, gateway installation and maintenance costs will be substantially reduced.

An increase in operating costs from £4.4m in H1 FY 2025 to £5m in H1 FY 2026 was driven by £0.9m of foreign exchange losses partly as a result of translation of accounts. Operating loss of £3m (H1 FY 2025 loss: £2.1m) was also driven by the £0.9m of foreign exchange losses

Cash

Cash and cash equivalents at end of period was £1.6m (FY 2025: £3.7m), excluding £6 million held in a fixed deposit at ICICI Bank in London, securing an overdraft facility in India for the same amount.

During the period the Company raised $15 million through two convertible loan notes for $7.5 million each supporting the Group’s working capital requirements and ability to pursue further contract tenders. A further $5.25 million was raised from the same investor after period end to secure Earnest Money Deposits (“EMDs”) for AMISP tenders on which DigiSmart intends to bid.

Accounts receivable

A total of £7.4m cash was collected from customers during the period (compared to £7.3m for the same period in FY 2025), and a further £1.6m since the period end. In the period, our non-current trade receivables such as contract assets, reported in the non-current assets part of the balance sheet, increased to £6.0m (FY 2025: £3.3m), where revenue has been recognised in accordance with IFRS 15, and will be paid for over the period of the contract. The remainder of trade receivables included in non-current assets related to accrued income from contracts. Approximately 23% of cash collection during H1 FY 2026 related to trade receivables from FY 2025 and a further 17% of FY 2025 trade receivables has been collected since period end.