CyanConnode Holdings plc (LON:CYAN) is awaiting news with respect to the first large tranche of smart meter contracts in India, for which it is an established supplier of intelligent communications modules. In the meantime, contract wins in other markets continue; for example, this week’s announcement of a win in the Middle East and North Africa (MENA) region, which we expect has a multi-million pound value. The recent fundraising of £2.0m gross saw strong investor support ‒ this was a growth-centric initiative as the new funds will be primarily used to fund inventory of components in short supply and/or have longer lead times. Our DCF-implied fair equity value is £91.4m compared with the current market capitalisation of £40.5m.

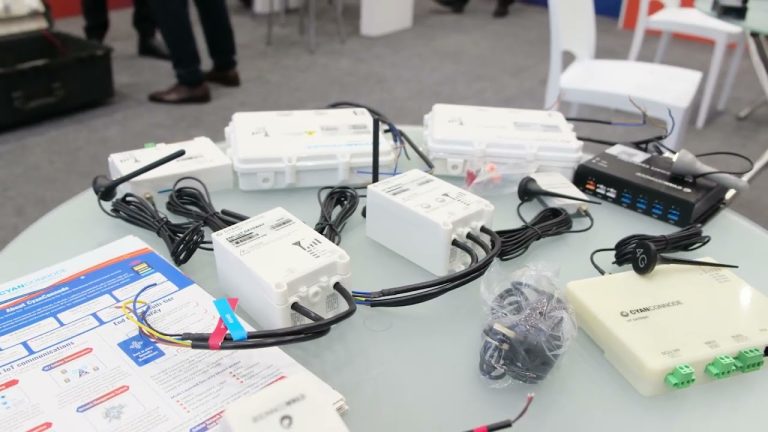

- Major new contract win: A new contract in the MENA region for electricity and water meters will see the deployment of CyanConnode’s cellular communications hubs to connect up to 1m existing meters to central infrastructure. We expect this high-profile deployment to be a multi-million pound contract in total.

- Indian opportunity remains firmly on track: Benefiting from renewed momentum stemming from Government initiatives, over 40m meters are currently out for tender, with awards for most expected by year-end. The emphasis is on vendors with proven, end-to-end technologies, boxes that the company clearly ticks. CyanConnode India has deployed over 1.1m smart meters and is profitable.

- State elections yield favourable outcome: Uttar Pradesh has been a leader in smart meter rollouts from the outset. This week saw the re-election of the ruling BJP party in the state, which is currently tendering for close to 27m meters, making continuity critical. The BJP also won in three other significant state elections.

- Successful fundraising to scale inventory and production: The company recently raised £2.0m gross through a placing of 14.3m new shares at £0.14, a discount of only 1.8% to the previous close due to oversubscription. The news triggered a positive market response with stock up 16% in choppy markets.

- Investment summary: The coming 12 months will be a key period for CyanConnode as the 40m or so meters out for tender are awarded. The company is working with many bidders and its prospects of winning a solid share are strong, In the meantime, management is wisely scaling up key aspects of the business. Our DCF-implied fair equity value for CyanConnode is £91.4m (£0.39 per share), vs. the current market capitalisation of £40,5m.