Arc Minerals (LON:ARCM) has taken another significant step forward in its joint venture with Anglo American in Zambia, with new drilling results extending known copper mineralisation. The latest assay results from three of six drill holes have delivered impressive copper grades, reinforcing the potential of the project in one of the world’s richest copper belts.

Zeus Capital analysts Paul Smith and David Seers highlighted the significance of these findings:

“Results from these early holes look impressive with significant high-grade copper (e.g. 7.7m grading 1.7% copper) or thickness (40.6m grading 0.6% copper); the latter are mineable grades as the Sentinel mine just to the east of the Arc/Anglo licences proves.”

With assays still pending from three more holes, further positive news could be on the horizon. The JV is in its early stages, yet these results already compare favourably to established mines in the region. First Quantum’s Sentinel mine, for instance, produces over 300,000 tonnes of copper concentrate annually from a reserve grading just 0.4% copper.

A Growing Copper Resource in Zambia

Arc Minerals, which owns 67% of the JV licences via its stake in Unico, is strategically positioned as Anglo American aims to earn a 70% stake in the project over three phases with a total investment of $88.5 million. The presence of both oxide and sulphide copper mineralisation suggests strong potential for further discoveries, with some intervals showing particularly high grades.

The analysts at Zeus Capital noted:

“There looks like there could be a higher-grade zone to target further drilling in our view. Both oxide and sulphide copper has been found – much like Cheyeza to the west where similar high-grade zones have been intersected and reported in the past.”

These results support the geological model of in situ copper mineralisation, which strengthens the case for continued exploration and development in the region.

Strong Position for Future Growth

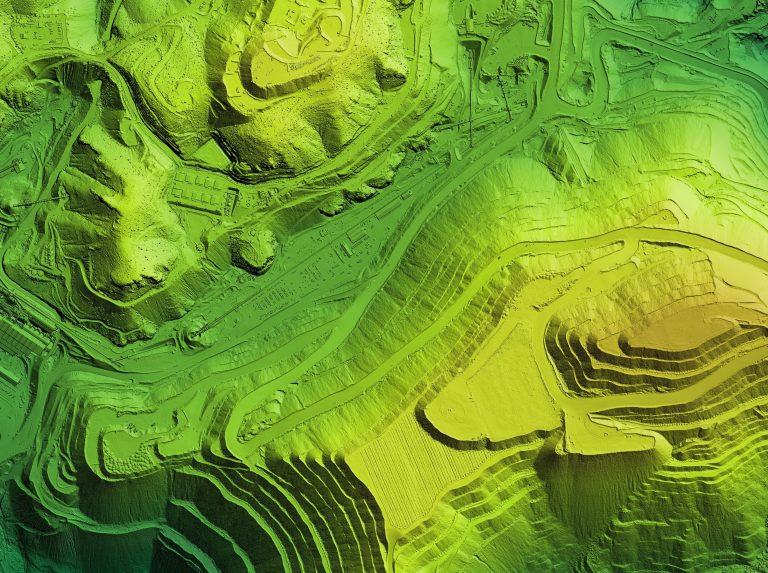

Arc Minerals’ partnership with Anglo American brings both expertise and significant financial backing. The JV covers an area of approximately 870km² in the Domes region of the Zambian Copperbelt, near major producing mines such as Sentinel, Kansanshi, and Lumwana.

Zeus Capital analysts outlined the three potential outcomes for Arc Minerals:

“We foresee one of three outcomes: i) a major discovery with Arc owning a substantial stake of a project of significant value ii) Arc left with a substantial interest in a significantly derisked copper project too small for the mining majors but of significant value to a mid-cap or junior miner, or iii) no significant discovery is made.”

Crucially, Arc has already benefited financially, securing upfront funding from its 67% share of Anglo’s $14.5 million initial payment.

Final Thoughts

The latest drilling results mark a promising development for Arc Minerals, reinforcing confidence in the company’s Zambian copper project. With further assays expected, ongoing drilling, and Anglo American’s strong commitment, the company remains well-placed to benefit from future discoveries. Zeus Capital sees fair value at 5.8p per share, with potential for significant upside should a consistent series of high-grade drill results emerge.

Arc Minerals continues to advance its position in one of the world’s most prospective copper regions, and investors will be watching closely as further results come in.