Investors have shifted into a low‑volatility posture, nudging copper higher in a subtle yet telling move just before the Federal Reserve unveils its next policy stance. This pause reflects a broader undercurrent of caution and strategic hedging, with markets eyeing how central‑bank cues might influence industrial demand and financing costs.

Copper’s recent 0.02 % uptick, to $879.90 per ton on the London Metal Exchange, may seem modest, but it masks more significant shifts beneath the surface. LME inventories have plummeted by 7,300 t this week, bringing stockpiles down to just over 107,000 t, a level not seen in more than a year and marking a 60 % collapse over the past four months. That tightness hints at dwindling near‑term supply and growing pressure on availability.

Yet headwinds remain. The premium traders pay for U.S. COMEX copper above LME prices has contracted from $969 to $927 per ton, suggesting that demand across oceans is softening. Key Chinese smelters are accelerating exports to offset local slumps, while imported copper concentrates into China dropped 18 % month‑on‑month in May, though year‑on‑year demand holds slightly stronger, up 5.8 %.

Speculative positioning shows signs of retraction. Open interest across futures markets is down approximately 18 %, pointing to short covering rather than fresh bullish inflows. Technical patterns suggest underlying support near $877.90, with potential to revisit $875.70 if broader equities sag. Conversely, a breakout above $882.80 could clear the way toward $885.50.

The context here spans more than just a chart. With U.S. retail sales disappointing in May and geopolitical friction flaring, particularly following Washington’s assertive posture toward Iran, markets remain on edge. Commodities like oil and gold are finding footing in those trends, and copper, with its industrial backbone, is trading in the shadow of macroeconomic uncertainty.

Copper’s appeal in this setup lies in its dual role as a bellwether for economic health and a hedge against policy and geopolitical drift. Inventory declines speak to real‑world short supply, but the ebb in speculative interest flags caution. The market now hinges on the Fed’s tone: a dovish tilt might bolster copper by lowering financing costs and lifting industrial sentiment, while hawkish rhetoric could reset positioning into a defensive stance.

Copper remains a critical industrial metal, vital in construction, manufacturing, electrification, and green‑tech applications. Its recent price movement reflects a tight tangible supply, tempered by weaker speculative demand and a market attuned to macro‑signals.

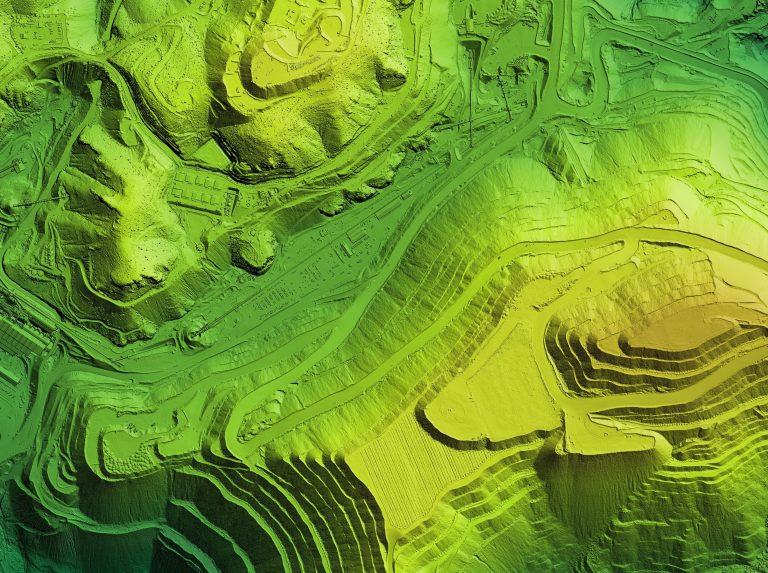

ARC Minerals Ltd (LON:ARCM) is a dynamic exploration and prospect generation company, forging partnerships with major mining companies, in its quest to discover and develop Tier 1 copper deposits.