Copper prices have surged to multi-year highs, fuelled by escalating fears of U.S. import tariffs and a scramble for supply. This rally is not just a market anomaly; it’s a signal of deeper shifts in global trade dynamics and industrial demand.

U.S. copper futures have soared nearly 6%, reaching $4.9175 per pound, the highest since April. This spike follows President Donald Trump’s announcement to double tariffs on imported steel and aluminium to 50%, intensifying speculation that copper could be next. Although copper wasn’t explicitly mentioned, the market is reacting to the possibility of new import duties, especially given the ongoing investigation into copper imports initiated by the Trump administration earlier this year.

The premium of U.S. Comex copper over London Metal Exchange (LME) prices has widened significantly, now standing at $1,231 per ton, up from $759 just days prior. This disparity underscores the urgency among traders to secure copper supplies before potential tariffs are implemented. The rush has led to a notable influx of copper into the U.S., creating shortages and price distortions in other regions, particularly Europe.

In continental Europe, spot markets have experienced record-high premiums for immediate copper delivery. German premiums have reached $250 per tonne, while ports like Livorno and Rotterdam have seen premiums of $180 per tonne. These figures reflect the aggressive diversion of copper supplies to the U.S., leaving European markets strained and highlighting the interconnectedness of global commodity flows.

China’s role in this scenario is also pivotal. The country’s economic stimulus measures have bolstered demand for industrial metals, including copper. As the world’s largest importer of copper, China’s increased consumption adds another layer of pressure to an already tight market. The International Energy Agency forecasts a 20% rise in copper demand by 2030, driven by the global shift towards electrification and green technologies.

The current copper market dynamics are a confluence of trade policy uncertainty, supply chain disruptions, and robust demand from industrial sectors. The potential imposition of U.S. tariffs on copper imports has triggered a chain reaction, affecting global supply and pricing structures. As the situation evolves, stakeholders across industries will need to navigate the complexities of this shifting landscape.

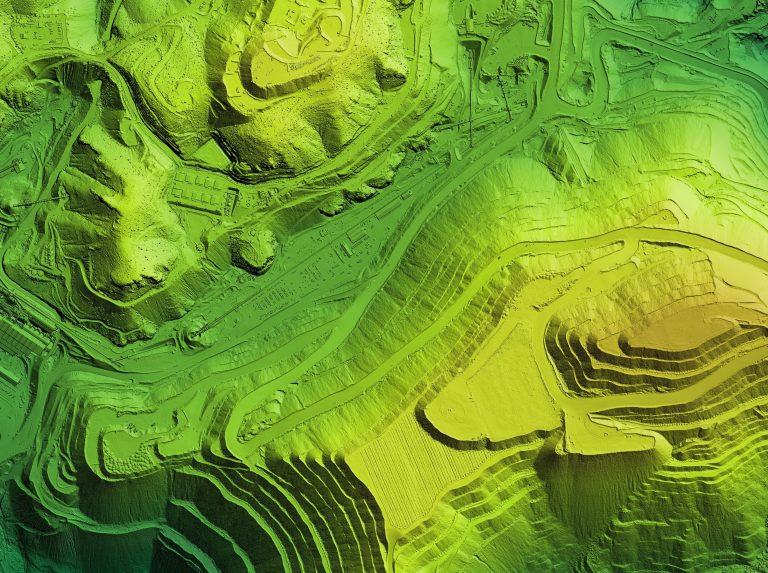

ARC Minerals Ltd (LON:ARCM) is a dynamic exploration and prospect generation company, forging partnerships with major mining companies, in its quest to discover and develop Tier 1 copper deposits.