James Cropper Plc (LON:CRPR) Chief Executive Officer David Stirling and Chief Financial Officer Andrew Goody caught up with DirectorsTalk to discuss the Group’s performance for the year ended 29 March 2025 and the new strategy they have unveiled.

Q1: David, this is the first time that Director’s Talk has heard from James Cropper. Can you tell us more about what the business does?

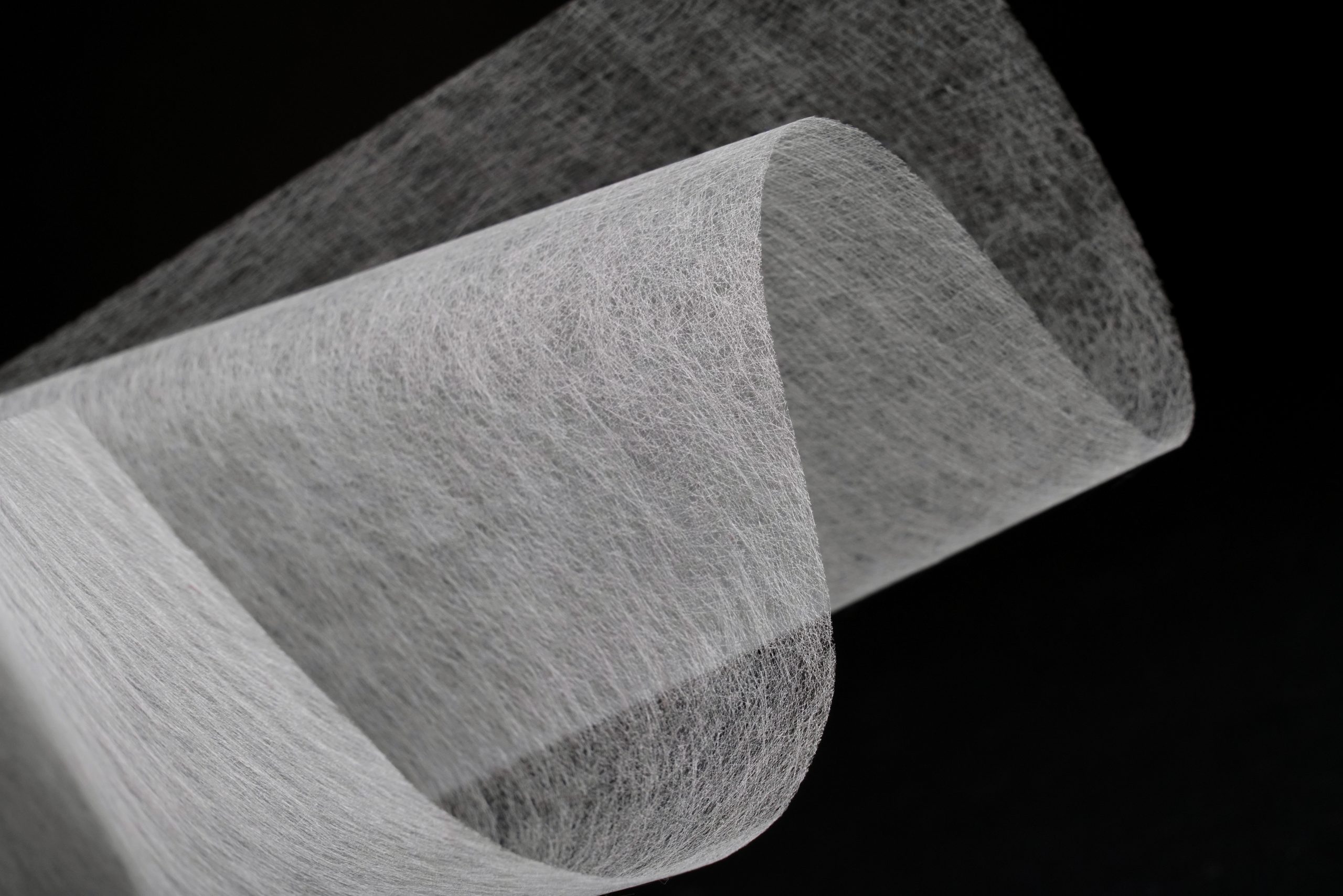

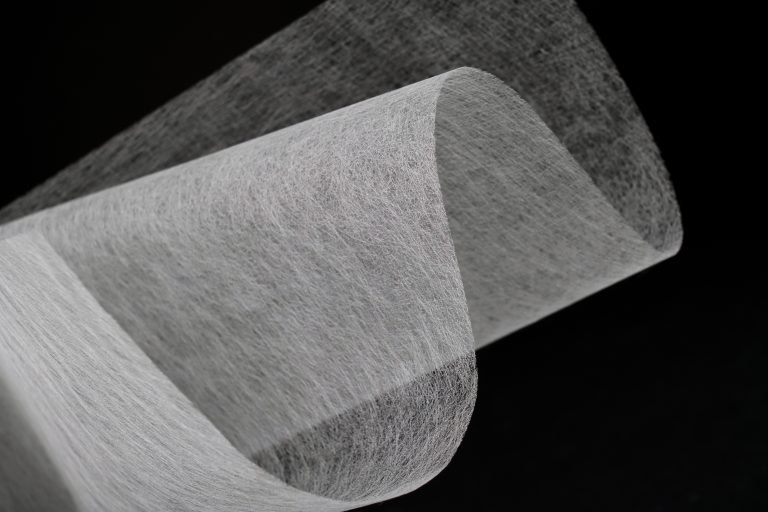

A1: The business has two main business units. Advanced Materials is a technical fibres business, along with coatings, supplied into such industries as energy transitions – fuel cells, hydrogen electrolysis, carbon capture – all of which are nascent growing, higher growth, possibly higher risk, difficult to correct industries, and things like aviation, commercial planes – there’s probably 20,000 commercial planes flying around using James Cropper’s non-woven fibre technology. So, so good, solid business in a range of industries in Advanced Materials.

The genesis of the business is a paper manufacturer, a paper mill, and so the business today, two-thirds of the revenue comes from a paper mill, predominantly supplying technical papers and luxury packaging, craft papers, etc.

Q2: Just turning to you, Andrew. You’ve just released a solid set of results, congratulations on those. Could you just talk us through the financial highlights?

A2: The key financial highlights for the year to March 2025, our revenue was just under £100 million, slightly down on last year. The revenue in the Advanced Materials business was up slightly. We had a strong second half of the year in that business, a growth across both these established sectors and some of the more nascent future energy-related sectors. Paper revenue was down across the year, but it did stabilise through the year compared with the previous period. EBITDA, which is the profit measure that we are particularly focused on, was marginally up on the previous year, just under £7 million. Our net debt, which has been high recently, fell by just under £3 million across the year. So, we finished the year with the net debt to EBITDA multiple, at just under £2 million, and certainly, our aim is to have it always under £2 million, and we want to see that coming down further.

We did have a good year in terms of cash management. Our disciplines around working capital, capital expenditure, were improved, and that’s really what drove the net debt to come down across the year.

So, I think it’s fair to say the balance sheet has been stretched by trading being challenging, and by debt being high to fund previous capital expenditure plans. We’ve addressed that, certainly in part over the last 12 to 18 months, we’ve re-profiled some of our debt repayments so they’re much more manageable moving forward.

The balance sheet is stabilised, there’s more to do on that but really, it’s about EBITDA recovering as the strategy is executed that will just complete that process in terms of balance sheet health.

Q3: David, you recently joined the company earlier this year. You’ve now unveiled a revised strategy, which I think Andrew was just referring to. Could you talk us through the key pillars of this new strategy?

A3: I’ve set three very clear priorities. One was cash and debt management, which Andy has just talked about.

In Advanced Materials, it’s all about growth. We have a good business, margins are where they should be, but growth has been absent in the past few years. The team are, I think, under a new leadership in that business as well, looking to re-establish that growth pattern.

In Paper, we have been losing money for quite some time and the strategy is all about driving a profitable paper business, so improving profitability, through internal measures to drive stability and efficiency in that business. When that is well under way, we will turn to a growth strategy in Paper.

In the shorter term, it’s more about those operating efficiencies to drive costs out of the business to re-establish the profitable base.

Q4: What should investors expect from James Cropper in the coming months?

A4: Well, I think what we want to do is deliver on what we’re saying we will deliver on. So, it’s going to be, I hope, quite boring for a few months, no surprises but just very simply, off we go on the path.

I think when we think about what might change, we are looking in Advanced Materials to develop platform technologies and take those technologies into new and established markets. So, in terms of commercial acceleration, we don’t really expect this year to deliver huge top line growth in Advanced Materials, and we are investing for future growth.

So, I think it’s going to be a period where let’s just give us a little while to deliver and come back and talk to you in six months and hopefully see some results coming through.