The moment Washington signalled a sweeping tariff on key imports, the hum of trading floors quickened as copper suddenly took centre stage. In that flash, a commodity often seen as a barometer for industrial health became a vessel for geopolitical tension, leaving investors to reconsider long-held assumptions about supply chains and pricing dynamics.

July’s headline-grabbing tariff announcement did more than alter trade balances; it exposed copper’s latent volatility and underscored its newfound role as a proxy for broader economic conflicts. Brokers found their screens awash with bids well beyond previous highs, as traders weighed the implications of a half-century levy on the very metal that underpins everything from renewable infrastructure to electric vehicles. Far from a routine policy shift, this move reignited memories of the market’s last major upheaval in the 1980s, when similar regulatory shocks presaged years of price consolidation and strategic stockpiling.

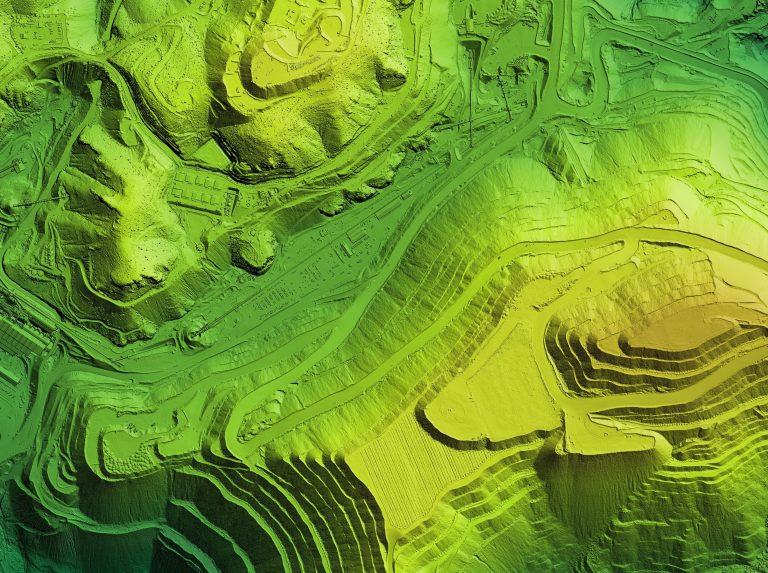

Yet the roots of today’s dramatic re-pricing extend deeper than a single tweet or tariff schedule. Global demand for copper has surged in tandem with decarbonisation drives, as governments and corporations race to electrify transport networks and expand power grids. At the same time, supply has failed to keep pace, constrained by ageing mines and delayed projects. In Chile and Peru, two of the world’s leading producers, labour disputes and environmental permits have throttled output at sites that once promised abundance. Against this backdrop, even a modest policy tweak in Washington can send ripples through an already taut market.

Investors now find themselves at a crossroads. Those with a bullish outlook highlight the metal’s essential role in emerging technologies, pointing to forecasts of sustained consumption as urbanisation and green energy adoption accelerate. From wind turbines to photovoltaic installations, copper remains irreplaceable, lending credibility to arguments that today’s price levels may prove but a stepping stone to even loftier valuations. Conversely, sceptics warn that the current spike could prove ephemeral, driven more by headline risk than by enduring fundamentals. Should diplomatic channels restore equilibrium or should supply bottlenecks ease, a swift correction might follow, catching unprepared positions off guard.

In recent days, a cascade of hedge funds and commodity pools repositioned their holdings, some doubling down in anticipation of protracted tightness, others trimming exposure to lock in gains. Market liquidity has tightened in parallel with bid-ask spreads widening, suggesting that while appetite remains, so too does uncertainty. For allocators, the key challenge lies in calibrating exposure to copper so as to capture potential upside without falling prey to the whims of policy pronouncements.

Meanwhile, producers and refiners have scrambled to adjust. Major smelting operations are revisiting hedging strategies, while mining companies are exploring accelerated development plans for greenfield projects. However, the gestation period for new capacity, from exploration to first metal, stretches across several years, meaning any relief on the supply side may only materialise long after prices have peaked. In this light, investors considering upstream equity in copper miners must weigh the lure of elevated cashflows against operational risks and capital expenditure demands.

Adding further complexity, substitution risks loom on the horizon. Technological innovations aimed at reducing copper use or replacing it with alternative conductors could temper demand growth. Yet such breakthroughs remain embryonic, and the economic viability of substitutes is far from assured. For now, copper retains its unrivalled balance of conductivity, malleability and cost-effectiveness, preserving its status as the metal of choice for power transmission and complex circuitry.

As autumn approaches, all eyes will rest on inventory reports and shipment data from primary ports, along with any fresh commentary from policymakers. Should Washington confirm the tariff’s permanence or extend its scope, markets could again recalibrate to yet higher price brackets. Conversely, talk of exemptions or negotiated rollbacks could trigger relief rallies, though possibly short-lived in light of supply constraints that show little sign of abating.

For investors casting a long view, copper’s latest episode offers more than a fleeting opportunity; it serves as a case study in how policy imperatives and industrial momentum can collide to reshape commodity landscapes. Navigating this terrain demands not only an understanding of macroeconomic drivers but also a keen eye on regional developments, from miner labour actions to infrastructural spending plans. Those who can synthesise these threads may find a path to capture returns while buffering against the very volatility that defines today’s copper market.

ARC Minerals Ltd (LON:ARCM) is a dynamic exploration and prospect generation company, forging partnerships with major mining companies, in its quest to discover and develop Tier 1 copper deposits.