CyanConnode Holdings Plc (LON:CYAN) Chief Executive Officer John Cronin caught up with DirectorsTalk to discuss the company’s strategic win and its transition to an AMISP model in India.

Q1: John, first off, congratulations on this win, great news. Could you just explain for us what an AMISP is and what the key advantages of running an AMISP project is over being a supplier?

A1: We’re very, very excited having won our first AMISP, and AMISP stands for Advanced Meter Infrastructure Service Provider. We’ve really worked up to this point, we’ve been working in India alone for 12 years as an OEM supplier, supplying through third parties with the meter manufacturers system integrators etc. Now, we’re stepping into the forefront.

We are one of the lead providers of communications today in India, specialising in radio frequency and we’ve got a great share of the market, close to 25% so far of the market that’s been awarded, and there’s still a lot more to do. The teams really worked hard in getting us to this point that really offers us more certainty in terms of the rollout of the project. Now we’re the head of the dog, as I call it, instead of the tail of the dog. We’re talking directly to the utility, we’re looking at what needs to be done with agreeing the rollout plan, when meters will be put in, when communications will be put in. This is more in our control now and gives us that future looking. When you’re the tail of the dog, we’re reliant on all the other players of doing their piece before we can do ours, it does slow us down in terms of execution etc. So, this type really is fantastic for us.

It is under what they call the RDSS scheme or re-known as the Revamped Distribution Sector Scheme of the Government of India and this is all about now executing the projects. They have been a bit slow to date for a number of reasons with elections, state elections, national elections, some infrastructure by the utilities of India having to get their IT infrastructures in place so they can accept all this data that’s coming through from all these meters.

The government is actually going to roll out 250 million smart meters and there’s only something around c. 20 million deployed to date so still a lot to go at. Even that 20 million has created a bit of a blockage in terms of the data throughput because the IT infrastructure systems within the utilities weren’t able to handle 15 minutes of data. Can you imagine 15 minutes of data when it’s rolled out 250 million meters is an awful lot of data that, these utilities have to handle.

So, coming back really to what you’ve asked for is some of the benefits which have eluded there but also having the direct contract with the utility is really, really important for us being in charge of our own destiny and knowing then with more certainty what our revenues will be year-on-year going forward. Secondly, there’s another point really that we are supplying now an end-to-end solution, including the meters. Now, we don’t manufacture meters, therefore we would have subcontractors to do this and subcontractors to do other forms of what isn’t our core business, but we are project managing the whole. We’ve got a full communications platform today of RF and cellular, we’ll also be supplying the meter data management system, cloud services as well, and integration services. All of that we’ll project manage, what we do with our core ourselves and subcontract others out. There’s a third point, then, which is all about our pricing per point. So, our revenues will be significantly higher for this type of contract compared to being a subcontractor an OEM. If you think now, where we move to with these sort of projects, it’s c. £100 per point and multiply that 250 million times, you can see the scale, the billions required to fund these projects as we go forward.

So, a really exciting time for us.

Q2: Just moving to the actual contract with the Government of Goa. Are you set up or ready to execute the contract, and what are the payment terms for CyanConnode?

A2: So, maybe people will realise this being an OEM that even when we announce being a prime AMISP, we still then get into, at that point, negotiation with the subcontractors for execution. We’ve got quotes from them, but we have to get into more detail. The same as we’ve got this LOI so now we’re talking in detail with the Goa Government, the utilities there to form our own contract that we back off then to the subcontractors, so that’s ongoing at the moment.

In terms of payment, what we now get is an element upfront and the remainder will be on per meter per month. As you can appreciate, we have to speak with our auditors to look at this contract because it’s a new form of contract for us and we have to make sure we do it under the right revenue recognition regulations for that. We’re just going through that so I can’t give you any more clarity other than, yes, there’s an element upfront and per meter per month. Remember, these are 10-year contracts as well, which is great for annuity as we build up, i.e. recurring revenue streams coming along.

For this contract, the first phase of the smart meters in Goa will cover commercial properties, which actually essentially, we anticipate an even smoother rollout than going into residential consumer homes. Also, we know that this is for the first phase so we’re expecting upon success of this rollout, there’ll be additional volume of meters which will take in then the residential consumers in Goa as well.

Q3: Are you bidding for further AMISP projects and do you believe you’ll win?

A3: Absolutely, we are bidding, and we’ve won this contract against some of the big boys in the industry, with our focus, our dedication, and the team that we’ve got in India have done a great job in securing this contract.

If you think about it, to put it in another perspective, there’s currently 115 million smart meters worth about $11.5 billion, and those are still to be awarded to AMISP’s so there’s an awful lot to go at huge numbers. We’re realistic as well with the size that we are, the competition that’s out there, the way that tenders are given out, where they do multiple tenders and you can only tender for one or two, you can’t do all of them, etc. If there’s five packages within a utility, you may be able to be awarded one of those, that’s just the way it is, because of the volume.

Our subsidiary, known as CyanConnode India, we have a subsidiary under them called DigiSmart, and DigiSmart is targeting around about 10 million as an AMISP. On top of being an AMISP, core business to date as a subcontractor, as an OEM, there’s still a further over 80 million still to be awarded, to be allocated, and hopefully we’ll get some of that as well.

So, here we’ve got two business models; we’ve got the business model as an OEM and then we’ve got the second one, which is an AMISP service provider so two bites of the cherry, really, as we go forward.

Q4: Now, you announced that you’re engaging with strategic investors. Has this contract win changed these conversations? Has it increased future revenue visibility? Has it shifted the potential of business, like a gear up?

A4: Yes, it has. We are talking to various infrastructure investment funds, mainly in India, for India, and really this investment is into both CyanConnode India as well as DigiSmart for the Goa project and other projects that we’re bidding for, that will happen.

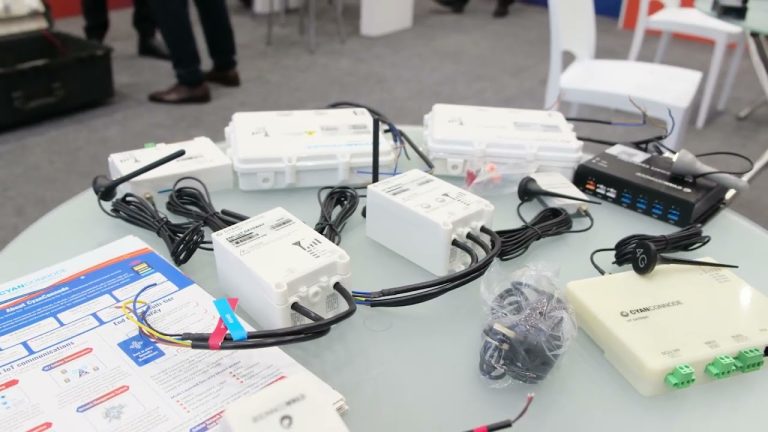

Why would I say that we want to have funding in CyanConnode India as well as DigiSmart? Well, we’ve really launched a range of cellular products, and this is really another step change for us as we improve our product range, not only in cellular, but in meter gateway.

We’ve got a hybrid solution of standard RF long range radio, as well as a combination of cellular, which is, for those that know cellular, you’ve got 4G now and that’s the general one because everything’s moved from 3G on rolling out of smart meters, and that really goes with a backstop to 2G and also with Bluetooth as well. So, a really hybrid approach for rollouts that we’ve got on the technology front, and this is very appropriate in the technology we had in diverse areas.

Difficult to reach areas now, we can say to customers, look, forget about the technology, give us the contract, we will decide a) its cellular, b) if it’s RF or long range or NB-IoT or whatever words there are in communications. You measure us on the service level agreement, the SLA is important, we will deliver the 99.5% SLA to you and that’s really what they’re measured against from their own masters as well. So, that really puts us in a different position on that front.

Secondly, CyanConnode have partners that have dealt with utilities for years, they are system integrators, meter OEMs, we’re a global player, we’re not just playing in India, we’re in the UK, we’re in Scandinavia, in the Middle East. We concentrate on really advancing digital transformation in the energy sector in all of those areas and we are looking at places like Indonesia and Malaysia. So, watch this space.

Things are happening, and as I have said in the past, slower than we would like but we’ve been waiting for the master’s to award us contract. Now, with this, it puts us in a different position.