Ilika plc (LON:AGM) Chief Executive Officer Graeme Purdy caught up with DirectorsTalk for an exclusive interview to discuss their remote working practises during COVID-19, operational capability, confidence in meeting market expectations and the resilience of the share price.

Q1: In your review of measures to minimise any COVID-19 impact, you mentioned use of effective remote working practises, what sort of activities can Ilika’s battery development team carry out?

A1: There’s actually a lot that our technical team can do remotely.

So, activities that they’re undertaking at the minute include in particular, analysis of the large amount of data that we’ve got from battery testing and characterisation and this really underpins product development. They can do battery design for some of the future roadmap products that we’ve got coming through and of course, really quite important is the preparation of data for invention notices for patent filing to protect our technology.

Operationally, they can update some of the procedures that we use for continued quality system compliance, you know that we use ISO 9001 to keep our operations on track and they can also carry out quite a few procurement activities.

Q2: The global travel lockdown limit, does that not limit interactions with customers?

A2: Well, clearly face to face interactions have stopped, however in our normal course of business we regularly use teleconferencing capabilities so for example, earlier this morning I was on a call that our business team had set up with a company in China interested in doing business with us. The business team is pretty busy at the minute with calls around the globe.

Q3: The University of Southampton, with that closing does that limit your operational capability?

A3: We have two operational bases, one is embedded in the University and the other is our Headquarters here at Romsey so the team members that were usually at the University are now working from home where possible. If they’re carrying out essential work that requires lab access, they’ve been redeployed to our main facility here which remains open.

Q4: You explicitly mentioned the market expectations for the financial year and for the following 3 years that they’re likely to be met. What gives you the confidence that this is going to be the case?

A4: Our current financial year ends quite soon, it ends of 30th April, so our financial outcome for this year is pretty well understood and frankly, there’s not much time left to disrupt that.

With the remote working processes that we have in place, we can still be very effective into next year and large proportion of our revenue is already committed to next year and a lot of it actually relates to grant-supported development revenue which we feel confident about executing.

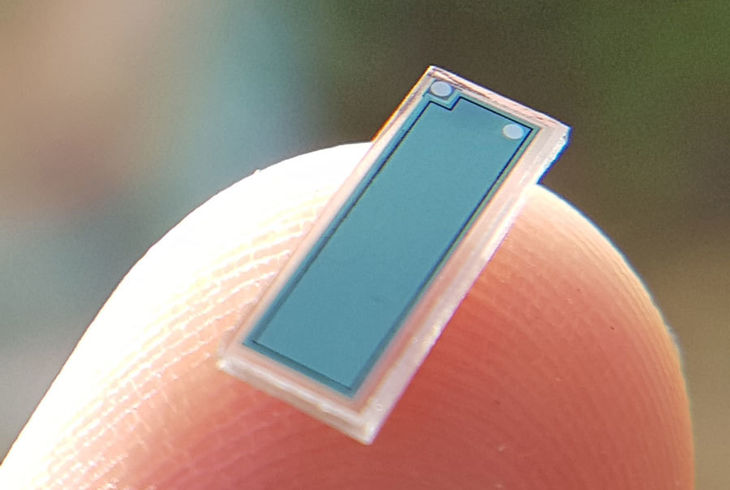

So, the revenue upswing in the subsequent 2 years really relate to the implementation of our Stereax manufacturing plans and these remain on track.

Q5: Although there’s been some volatility, Ilika’s share price today is similar to what is was at the beginning of January. Why do you think it’s been so resilient?

A5: Our share price is largely driven by retail investor following and we heard at our Capital Market’s Day that we held in December last year that our business is very well understood and supported by retail investors.

So, our shareholders understand that when this pandemic passes, our business has an offering that is well aligned with large global opportunities. They’re less worried about short-term operational disruption and more focussed on the long-term value that the business offers.