On 14 and 15 October 2022, the Indian Ministry of Power held a “Brainstorming Session” at the Power Ministers’ Conference. The presentation for the session contains a detailed update on the smart meter rollout in terms of rationale, targets and current progress. The Indian Government’s commitment to achieving the replacement of 250m meters remains emphatic, likely reinforced by the positive benefits delivered so far in terms of key metrics, such as billing and collection efficiency. Deployments of some 179m meters have been sanctioned, of which c.35% are at various stages of the tendering/award process. CyanConnode Holdings plc (LON:CYAN) remains a proven vendor and supplier to many prime contractors, boding well for the company.

- Process is reaching the critical phases: After a lengthy gestation period and a couple of partial reboots, the Indian programme is gaining significant momentum, which is impressive given the unprecedented scale of the rollout of 250m smart meters across one of the most populous countries in the world.

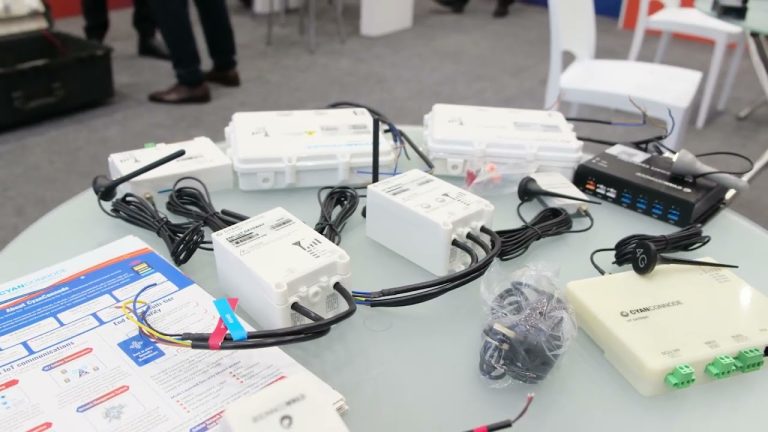

- CyanConnode is emerging as a key technology provider: Around 5m modules have been deployed so far, in total, in India, of which CyanConnode has delivered approximately 25%. It is, to date, the sole provider and/or primary vendor of smart meter connectivity technologies in several states across the country.

- The total Indian programme value is immense: The total budgeted outlay for the smart meter element of the Indian programme is INR1.5 lakh crores, i.e. INR1.5tr, or around £15.8bn. A similar amount has been allocated to enabling activities such as expansion of distribution capacity and training.

- Forecasts are conservative: Investors may perceive a disconnect between the growing momentum in the Indian programme and revenue growth forecasts, which anticipate 26% revenue growth in FY23. This is a function of the greater element of deferred revenue recognition, plus a highly conservative management approach.

- Investment summary: The bias towards proven technology suppliers in the Indian programme is evident, especially for newer service provider participants looking to establish track records for successful deployments and positive reference sites. CyanConnode is benefiting from, and often working with, multiple partners in single tenders. Our DCF-implied fair equity value for CyanConnode is £63.7m (£0.27 per share), vs. the current market cap. of £31.9m.