Thor Energy PLC (LON:THR, ASX: THR, OTCQB: THORF) has reported on its activities for the Quarterly period October to December 2025.

Andrew Hume, CEO and Managing Director, Thor Energy Plc, commented:

“This final quarter of 2025 has fulfilled a pivotal year of strategic transformation for Thor Energy. I am delighted to report that we ended the year with a healthy financial position, having successfully reshaped the Company to prioritise the high-growth natural hydrogen and helium sector, whilst simultaneously reinforcing our strategic metals portfolio through portfolio rationalisation, intelligent monetisation and strong partnerships.

“At our flagship HY-Range Project (Regulated Substance Exploration Licence, RSEL 802) in South Australia, we continue to progress swiftly from concept to drill readiness. Following the exceptional results of May 2025’s Phase 1 geochemical sampling program, we commenced Phase 2 in November, a design that is an extended monitoring campaign continuing through Q1 2026. This program enables rigorous measurement of gas flux over time and proactively ground-truths our high-grade anomalies. This high-fidelity dataset is a prerequisite for finalising the design of our major 2D seismic survey scheduled for mid-2026 and the subsequent drilling campaign.

“Crucially, this committed work program is supported by our successful non-dilutionary funding strategy. The 75% divestment of our US Uranium assets to Metals One and the 100% sale of the Molyhil Tungsten Project to Tivan Limited (completing post-period) simplified our portfolio and crucially facilitated the working capital necessary to advance our ambitions.

“Simultaneously, we have retained significant upside in our exciting South Australian copper-gold assets. The strategic investment of A$3.5 million into our investee company, EnviroCopper Limited, by an international energy company, validates the quality of these assets. With projects located within the renowned Copper Coast and historic Kapunda districts, we maintain material leverage to the region’s significant copper and gold endowments. Through our well-thought-out corporate deal structures, Thor retains upside whilst ensuring our direct holding costs remain minimal.

“Thor enters 2026 as a focused, well-capitalised clean energy explorer, ready to unlock value across a curated and strategically diversified portfolio.”

HY-RANGE PROJECT – “RSEL 802” – SOUTH AUSTRALIAN NATURAL HYDROGEN AND HELIUM

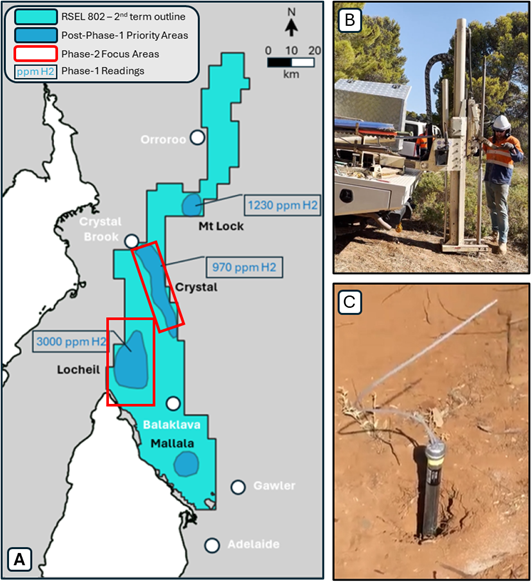

Building on the outstanding results of the Phase 1 survey reported on 7 July 2025-which identified hydrogen up to 3,000ppm and helium up to 27ppm-the Company commenced Phase 2 fieldwork during the quarter. Unlike standard spot-sampling or short-period monitoring, Phase 2 is being executed as a comprehensive monitoring programme which will provide the necessary information to confirm a consistent and productive natural hydrogen system, determine source to trap migration mechanism, and identify the specific pathways to aid prospect identification, maturation and integrated modelling. This campaign began in November 2025 and is scheduled to extend until March 2026, with work concentrated on the high prospectivity zones identified in Phase 1 (Figure 1), with new approaches being deployed which build on the learnings from Phase-1. Full details of the programme and results will be released when available.

Figure 1A) RSEL 802 (2nd term) map illustrating priority areas identified following the Phase-1 geochemistry survey, and the location of Phase-2 focus areas

Figure 1B) Preparation of monitor site

Figure 1C) Mid installation process of monitor locations

Data from this ongoing geochemical programme will be integrated with our robust geological understanding and augmented by ancillary geophysical and geological studies, which will include core analysis and the interpretation of reprocessed legacy 2D seismic data.

Thor’s integrated understanding forms the basis of design for our proprietary 2D exploration seismic acquisition campaign, targeted for mid-2026, with contract award expected during 2025 Q1. The results of this bespoke 2D seismic program will be pivotal for our natural hydrogen/helium project as we aim to integrate our findings, finalise prospect selection, and define drilling targets for fast-tracked exploration drilling. As a further benefit, the co-located Gas Storage Exploration Licences, 804, 805 and 806 will also benefit from this work by helping to determine if suitable geological conditions could occur for the underground storage of hydrogen, natural gas or long-term sequestration of greenhouse gases.

STRATEGIC METALS PORTFOLIO – INTELLIGENT MONETISATION

US Uranium – Binding Agreement with DISA:

On 23 October 2025, Thor executed a full binding agreement with DISA Technologies, Inc. This agreement allows DISA to evaluate and treat historically abandoned uranium mine waste dumps at Thor’s Colorado projects using its patented High-Pressure Slurry Ablation technology. Thor is entitled to a gross revenue share (sliding scale 2.5% to 4.0%) from the sale of recovered uranium and critical minerals, with no capital or operating expenditure required from Thor. Significantly, DISA received its final U.S. Nuclear Regulatory Commission Service Providers License during the quarter, paving the way for future deployment.

Molyhil Divestment:

Work continued during the quarter to satisfy conditions precedent regarding the sale of the Molyhil Tungsten Project (“FRAM JV”) to Tivan Limited for a total consideration of A$6.56 million. This process was subsequently completed post-period on 19 January 2026, accompanied by a payment of A$2.25 million and capturing three equal annual payments of A$1,312,500 (totalling A$3,937,500), commencing September 2026.

RETAINING UPSIDE IN SOUTH AUSTRALIAN COPPER-GOLD & REE ASSETS

Whilst the Company has successfully monetised non-core metal exploration assets, we have strategically maintained significant exposure to copper-gold and critical rare earth elements, as essential components of the energy transition, aligned with Thor’s fundamental strategic purpose. Furthermore, these assets host significant gold mineralisation, and our direct 80% interest in the Alford East Copper-Gold Project.

On 27 October 2025, Thor announced that ECL had entered into a binding agreement with a large international energy company for a A$3.5 million investment to rapidly advance the Alford West and Kapunda projects. Thor’s position in ECL continues to represent a strategic holding (20% post-period) with this investment ensuring that the Company maintains material upside exposure to these assets without the associated funding requirements.

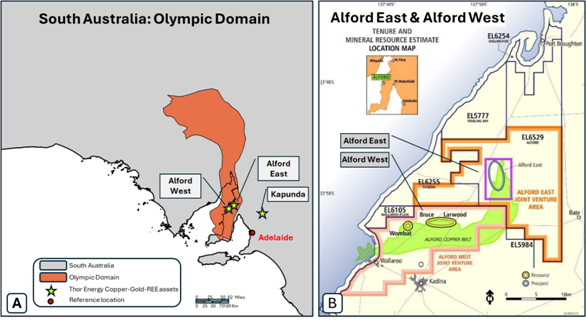

These assets are located within South Australia’s historic copper districts (Figure 2). The Alford West (held by ECL) and Alford East (Thor Energy, 80% and Operator) projects are situated within the world-famous Copper Coast area on the Yorke Peninsula, forming part of the prodigious Olympic Copper-Gold Province, with deposits interpreted as metasomatised IOCG systems with significant supergene enrichment. The Kapunda Project (held by ECL) represents a separate historic mining centre, characterised as a hybrid sedimentary-hydrothermal system with intense supergene enrichment. Both geological settings host oxide mineralisation, potentially amenable to low-impact In-Situ Recovery techniques.

Since these high-quality assets host significant recoverable copper, gold and REE mineralisation, Thor continues to maintain access to critical metals projects with minimal direct holding costs and the potential of timely pathways to commercialisation.

Figure 2A) Location of Thor South Australian metals assets. The Alford West and East projects are located within the southern portion of the Olympic Copper-Gold Province. The shaded area (red) represents the Olympic domain as defined by Tom Wise (2019), ‘Prospectivity modelling of the Olympic Cu-Au Province’, MESA Journal, vol. 90, no. 2, pp. 36-41

Figure 2B) Map zoomed to the Alford West / Alford East area of the northern Yorke Peninsula, illustrating overlap of the Alford Copper Belt (Green)

FINANCE, AND CASH MOVEMENTS

Cash Movement

Net cash outflows from Operating and Investing activities for the quarter of $63,000, which included outflows of $88,000 directly related to exploration activities. Thor Energy ended the quarter with a cash balance of $1,660,000. Post period end, a further A$2,250,000 was received as a completion payment from Tivan (as announced on 19 January 2026).

Cashflows for the quarter include payments of $134,000 to Directors, comprising the CEO-Managing Director’s salary and the Non-Executive Directors’ salaries.