Surface Transforms plc (LON:SCE) has announced another contract win. The Group will provide discs for OEM 5, an existing customer, for an upgraded model of an ICE vehicle with start-of-production in Q1 2024e. The lifetime value of the contract is c.€5m, from 2024e to 2028e. This follows a £20m win with a new customer, OEM 10, in August. Surface Transforms has now secured over £65m of OEM contracts. Revenues for both will flow from 2024e and hence are not included in our estimates at this time.

Separately, the Group has announced its revised manufacturing strategy and factory layout to increase capacity, improve lead times on installing new equipment and reduce the environmental impact of operations. The immediate effect is to raise the 2023e factory sales capacity from £35m p.a. sales to £50m p.a., with no impact on 2022e cash requirements. We recently visited the Knowsley factory and discussed these changes and the potential for higher returns with management. Both announcements today signal that Surface is fast becoming an efficient and volume supplier of carbon ceramic brake discs. We lift our valuation to 85p from 80p, potential upside c.30%.

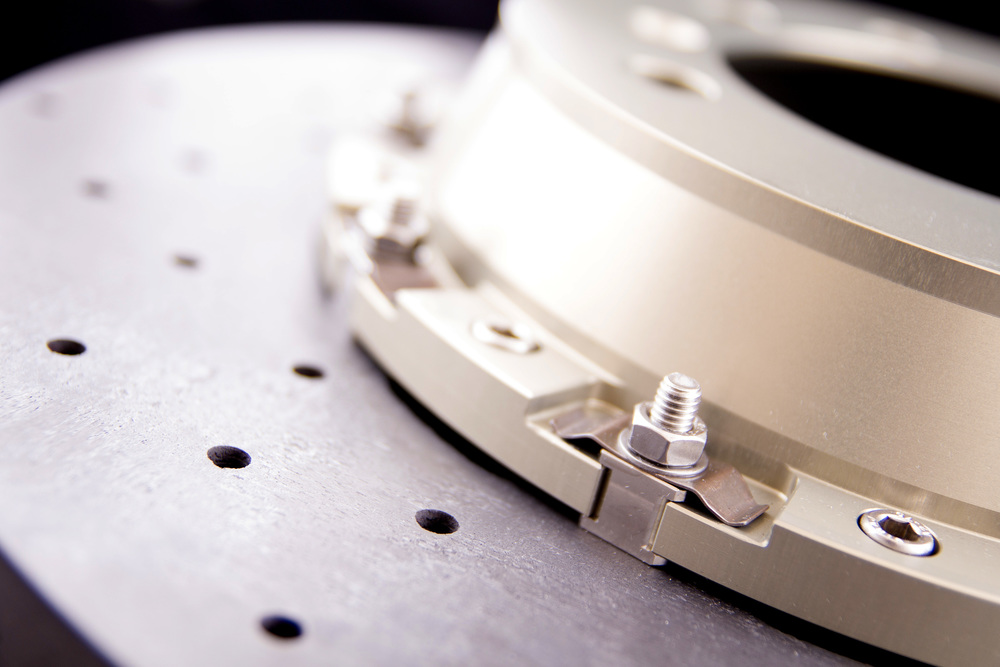

New OEM 5 contract – Surface Transforms has been selected as a tier one supplier of discs to its existing customer, OEM 5. All terms have been carried over from the master purchase agreement signed with this customer in mid-2019. The car is an upgrade to an existing ICE model with start of production in Q1 2024e. Discs will be fitted as an option to the front axle. The lifetime value of the contract is c.€5m spread over 5 years from 2024e to 2028e. We have discussed volumes, pricing, and projected customer take-up with management; assumptions are conservative, in our view. This win demonstrates the Group’s ability to secure repeat contracts with major OEMs. We continue to expect further contract win announcements.

Revised manufacturing strategy to reduce capex and improve efficiency – Reflecting the maturing of the Group, growing order book, and need to reduce the environmental impact of operations, a revised manufacturing strategy has been set. The objective remains to develop the Knowsley factory with sales capacity of £75m p.a. However, Surface Transforms will no longer build separate production cells but implement a more efficient plant-wide single production line. We discussed this plan in detail during our site visit in July. The Group will now purchase a smaller number of larger furnaces to support the sales capacity target of £75m p.a. In the short-term this will raise the 2023e capacity availability from £35m p.a. sales to £50m, with no impact on the 2022e cash requirement. Generally, factory build-out will be focused on a 2024e completion and not 2025e, as previously indicated. The procurement of other machine tools will now be in batches of c.£5m p.a. capacity (previously c.£15m p.a.) giving the Group shorter lead times and greater flexibility to address certain customers’ requests. Overall, during Surface’s £20m fundraise roadshow earlier in the year, the Group said it expected it would cost c.£50m of capex to provide annual factory sales capacity of £75m p.a. With these revised specifications, this total requirement is reduced to £40m p.a. Surface Transforms will also seek to reduce its projected carbon footprint using more environmentally friendly furnace technology. Further details on this revised manufacturing strategy should be provided by management in the coming months.