Surface Transforms PLC (LON:SCE) has reported a strong trading update for the six months ended 30 June 2025, with revenue expected at approximately £8.1 million, up from £4.7 million a year earlier — reflecting a remarkable 72% increase year-on-year.

“During Q2 2025 we started to deliver sustainable improvements in output, yield and quality and we are cautiously confident this level of performance will be maintained in the second half of the year and beyond. … While there remains a lot still to do we are encouraged that a pivotal change has occurred.”

— Kevin Johnson, Chief Executive Officer

The surge in revenue has been driven by a pivotal turnaround in manufacturing yield, which rose to 77% in Q2 from just 49% in Q1 2025, significantly enhancing production capacity and output consistency. Share price reacted strongly, rising approximately 50% to 1.39 pence in the London market on the day of the announcement.

Operationally, the company improved its gross cash position to £1.2 million by 30 June (up from £500,000 at 31 December 2024), while benefiting from £12.9 million in customer cash advances, of which repayments are expected to begin in H2 2025. Surface Transforms has drawn £9.8 million from a £13.2 million ERDF loan to fund capital expenditure, with full utilisation scheduled by year-end. Management anticipates year-end gross cash of around £1.0 million, supported by £2.5 million in VAT and R&D tax receipts.

Looking ahead, the company forecasts approximately 20% revenue growth in H2 2025 compared with H1, assuming continued yield stability and customer repayment progress.

Leadership changes include the departure of COO Stephen Easton, replaced effective 1 August 2025 by Gareth Laker, previously Manufacturing Technology Manager and instrumental in the recent operational improvements.

About Surface Transforms PLC:

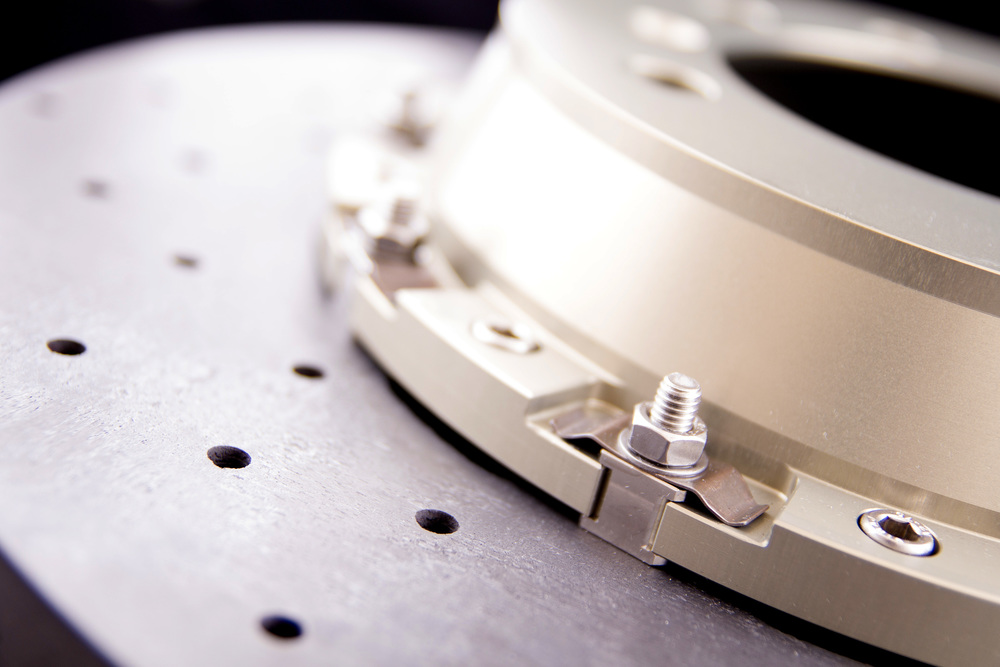

Based in Liverpool and listed on AIM under the ticker SCE, Surface Transforms develops and manufactures carbon-fibre-reinforced ceramic brake discs, serving global original equipment manufacturers. It is the UK’s only producer of carbon-ceramic brake discs and one of just two mainstream companies globally in this specialised sector. Its next-generation technology uses interwoven continuous carbon fibre to deliver lighter, more durable, and thermally efficient brake systems than traditional iron or competitor ceramic designs.