Spirax-Sarco Engineering plc (LON:SPX), the thermal energy management and niche pumping specialist, has announced that it has entered into a definitive agreement to acquire Durex International Corporation (Durex), a privately-owned US based specialist in custom electric thermal solutions for ultra-high criticality industrial equipment.

The consideration is US$342.2 million on a cash and debt free basis, subject to customary closing adjustments. The transaction will be financed through acquisition bank facilities and will be accretive to Group earnings in 2023. Following regulatory approval, completion is expected in October 2022.

Durex was founded in 1980 and has close to 380 employees most of whom are located at its headquarters and three manufacturing facilities in Cary, Illinois. In 2021, 89% of its sales were to Original Equipment Manufacturers (OEMs), which tend to be highly recurring in nature. Geographically, 87% of sales were generated in North America and 12% in Asia Pacific, with 60% of total sales to OEMs in the Semiconductor sector.

Durex has a strong track record of top line growth and profitability. For the 12 months to 31st August 2022, revenues were US$74.5 million, EBITDA was US$25.3 million and EBIT was US$23.5 million. For the full year ended 31st December 2021, revenues were US$61.7 million, EBITDA was US$18.7 million and EBIT was US$17.1 million.

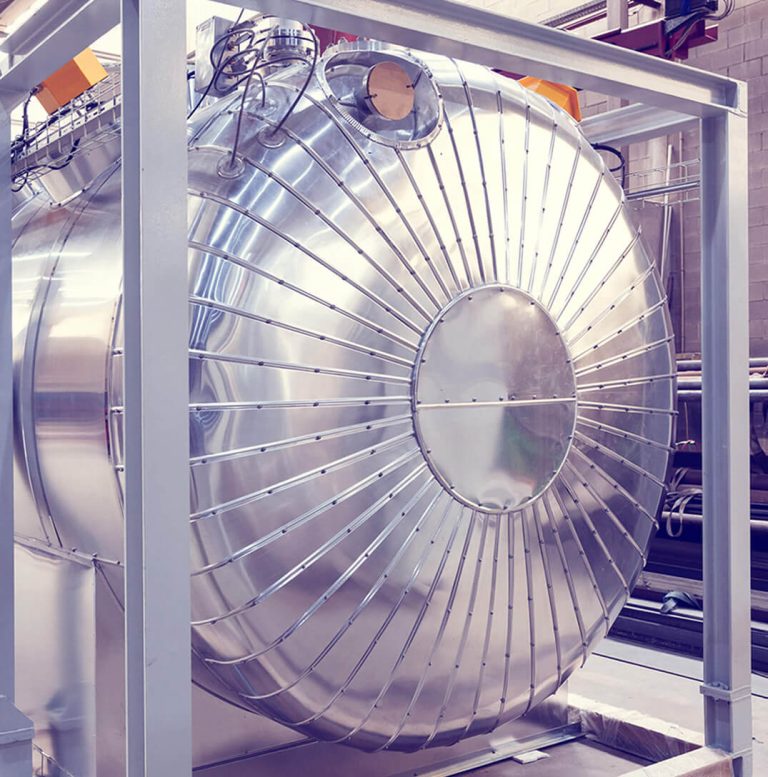

Durex provides OEMs with custom-designed precision thermal solutions with embedded electric heating, cooling and sensing technologies. These high criticality solutions are incorporated by the OEMs into complex equipment requiring precise thermal control, such as Semiconductor Wafer Fabrication Equipment (WFE). Durex is well positioned to capitalise on the growing trend of increasingly stringent thermal demands in high technology equipment and processes.

Upon completion, Durex will form part of the Group’s Electric Thermal Solutions Business (ETS) which comprises Chromalox, Thermocoax and shortly Vulcanic. Chromalox and Vulcanic will be the lead brands for electric process heating, including decarbonisation of industrial processes. Thermocoax and Durex will be the lead brands for high criticality OEM applications, are highly complementary with minimal customer overlap and will strengthen coverage of the North American and European markets. Durex will accelerate the development of ETS’ critical OEM business in attractive market sectors and target application areas, fulfilling key objectives of ETS’ growth strategy.

Nicholas Anderson, Group Chief Executive, Spirax-Sarco Engineering plc, said: “We are excited about this opportunity to further strengthen our ETS Business and look forward to welcoming colleagues from Durex into our Group. We have great respect and admiration for Durex that has grown and developed under the skilful leadership of Ed Hinz, who founded the business over 40 years ago. Ed’s impending retirement provided an excellent opportunity for us to broaden our capabilities in key target sectors, accelerating the development of our ETS business in line with our long-term plans.”