In the December 2025 edition of The Green Line, Ruffer examines the rapid rise of prediction markets and what this trend could imply for financial markets and investor behaviour.

Prediction markets are gaining momentum. Platforms like Polymarket and Kalshi now allow users to trade contracts on a wide range of binary outcomes, with each contract paying out based on a simple yes or no. The price of each trade reflects the perceived probability of the event, and the total volume reflects the level of conviction.

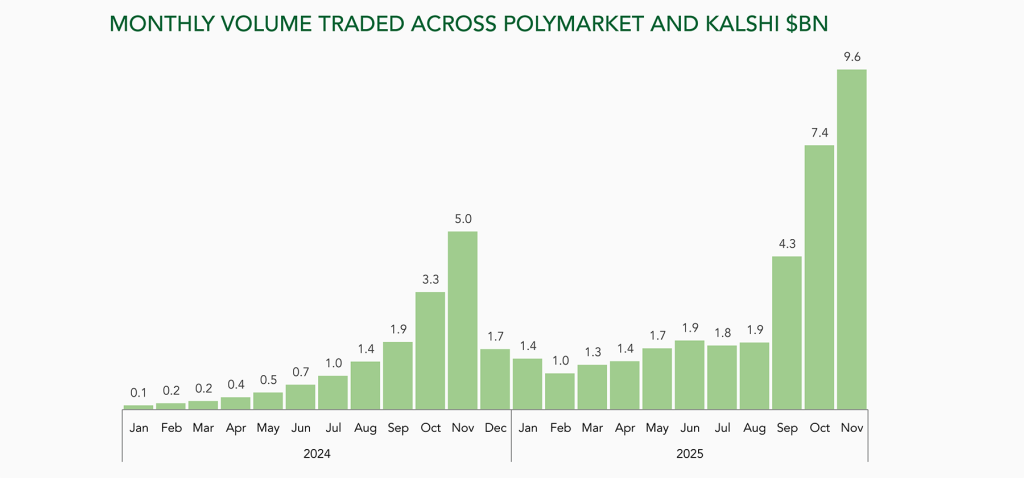

In November 2025, these platforms traded nearly $10 billion in volume. Kalshi has gained federal regulatory approval, and Polymarket has attracted major institutional backing. Even large financial firms and tech platforms are integrating prediction pricing into their systems.

These markets offer a new way to see what people believe about the future, and how strongly they believe it. That has value. For those managing multi-asset portfolios, this type of pricing can offer signals about sentiment, risk appetite and possible dislocations well before they show up in traditional indicators.

As more capital flows into these binary markets, and as large players begin to influence pricing, the line between forecasting and market-moving starts to blur. When enough money flows into a contract predicting a specific outcome, it can affect perception, behaviour and, in some cases, actual events. We are already seeing large bets that move prices, and a growing overlap between public sentiment and financial exposure.

Prediction markets strip away detail and turn complex issues into simplified bets. That encourages short-term thinking and momentum-driven flows. It also adds to the growing role of reflexivity in financial markets, where prices influence behaviour, and behaviour drives outcomes.

Ruffer is a discretionary investment manager focused on capital preservation and absolute returns. Its portfolios are built to perform through different market conditions by combining conventional assets with uncorrelated protection strategies.