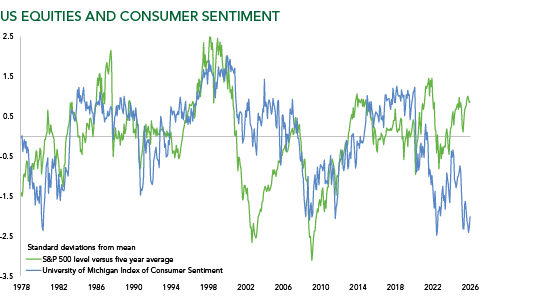

In her latest Green Line commentary, Jasmine Yeo, Fund Manager at Ruffer, the fund group behind the Ruffer Investment Company, examines the growing divergence between consumer confidence and equity market performance in the United States as the 2026 mid term elections approach. Her central observation is that political incentives to improve household sentiment may not align neatly with the drivers of long term asset returns.

Yeo highlights how measures of consumer confidence have at times failed to track the strength of equity indices. While markets have demonstrated resilience, survey based indicators of household sentiment have reflected a more cautious public mood. This disconnect is not unprecedented, but in an election cycle it carries additional significance. Politicians have clear incentives to influence the narrative around economic wellbeing, particularly when inflation and cost of living pressures remain recent concerns for voters.

Efforts to bolster confidence can support spending and risk appetite in the short term. Fiscal initiatives, policy announcements and changes in tone can all affect how households perceive their financial prospects. Jasmine cautions that sentiment is not a substitute for earnings growth or productivity gains. If markets are pricing in an improvement in the economic backdrop that is not yet visible in fundamentals, valuations may become increasingly sensitive to disappointment.

When confidence begins to recover while structural economic indicators remain mixed, the durability of market strength should be examined closely. Equity multiples can expand on improved mood, but without corresponding growth in cash flows, the margin for error narrows. In such an environment, volatility can re emerge quickly if expectations are revised.

Chart source: Bloomberg, University of Michigan, data to January 2026