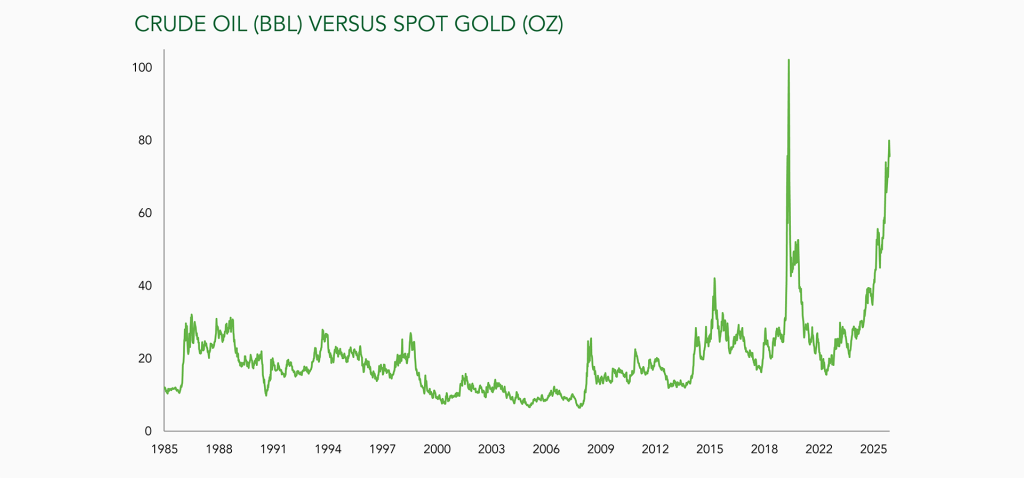

In its latest market commentary, Ruffer Investment Company highlights a growing dislocation between two key real assets: gold and oil. As inflationary pressures and geopolitical risks persist, gold has continued to attract capital, while oil prices have declined sharply. This unusual divergence has pushed the gold–oil ratio to extreme levels, prompting Ruffer to examine whether current market pricing reflects a structural shift or a short-term opportunity.

Oil prices fell steadily through 2025, even as inflation remained elevated and geopolitical tensions persisted. After peaking above $80 per barrel early in the year, crude lost momentum, underperforming not only equities but also other real assets. Gold, by contrast, moved higher, driven by central bank demand and its perceived resilience in unstable conditions. By year-end, the ratio of gold to oil had reached a rare extreme, with one ounce of gold purchasing more than 75 barrels of crude—a level last seen only during the 2020 oil collapse.

This divergence is significant. It reflects a market narrative that favours long-duration defensive assets while discounting energy exposure. Investors have remained cautious on oil despite tight supply, weak investment, and rising geopolitical risk. That positioning may now be stretched. Sentiment has turned so sharply against oil that current prices appear to imply a deeper and more prolonged demand shock than current macro data supports.

For contrarian investors, this raises a clear question: how much of the downside is already priced in? Crude is trading near multi-year lows in real terms. The sector continues to show capital discipline, with producers focused on cash flow rather than expansion. Meanwhile, inventories are lean, and spare capacity is limited. Any stabilisation in global growth or disruption to supply could rebalance the market quickly.

The longer-term energy transition remains a dominant theme. But pricing is now at a point where shorter-term exposure could offer asymmetrical upside. The oil market does not need a boom to recover, just the removal of extreme pessimism.

The divergence with gold also carries implications for broader portfolio construction. Investors relying on gold as their sole hedge against instability may be overlooking more attractively priced alternatives. Crude oil, though volatile, remains a core macro-sensitive asset with a distinct return profile. Including it selectively could improve balance across real asset allocations.

Chart Source: Ruffer/Bloomberg