Ilika plc (LON:IKA) is the topic of conversation when Baden Hill’s Partner and Clean-Tech Equity Specialist Dr Tom McColm caught up with DirectorsTalk for an exclusive interview.

Q1: Ilika’s share price has risen considerably over the last 12 months, what do you think the main reasons are for this?

A1: Basically, the global nature of COVID has brought into view the global nature of the big challenges for society and the nearest and biggest looming one is climate change. There was already a lot going on but it’s really started to accelerate the decarbonisation of our energy system and the electrification of transport.

We’re on the cusp of exponential growth in those areas and what’s being recognised is a key piece of the jigsaw in achieving those two goals is scale storage of electricity. What that enables is variable demand across networks to match intermittent renewable supply so if you want to have full scale renewables powering a grid then you need storage to balance supply and demand.

Batteries now and for the foreseeable future are recognised as the best storage technology and so battery companies that are addressing one or both of those two markets are attracting a lot of investment and IKA is such a company.

Q2: What do you think differentiates the company from other high share price performing battery companies, particularly in the US?

A2: The company is commercialising solid state lithium technology and part of its business is doing that for electric vehicles which is the same as a lot of the big players particularly a company called QuantumScape in the UK which is probably the biggest and the highest profile solid state lithium producer. It’s attracted huge investment, I think it’s a multi-billion valuation, I think it’s slightly ridiculous.

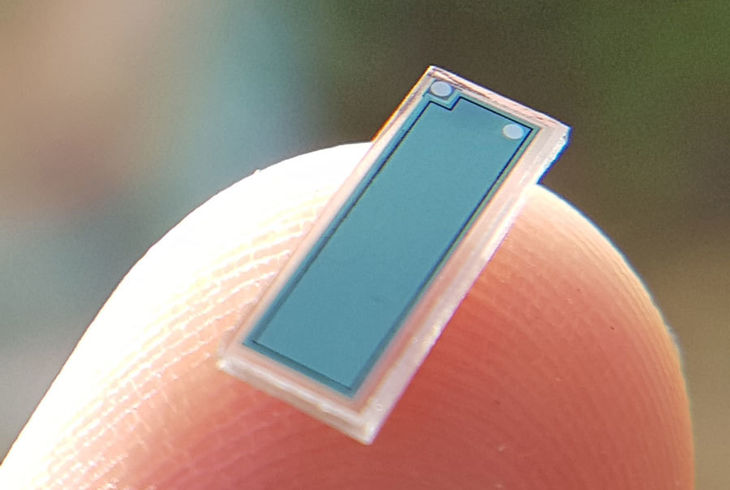

Where IKA is differentiated from these companies is that its nearest term revenue platform isn’t actually its large EV format tech but it’s a much smaller quite different Stereax platform which is addressing different high value Industrial Internet of Things and Medical technology markets.

So, that is actually where the company’s first revenues are very likely going to come from, not from electric vehicles and not from big batteries for these huge markets of storage and electric vehicles, and that differentiates them significantly.

Q3: With that in mind, what news flow should investors be looking out for over the next 12 months?

A3: Definitely progress with the installation and commissioning and bringing online of this big scaled-up production hardware that’s going to increase their Stereax production capacity by a factor of 70 so good positive announcements around that whole programme being executed in a timely manner.

At the same time, hopefully we’ll see some increased number of potential OEM IIoT and MedTech Stereax licensees so hopefully some new potential customers and what would be really nice is if we do see that first full Stereax licencing deal.

Q4: How do you see the company’s strategy evolving over the next 12/18 months as the battery markets develop?

A4: Well, the big thing for the company to decide strategically, I would guess is how to handle this Goliath programme once the grant funding project is complete and it requires financing. A lot of the financial side of that part of their business has been done through grant funding, which is great, when those grants finish, at some point they’re going to have to decide if they want to finance it themselves or maybe sell it off, I’m not sure what they’ll decide to do.

The money they have raised in the last raise they did that they have on the balance sheet is specifically earmarked for the commercialisation of Stereax which is their near-term product line.

An option they may consider is to take advantage of these large valuations in the battery, they’ve got quite a nice valuation and raise further capital specifically earmarked for advancing the Goliath programme.

So, that’s one to watch, what will they do with Goliath.

Q5: Where would you like to see Ilika at this point next year?

A5: I’d like to see Stereax capacity installed commission and ramping up nicely, be great if there’s a big Stereax licensee secured or at least very close and personally, I would like to see them continue the Goliath programme and progressing that finance by a capital raise at some point in the next 12 months.