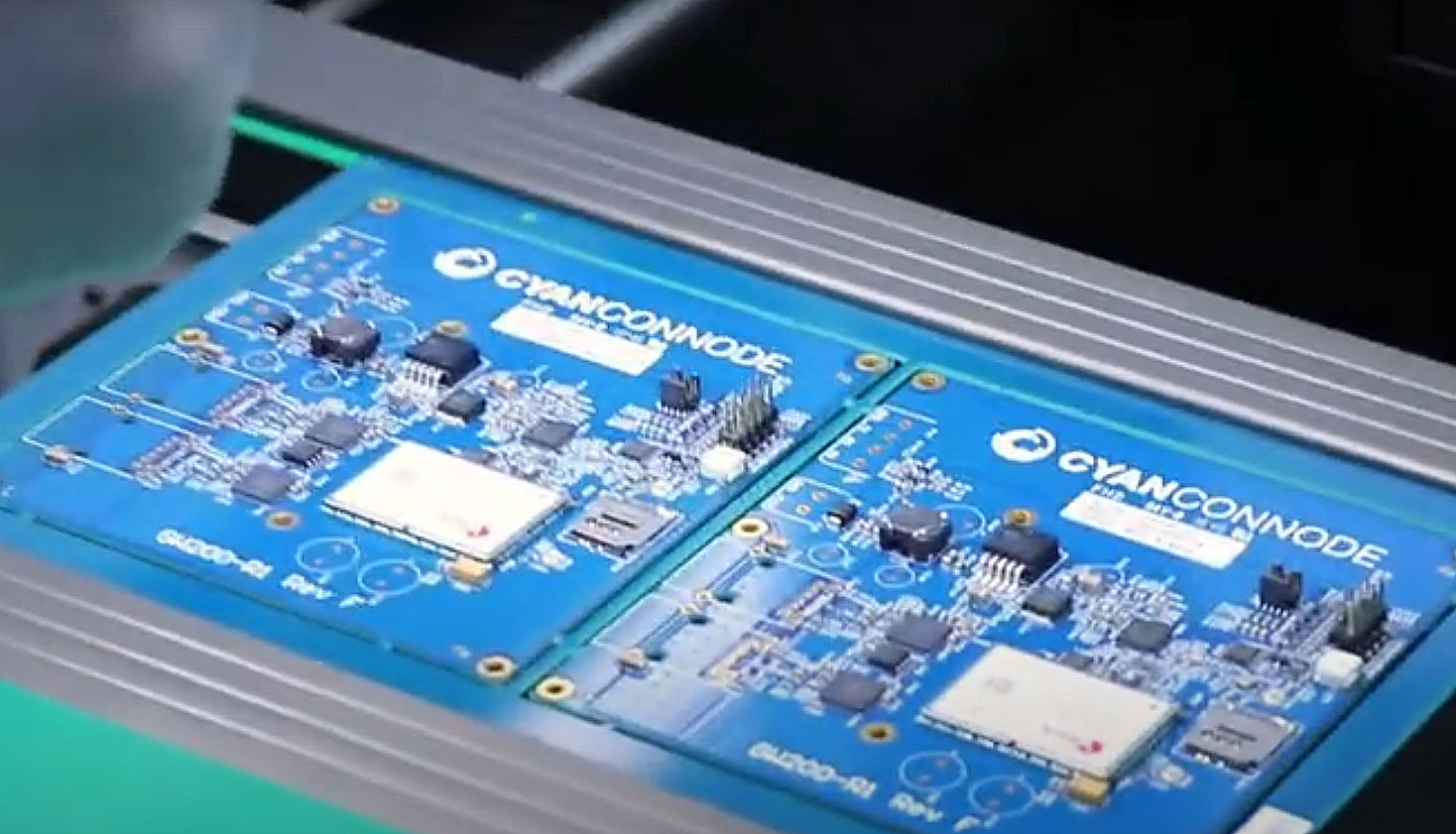

CyanConnode Holdings plc (LON:CYAN), a global leader in narrowband radio frequency (RF) smart mesh networks, has announced that the wholly owned subsidiary of its Indian entity, Digismart Networks Private Limited (Digismart), has qualified and been certified to participate in the upcoming smart metering tenders as an Advanced Metering Infrastructure Service Provider (AMISP).

Following a rigorous testing process, Digismart has successfully demonstrated an end-to-end Advanced Metering Infrastructure (AMI) prepaid solution on its Omnimesh RF network. The certification, valid until 13 May 2026, was issued by REC Ltd. (a Public Sector Undertaking under Ministry of Power, Govt. of India) in recognition of Digismart’s adherence to the specifications outlined in the Request for Empanelment. This certification enables Digismart to bid directly as an AMISP under the Revamped Distribution Sector Scheme (RDSS) for smart prepaid metering in India on a Design, Build, Finance, Own, Operate, and Transfer (DBFOOT) basis.

This certification provides a strategic boost to CyanConnode in India, which is steadily increasing its footprint as the nationwide rollout of smart meters continues to gain momentum. CyanConnode’s current order book stands at 6.6 million units, of which 3 million have already been dispatched. Through Digismart, the Company would be responsible for the end-to-end execution of smart metering projects, from meter supply to Meter Data Management (MDM).

This empanelment allows Digismart to engage directly in significant projects, further integrating CyanConnode’s advanced RF technology into critical infrastructure projects across India.

John Cronin, Executive Chairman, commented:

“The AMISP certification for Digismart is significant for CyanConnode as it puts us at the forefront of India’s rapidly evolving smart metering landscape. Having been active in India for 15 years, and executing our first project a decade ago, we understand this country exceptionally well and are ideally placed to execute projects and meet the vision and standards set by the Government. We are now well-positioned to contribute to the modernization of India’s energy management systems and further strengthen our presence in the market.”