TEAM Asset Management provides a global weekly market review for week commencing 6 February 2023. TEAM Asset Management is a Jersey-based independent asset management company of AIM-listed parent, TEAM plc (LON:TEAM).

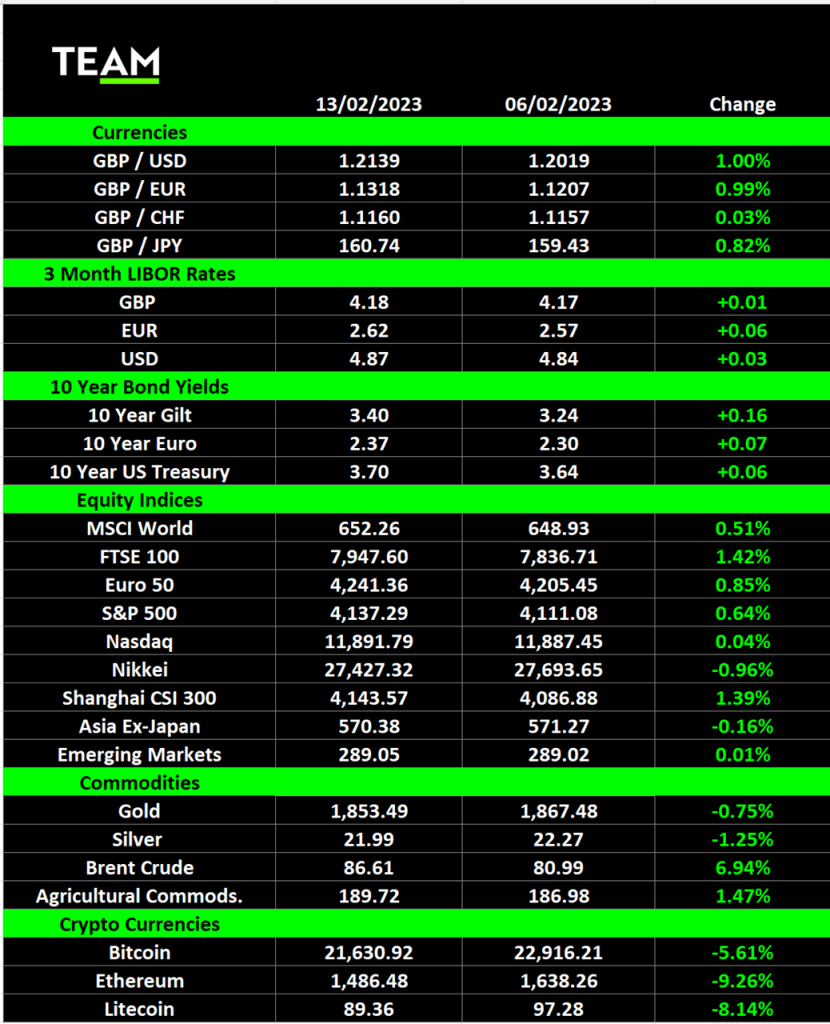

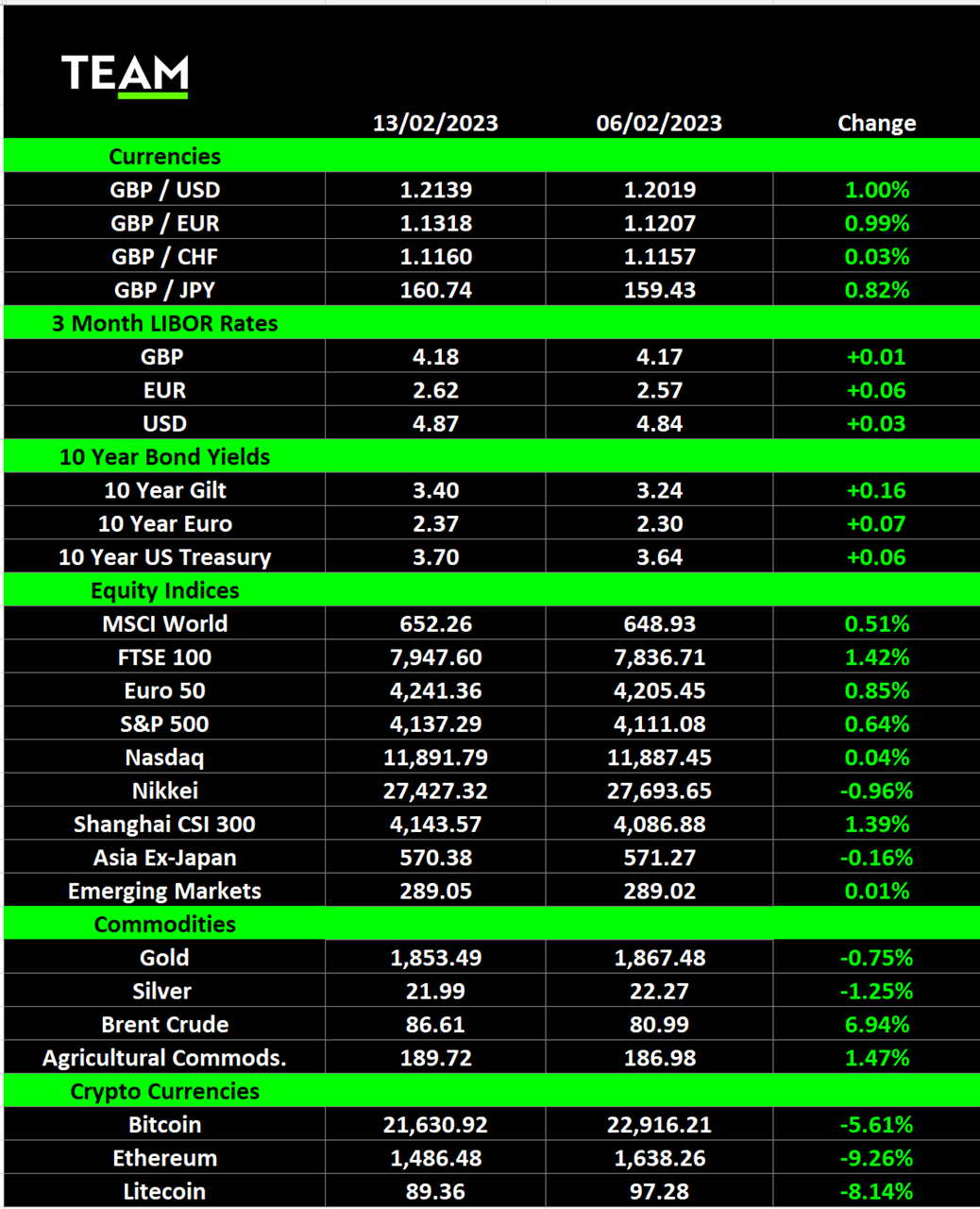

Stocks struggled for direction, whilst bonds fell, as investors digested mixed corporate earnings and economic data reports. The blue-chip S&P 500 index gained 0.6%.

Investors scrutinising economic data releases for clues on central bank policy, especially the outlook for interest rates, were given more conflicting signals. Thus far, economies haven’t slowed down as much as many predicted, including the UK’s which narrowly avoided falling into recession in the fourth quarter by stagnating. A technical recession is defined as two consecutive quarters of economic contraction.

Whilst the UK is only G7 economy that is smaller than it was at the outbreak of the pandemic, mutli-decade low unemployment and government support for households and businesses have cushioned some of the impact of the higher inflation and borrowing costs. The US and Eurozone economies also fared better than expected in the fourth quarter which may embolden central banks to hike interest rates further.

On the other hand, lower headline inflation may persuade policymakers to ease up and markets reacted positively to the news that annual CPI inflation in Germany slowed to a 5-month low of 9.2% in January. The government paid December’s monthly gas bill for all households and small-to-medium sized businesses and will cap prices until April next year.

Despite the better news on inflation, the supermarket shop is not going to be any more affordable. Unilever, whose brands include Ben & Jerry’s ice cream, Domestos and Dove, increased the prices of its products by a record 13.3% in the fourth quarter of 2022. CFO Graeme Pitkethly warned we are “probably past peak inflation, but not past peak pricing” to repair gross margins.

Pepsico also revealed it raised prices by an average 16% in the final three months of last year.

There has been contrasting fortunes for the tech heavyweights in the race to establish an early lead in artificial intelligence supremacy. Microsoft has attracted a lot of attention for its multibillion-dollar investment into OpenAI, the creator of ChatGPT, to bring AI into products such as its Bing search engine, Edge web browser and Office. ChatGPT has accumulated more than 100 million users since it was launched just two months ago and Microsoft’s chief executive Satya Nadella predicts the technology will revolutionize every software category, including internet search.

However, a botched demo of Google’s AI capabilities wiped more than $150 billion off the market value of its parent Alphabet last week. Its shares fell nearly 12% after the Google’s intelligence chatbot Bard stumbled and experts flagged up that it had answered a question about the James Webb space telescope incorrectly. Investors were also disappointed that Google didn’t demonstrate how Bard will integrate with its Search and Maps products.

Shares in Walt Disney jumped more than 5% in after-hours trading following the release of its fourth quarter earnings on Wednesday night. Recently returned CEO Bob Iger announced a broad restructuring in a bid to save costs, including 7,000 job cuts and a $3 billion lower spend on content, excluding sports. He added Disney will consider restoring its dividend which was suspended during the pandemic.

The measures were enough for billionaire activist investor Nelson Peltz to call off his proxy fight with Disney. Peltz is sitting on a paper profit of more than $150 million since he acquired shares in the entertainment giant in November.

Adidas shares fell more than 12% on Friday after it issued its fourth profit warning since July. The German sportswear manufacturer, who cut ties with the controversial rapper Kanye West in October after he put antisemitic posts on social media, revealed it could lose up to €700 million this year if it decides to scrap the remaining stocks of its Yeezy range.

The price of Brent crude climbed more than $4 to $86 a barrel last week after Russia retaliated to price caps imposed by the West. Deputy PM Alexander Novak announced it will cut production by 500,000 a day, equivalent to around 0.5% of global supply, providing more tailwinds for Big Oil. Earlier in the week, BP reported a record annual profit of $27.7 billion, beating its previous set back in 2008.