TEAM Asset Management’s global weekly market review for week commencing 18th September. TEAM Asset Management is a Jersey-based independent asset management company of AIM-listed parent, TEAM plc (LON:TEAM).

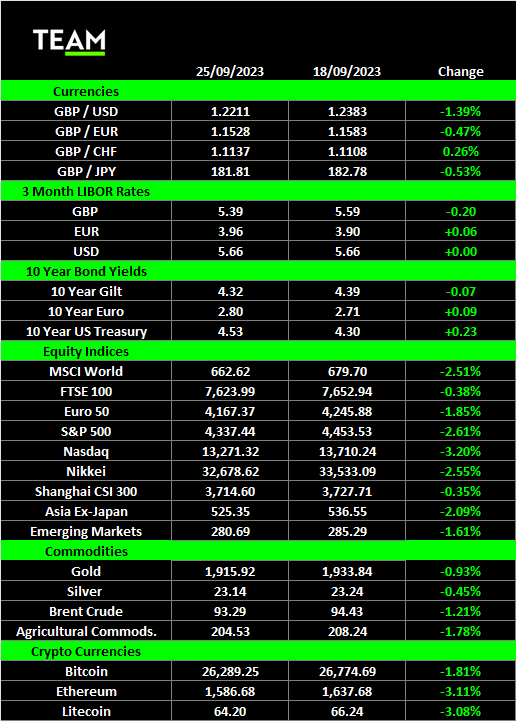

September is statistically the weakest month of the Calendar year for world equity markets and 2023 is proving no exception. Last week the broad American market was down close to 3% whilst the technology dominated NASDAQ index was even worse. General European bourses and Emerging Markets only fared slightly better. Strangely, this September anomaly is often unrelated to any market event or news but owes probably more to seasonal investor behaviour as action is taken to change portfolios around the end of the summer.

Important news came from the US as the Federal Open Market Committee decided to leave interest rates unchanged at the 5.25 -5.5% level. The statement expressed the likelihood of one more rate hike this year along with fewer rate cuts in 2024. Three clear take-away messages; inflation is stickier than expected, the economy is stronger than anticipated and interest rates will be higher for longer. As a result, US government bonds sold off sharply and the yield on the 10-year US Treasury rose to 4.5%, the highest level for seventeen years!

Elsewhere, on the Central Bank front, the Bank of England, and our own Monetary Policy Committee also decided to keep interest rates on hold at 5.25% in a 5-4 split vote. The majority of the committee, including the BoE’s governor Andrew Bailey, felt it was appropriate to leave rates unchanged for the first time since November 2021 and take a more data dependent approach going forward.

The decision provides some modest relief for hard pressed mortgage holders and indebted companies. Two key reasons for this were that recent UK economic data had proved noticeably weaker and there was a surprise drop in August inflation. The latter was at 6.7%, still way above the Bank of England’s target of 2%, but lower than forecasts of 7%, owing to food inflation slowing down.

The UK economy is not alone as Europe is also in the doldrums economically, with its most important economy, Germany, seeing business sentiment showing even greater weakness. This represents the fifth consecutive month of decline and points to probable future economic strife in the months ahead.

Local readers may be asking why petrol prices are once again rising on the garage forecourts? Back on 1 July the price of a barrel of Brent Crude oil was $75 – today the price is over $90 making a 20% plus increase. Much of the reason has been the efforts of Saudi Arabia to constrict the flow of oil to global markets whilst Russia has also had material impacts. Analysts are divided on where we go from here, but many observers believe market momentum suggests $100 a barrel is not far away which could influence Central Banks to raise interest rates again in the future, as inflation stays too high. In the week ahead, investors should look to see if US President Biden has influence on the Union of Automotive Workers strike – he is planning a visit to support workers in their aim of securing a better pay and conditions offer. An early resolution to the dispute may help bring about stronger investor confidence. In economic news the Federal Reserves preferred measure of inflation is released on Friday this week with the ‘core’ rate being the key. Any news showing this falling below 4% will be well received. Finally, do not forget that the US government has less than a week to agree a new budget deal or otherwise there is a chance of another Federal government shutdown!