Thor Energy plc (LON:THR, ASX: THR, OTCQB: THORF), well-funded specialists in Hydrogen and Helium exploration, has provided a comprehensive update on current and planned exploration activities at its flagship HY-Range Project (RSEL 802) in South Australia, alongside a corporate update highlighting a highly successful year of portfolio rationalisation and value generation.

HIGHLIGHTS:

HY-Range – Exploration and Planning

· Line layout completed for a major 2D seismic survey covering several hundred line-kilometres to identify drilling targets.

· Request for Quote (“RFQ”) to be released shortly, survey expected mid-2026, with exploration drilling targeted for 2026 or thereafter.

· A Phase-2 Geochemistry survey is currently underway to bolster models for hydrogen and helium migration, enriching the body of integrated data and evidence alongside reprocessed legacy seismic data, remote sensing, and offset well data.

Portfolio Rationalisation – Significant Cash Inflows expected in early 2026

· Strategic portfolio consolidation delivering significant, non-dilutive funding to execute the RSEL 802 work.

· Australia – Molyhil Divestment: Sale of Thor’s interest to Tivan Limited proceeding through final conditions precedents, including submission of approvals to the transaction to the Territory Government. Thor has already received A$375,000 with a further A$2.25 million anticipated in the new year upon successful completion, followed by three annual payments of A$1.3125 million in the Septembers of 2026, 2027, and 2028.

· US Uranium: Deal completed for divestment of 75% equity in the URAVAN portfolio to Metals One PLC completed in cash and non-restricted shares, plus a separate binding revenue-sharing agreement signed with DISA Technologies. Thor retains a carried 25% interest in these Projects and looks forward to DISA tabling the 2026 evaluation and extraction plans.

Andrew Hume, Managing Director and CEO, commented:

“We are delighted to report excellent progress in prosecuting our work plan for the HY-Range project (RSEL 802). The decision to prioritise a 2D seismic survey represents a significant step change in our exploration maturity, allowing us to transition from surface anomalies to defined subsurface drilling targets. With the RFQ process commencing shortly, we anticipate acquiring the survey by mid-2026 and are on a clear pathway toward drilling, potentially as early as 2026, should all permitting requirements be met in a timely fashion.

“The divestments of our non-core US Uranium and Molyhil assets have simplified and focused Thor’s portfolio, significantly reduced our cost base, and facilitated the working capital necessary to proactively prosecute our RSEL 802 without immediate recourse to shareholders.”

HY-RANGE PROJECT (RSEL 802) PROGRESS

2D Seismic Survey & Drilling Timeline

The Company is progressing at pace towards the acquisition of 2D seismic data in 2026, with plans to shoot several hundred-line kilometres of 2D seismic data over our primary prospective areas within RSEL 802.

This seismic survey will be the fundamental keystone of our pre-drill investigations, delivering unprecedented insights into the subsurface, identifying and refining prospectivity, delivering further insights into the natural hydrogen/helium systems (Source, Migration, Enrichment, and Trapping) to a depth of several kilometres, and ultimately allowing for the selection and necessary data to underpin successful exploration drilling.

The Company is shortly going to market with an RFQ for seismic acquisition and processing. The survey is expected to occur in mid-2026 to enable exploration drilling as soon as practical, depending on seismic results and well permitting requirements.

Phase 2 Geochemistry

Following the excellent results of the Phase 1 Geochemistry survey undertaken in May 2025, Thor is currently conducting a second phase to bolster its understanding of natural hydrogen and helium flow. This data is designed to fully integrate with our Phase 1 geochemical data, our licence-wide geological understanding, and our seismic datasets. In Phase 2, we are building on the innovative and highly successful Phase 1 survey by sampling additional locations, developing long-term monitoring at several sites, and implementing new approaches to borehole creation and sampling.

The survey is progressing on plan, and as expected, with the results consolidating our understanding, and generating innovative methodologies and IP for Thor to deploy in the future, across our portfolio.

2026 Data integration and other data sources

Whilst progressing our geochemical acquisition and 2D seismic planning, Thor has also initiated exploration well planning, is undertaking seismic reprocessing of legacy data on RSEL 802, is evaluating core material from several on-licence offset wells, and continues to integrate the benefits of its Phase-1 geochemistry results into our licence-wide and regional understanding of natural hydrogen and helium potential.

The net effect of all this work will be a robust, rapid maturation programme optimised for high-value exploration drilling on RSEL-802.

CORPORATE UPDATE: PORTFOLIO RATIONALISATION & FUNDING

The Company has had a successful and value-generating year in the deal space, executing a strategy to simplify and focus Thor’s portfolio whilst funding capital from non-core assets.

Molyhil Project Divestment

The divestiture of Thor’s interest in the Molyhil Tungsten Project to Tivan Limited (ASX: TVN) is continuing across the final condition precedents. This transaction is structured to provide substantial cash inflows to Thor:

• Received: Thor has already received A$375,000 in non-refundable exclusivity payments.

• Anticipated: A Cash Completion Payment of A$2,250,000 is anticipated in the new year.

• Deferred: Three subsequent annual payments of A$1,312,500 are scheduled for September 2026, 2027, and 2028.

US Uranium Divestment & DISA Partnership

Thor completed the divestiture of 75% equity in its USA URAVAN Uranium portfolio to Metals One PLC (AIM: MET1) in August 2025. This transaction included a cash exclusivity fee and significant equity.

Furthermore, Thor executed a binding agreement with DISA Technologies, Inc. to potentially generate revenue from legacy waste dumps at the US projects via a gross revenue-sharing arrangement, requiring no capital or operating expenditures from Thor. The project is particularly appealing, as it enables new technology development and provides a line of sight to a potential revenue stream, whilst delivering meaningful environmental and human benefits through the removal of surface radioactive material.

Collectively, these deals have simplified Thor’s portfolio, reduced the Company’s cost base to only minor costs and workload associated with non-core assets, and ultimately allocated working capital to proceed with the RSEL 802 programme.

2025 Portfolio, cost, and revenue

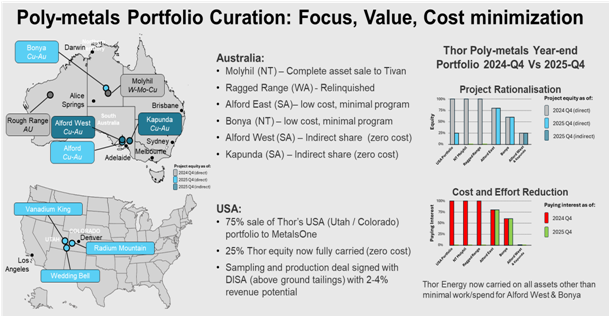

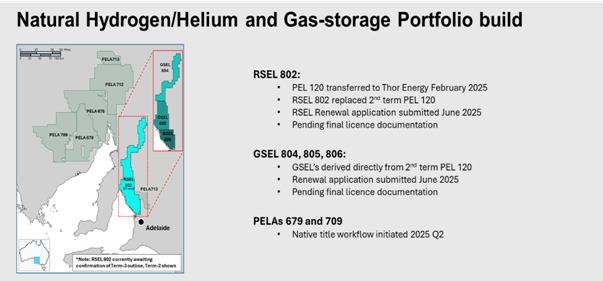

The below infographic (Figure 1) provides a snapshot of Thor’s evolving portfolio from a relatively high-cost diverse metals portfolio in December 2024 to our current, more focused, virtually zero-cost poly-metallic portfolio in December 2025, whilst Figure 2 provides a snapshot of Thor’s South Australia natural hydrogen and helium portfolio, acquired in 2025.

With the relinquishment of Western Australian licences, the sale of 75% of our USA portfolio and full carry of our 25% equity, and the full divestiture of Molyhil, we are left with a valuable, low- to no-cost metals portfolio in South Australia, the Northern Territory, and the USA.

Thor Energy’s focus is now on our South Australian (Figure 2) natural hydrogen and helium portfolio consisting of the key HY-Range project, a portfolio of future licences working through native title negotiations, and the unique, complementary, Gas Storage Exploration Licences (GSEL 804, 805, and 806), collocated with HY-Range offering potential for value-added hydrogen, natural gas or CO2 storage.

Figure 1: Infographic illustrating portfolio rationalisation, value-generation, and the establishment of a low-cost, largely carried poly-metals portfolio. Map callouts: grey callouts represent fully divested projects; light blue represents current operated assets, and dark blue represents current indirect projects (via shareholding in Enviro-Copper Limited). Upper right chart: 2024 project equity (grey), current direct equity (light blue), and current indirect equity (dark blue). Lower right chart: relative cost/effort for 2024 projects (red) and current portfolio (green).

Figure 2: Current South Australian natural hydrogen, helium, and gas storage exploration portfolio. Bright blue is the Second term licence of RSEL 802 (HY-Range), light grey blues represent Petroleum Exploration Licence Applications (PELAS), progressing toward full licence award and leading to the expansion of Thor’s natural hydrogen and helium portfolio, and dark blues illustrate Gas Storage Exploration Licences (GSEL) 804, 805, and 806, collocated with RSEL 802.