Thor Energy PLC (LON:THR, ASX: THR, OTCQB: THORF) has reported on its activities for the Quarterly period April to June 2025.

Andrew Hume, CEO and Managing Director, Thor Energy Plc, commented:

“This past quarter has been one of significant progress and strategic consolidation for Thor Energy. Our work at Project HY-Range has advanced exceptionally well as we completed a licence-wide geochemical survey, which delivered overwhelmingly positive data to prove working natural hydrogen and helium systems. These results enabled high grading of the most prospective areas to position Thor to efficiently target future exploration drilling.

“Beyond HY-Range, we have continued to strategically consolidate our unique natural hydrogen and helium offering, including the award of Gas Storage Exploration Licences adjacent to Adelaide, a strong synergy that substantially augments our existing South Australian footprint and facilitates natural hydrogen commerciality. Internally, we have remained steadfast in our commitment to lowering costs and streamlining our operations. I am also delighted earlier this month that I assumed the position of CEO, with Executive Chairman Alastair Clayton reverting to his previous role as Non-Executive Chairman.

“In the post-period, our work across the current quarter has continued to strengthen our strategic approach, as we have recorded prolific hydrogen and helium systems at our HY-Range Project whilst agreeing a term sheet to sell 75% of our US uranium assets. As we progress our operational developments for the rest of the quarter, we enter an exciting period for the Company in the upcoming months.”

HY-RANGE PROJECT – RSEL 802 – SOUTH AUSTRALIAN NATURAL HYDROGEN AND HELIUM

The key focus of our exploration efforts at the HY Range natural hydrogen and helium project was the successful completion of a full-licence geochemical sampling programme, designed to provide a further suite of data to prove working natural hydrogen and helium systems, and initiate high grading of our acreage to increase focus on drill targeting and as an aid to final drill design. As announced on 29 May, “HY-Range Hydrogen/Helium Geochemical Survey Completed”, the planned programme was upsized to include several new step-out locations, resulting in a total of 103 sample locations. Thor deployed field-based gas chromatography equipment, which we understand to be the first deployment of its kind for natural hydrogen and helium exploration in Australia, see Figure 1.

Figure 1: Field operations in the southern flinders area, collecting soil air geochemical analysis at Project HY-Range, May 2025.

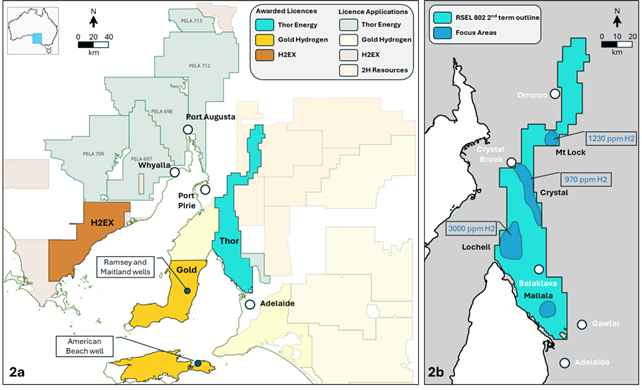

The excellent results of the geochemical sampling programme were announced post period on 7 July, “Outstanding Geochemical Results at HY-Range Project”. Analysis of the data yielded very positive results, with a high percentage of elevated hydrogen values in numerous areas of the licence, locally exceeding 1,000ppm in several locations, and up to 3,000ppm at one sample point (compared to typical background atmospheric values of 0.5ppm). Locally elevated helium readings were also recorded up to 27ppm (compared to typical background atmospheric values of 5ppm). Whilst soil gas sampling can be inherently prone to anthropogenic hydrogen contamination and sample bias, the distribution of the values strongly correlates with mapped geological features and supports the natural origin of these highly elevated readings, as shown in Figure 2a and 2b. The detection of elevated helium is unambiguous and demonstrates a working helium system.

Figure 2a illustrates the location of RSEL 802 (HY-Range) in the context of nearby Petroleum Exploration Licences (PELs) and licence applications (PELA’s), as well as nearby down-hole hydrogen/helium occurrences.

Figure 2b illustrates the four priority focus areas (Blue polygons) in the context of RSEL 802 licence (2nd term outline- black polygon).

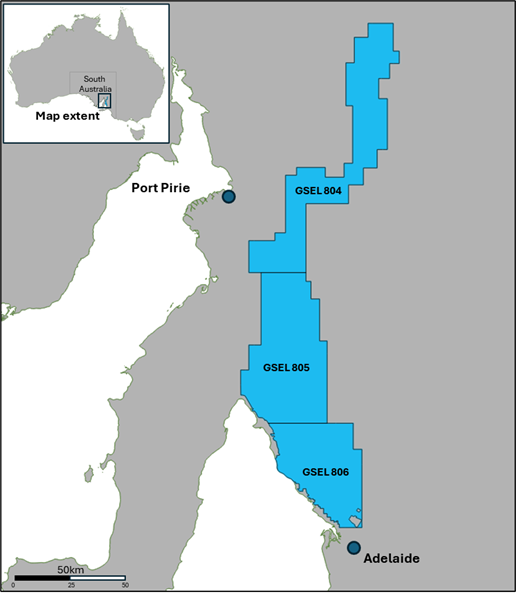

On 16 June, the Company announced “Gas Storage Exploration Licences, South Australia” that its subsidiary, Go Exploration Pty Ltd had received an offer from the South Australian Department for Energy and Mining to grant three Gas Storage Exploration Licences: GSEL 804, GSEL 805, and GSEL 806, as indicated in Figure 3. Go Exploration Pty Ltd duly accepted the offer, and the GSELs provide the exclusive right to explore for and develop underground gas storage facilities within the licence areas. The licences are now granted under the Energy Resources Act 2000 (SA).

|

Figure 3 GSEL 804, 805, 806 Location map

Molyhil, W, Cu, Mo NT, Australia

No work undertaken, under joint venture with Investigator Resources (IVR.ASX)

Uranium and Vanadium (USA)

No work undertaken other than rehabilitation inspections of 2024 drill sites. Post-period, the Company announced its intention to sell the US Uranium claims. Further described below and in the announcement on 25 July 2025.

EnviroCopper (via 26.3% equity holding) Kapunda, SA, Australia

No work undertaken

Alford East Cu, Au, SA, Australia

No work undertaken

CORPORATE, FINANCE, AND CASH MOVEMENTS

Corporate

Post-period as announced on 7 July, “Outstanding Geochemical Results at HY-Range Project”, Mr Andrew Hume, the Managing Director was also appointed the Chief Executive Officer role and the Executive Chairman, Alastair Clayton, resumed his previous role as Non-executive Chairman.

Post-period, the Company announced on 25 July, “Term sheet to sell 75% of US Uranium Claims”, had been signed with Metals One PLC, an AIM-listed uranium and metals explorer whereby Metals Once PLC would seek to acquire a 75% interest in the Standard Minerals and Cisco, subsidiary companies that own Thor’s US uranium projects. Consideration includes an upfront signing fee of £100,000 (~$205,000) and upon completion of a full Sale and Purchase Agreement, the issuance of £1,000,000 (~$2,050,000) in Metals One PLC stock. An option has also been granted to Metals One PLC, a 12-month option to acquire the remaining 25% in standard Minerals and Cisco for an amount to be mutually agreed and/or determined by an independent third-party valuation.

Cash Movement

For the quarter, the Company had no cash inflows.

▪ Net cash outflows from Operating and Investing activities for the quarter of $548,000, which included outflows of $59,000 directly related to exploration activities.

▪ Cash inflows from financing activities for the quarter were $1,000.

▪ Providing an ending cash balance of $1,459,000.

Cashflows for the quarter include payments of $95,000 to Directors, comprising the CEO-Managing Director’s salary, the Non-Executive Directors’ salaries. The Chairman is continuing to accrue his Non-Executive Directors’ fees.

The Board of Thor Energy Plc has approved this announcement and authorised its release.

Competent Person Statement and Qualified Person for the purposes of the AIM Note for Mining and Oil & Gas Companies

The information in this report that relates to exploration results and exploration targets is based on information compiled by Andrew Hume, who holds a BSc in Geology (Hons). Mr Hume is an employee of Thor Energy PLC. He has sufficient experience which is relevant to the style of mineralisation and type of deposit under consideration and to the activity which he is undertaking to qualify as a Competent Person as defined in the 2012 Edition of the ‘Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves’ and is a qualified person under AIM Rules. Andrew Hume consents to the inclusion in the report of the matters based on his formation in the form and context in which it appears.

TENEMENT SCHEDULE

As of 30 June 2025, the consolidated entity holds an interest in the following Australian tenements:

Go Exploration, natural hydrogen, helium and coincident gas storage portfolio

| Project | Tenement | Area kms2 | Area ha. | Holders | Company Interest |

| HY-Range | RSEL 802 * | 6332 | Go Exploration | 80.2% | |

| Geo-Range | GSEL 804 | 2368 | Go Exploration | 80.2% | |

| Geo-Range | GSEL 805 | 2389 | Go Exploration | 80.2% | |

| Geo-Range | GSEL 806 | 1558 | Go Exploration | 80.2% |

| Project | Tenement | Area kms2 | Area ha. | Holders | Company Interest |

| Molyhil * | EL22349 | 228.10 | Molyhil Mining Pty Ltd | 100% | |

| Molyhil * | EL31130 | 9.51 | Molyhil Mining Pty Ltd | 100% | |

| Molyhil * | ML23825 | 95.92 | Molyhil Mining Pty Ltd | 100% | |

| Molyhil * | ML24429 | 91.12 | Molyhil Mining Pty Ltd | 100% | |

| Molyhil * | ML25721 | 56.2 | Molyhil Mining Pty Ltd | 100% | |

| Molyhil * | AA29732 | 38.6 | Molyhil Mining Pty Ltd | 100% | |

| Molyhil * | MLS77 | 16.18 | Molyhil Mining Pty Ltd | 100% | |

| Molyhil * | MLS78 | 16.18 | Molyhil Mining Pty Ltd | 100% | |

| Molyhil * | MLS79 | 8.09 | Molyhil Mining Pty Ltd | 100% | |

| Molyhil * | MLS80 | 16.18 | Molyhil Mining Pty Ltd | 100% | |

| Molyhil * | MLS81 | 16.18 | Molyhil Mining Pty Ltd | 100% | |

| Molyhil * | MLS82 | 8.09 | Molyhil Mining Pty Ltd | 100% | |

| Molyhil * | MLS83 | 16.18 | Molyhil Mining Pty Ltd | 100% | |

| Molyhil * | MLS84 | 16.18 | Molyhil Mining Pty Ltd | 100% | |

| Molyhil * | MLS85 | 16.18 | Molyhil Mining Pty Ltd | 100% | |

| Molyhil * | MLS86 | 8.05 | Molyhil Mining Pty Ltd | 100% | |

| Bonya * | EL29701 | 204.5 | Molyhil Mining Pty Ltd | 40% | |

| Bonya | EL32167 | 74.54 | Molyhil Mining Pty Ltd | 40% | |

| Alford East | EL6529 | 315.1 | Hale Energy Pty Ltd | 80% oxide interest |

* Following formalisation of a Joint Venture Agreement (“JV”), the Company is transferring 25% of its 100% interest in the above Molyhil tenements holds and all of its 40% interest in one of the Bonya tenements (EL29701).

USA mineral exploration licence portfolio

As of 30 June 2025, the consolidated entity holds 100% interest in the uranium and vanadium projects in USA States of Colorado and Utah as follows:

| Claim Group | Serial Number | Claim Name | Area | Holders | Company Interest |

| Vanadium King (Utah) | UMC445103 to UMC445202 | VK-001 to VK-100 | 100 blocks (2,066 acres) | Cisco Minerals Inc | 100% |

| Radium Mountain (Colorado) | CMC292259 to CMC292357 | Radium-001 to Radium-099 | 99 blocks (2,045 acres) | Standard Minerals Inc | 100% |

| Groundhog (Colorado) | CMC292159 to CMC292258 | Groundhog-001 to Groundhog-100 | 100 blocks (2,066 acres) | Standard Minerals Inc | 100% |

Appendix 5B

Mining exploration entity or oil and gas exploration entity

quarterly cash flow report

| Name of entity | ||

| THOR ENERGY PLC | ||

| ABN | Quarter ended (“current quarter”) | |

| 121 117 673 | 30 June 2025 | |

| Consolidated statement of cash flows | Current quarter $A’000 | Year to date (12 months) $A’000 | |

| 1. | Cash flows from operating activities | – | – |

| 1.1 | Receipts from customers | ||

| 1.2 | Payments for | – | – |

| (a) exploration & evaluation | (8) | (41) | |

| (b) development | – | (8) | |

| (c) production | – | – | |

| (d) staff costs | (83) | (458) | |

| (e) administration and corporate costs | (407) | (1,293) | |

| 1.3 | Dividends received (see note 3) | – | – |

| 1.4 | Interest received | 1 | – |

| 1.5 | Interest and other costs of finance paid | – | 8 |

| 1.6 | Income taxes paid | – | (1) |

| 1.7 | Government grants and tax incentives | – | 208 |

| 1.8 | Other | – | 53 |

| 1.9 | Net cash from / (used in) operating activities | (497) | (1532) |

| 2. | Cash flows from investing activities | ||

| 2.1 | Payments to acquire or for: | ||

| (a) entities | – | – | |

| (b) tenements | – | – | |

| (c) property, plant and equipment | – | – | |

| (d) exploration & evaluation | (51) | (544) | |

| (e) equity accounted investments | – | – | |

| (f) other non-current assets (bonds) | – | – | |

| 2.2 | Proceeds from the disposal of: | — | — |

| (a) entities | |||

| (b) tenements (bond refunds) | – | 109 | |

| (c) property, plant and equipment | – | – | |

| (d) investments | – | – | |

| (e) other non-current assets | – | 116 | |

| 2.3 | Cash flows from loans to other entities | – | – |

| 2.4 | Dividends received (see note 3) | – | – |

| 2.5 | Other (Government grants) | – | – |

| 2.6 | Net cash from / (used in) investing activities | (51) | (319) |

| 3. | Cash flows from financing activities | – | 1,964 |

| 3.1 | Proceeds from issues of equity securities (excluding convertible debt securities) | ||

| 3.2 | Proceeds from issue of convertible debt securities | – | – |

| 3.3 | Proceeds from exercise of options | – | |

| 3.4 | Transaction costs related to issues of equity securities or convertible debt securities | – | (262) |

| 3.5 | Proceeds from borrowings | – | – |

| 3.6 | Repayment of borrowings (lease liability) | – | (12) |

| 3.7 | Transaction costs related to loans and borrowings | – | – |

| 3.8 | Dividends paid | – | – |

| 3.9 | Other (funds received in advance of a placement) | – | – |

| 3.10 | Net cash from / (used in) financing activities | – | 1,690 |

| 4. | Net increase / (decrease) in cash and cash equivalents for the period | (548) | (161) |

| 4.1 | Cash and cash equivalents at beginning of period | 1,987 | 1,535 |

| 4.2 | Net cash from / (used in) operating activities (item 1.9 above) | (497) | (1532) |

| 4.3 | Net cash from / (used in) investing activities (item 2.6 above) | (51) | (319) |

| 4.4 | Net cash from / (used in) financing activities (item 3.10 above) | – | 1,690 |

| 4.5 | Effect of movement in exchange rates on cash held | 20 | 85 |

| 4.6 | Cash and cash equivalents at end of period | 1,459 | 1,459 |

| 5. | Reconciliation of cash and cash equivalents at the end of the quarter (as shown in the consolidated statement of cash flows) to the related items in the accounts | Current quarter $A’000 | Previous quarter $A’000 |

| 5.1 | Bank balances | 1,459 | 1,987 |

| 5.2 | Call deposits | ||

| 5.3 | Bank overdrafts | ||

| 5.4 | Other (provide details) | ||

| 5.5 | Cash and cash equivalents at end of quarter (should equal item 4.6 above) | 1,459 | 1,987 |

| 6. | Payments to related parties of the entity and their associates | Current quarter $A’000 |

| 6.1 | Aggregate amount of payments to related parties and their associates included in item 1 | 95 |

| 6.2 | Aggregate amount of payments to related parties and their associates included in item 2 | – |

| Note: if any amounts are shown in items 6.1 or 6.2, your quarterly activity report must include a description of, and an explanation for, such payments. The amount at item 6.1 above represents fees paid to Non-Executive Directors, and remuneration paid to the Managing Director. | ||

| 7. | Financing facilities Note: the term “facility’ includes all forms of financing arrangements available to the entity.Add notes as necessary for an understanding of the sources of finance available to the entity. | Total facility amount at quarter end $A’000 | Amount drawn at quarter end $A’000 |

| 7.1 | Loan facilities | – | – |

| 7.2 | Credit standby arrangements | – | – |

| 7.3 | Other (please specify) | – | – |

| 7.4 | Total financing facilities | – | – |

| 7.5 | Unused financing facilities available at quarter end | – | |

| 7.6 | Include in the box below a description of each facility above, including the lender, interest rate, maturity date and whether it is secured or unsecured. If any additional financing facilities have been entered into or are proposed to be entered into after quarter end, include a note providing details of those facilities as well. | ||

| 8. | Estimated cash available for future operating activities | $A’000 |

| 8.1 | Net cash from / (used in) operating activities (item 1.9) | (497) |

| 8.2 | (Payments for exploration & evaluation classified as investing activities) (item 2.1(d)) | (51) |

| 8.3 | Total relevant outgoings (item 8.1 + item 8.2) | (548) |

| 8.4 | Cash and cash equivalents at quarter end (item 4.6) | 1,459 |

| 8.5 | Unused finance facilities available at quarter end (item 7.5) | – |

| 8.6 | Total available funding (item 8.4 + item 8.5) | 1,459 |

| 8.7 | Estimated quarters of funding available (item 8.6 divided by item 8.3) | 2.8 |

| Note: if the entity has reported positive relevant outgoings (ie a net cash inflow) in item 8.3, answer item 8.7 as “N/A”. Otherwise, a figure for the estimated quarters of funding available must be included in item 8.7. | ||

| 8.8 | If item 8.7 is less than 2 quarters, please provide answers to the following questions: | |

| 8.8.1 Does the entity expect that it will continue to have the current level of net operating cash flows for the time being and, if not, why not? | ||

| Answer: N/A | ||

| 8.8.2 Has the entity taken any steps, or does it propose to take any steps, to raise further cash to fund its operations and, if so, what are those steps and how likely does it believe that they will be successful? | ||

| Answer: N/A | ||

| 8.8.3 Does the entity expect to be able to continue its operations and to meet its business objectives and, if so, on what basis? | ||

| Answer: Yes | ||

| Note: where item 8.7 is less than 2 quarters, all of questions 8.8.1, 8.8.2 and 8.8.3 above must be answered. | ||

Compliance statement

1 This statement has been prepared in accordance with accounting standards and policies which comply with Listing Rule 19.11A.

2 This statement gives a true and fair view of the matters disclosed.

Date: 30 July 2025…………………………………………………..

Authorised by: the Board…………………………………………………………..

(Name of body or officer authorising release – see note 4)

Notes

1. This quarterly cash flow report and the accompanying activity report provide a basis for informing the market about the entity’s activities for the past quarter, how they have been financed and the effect this has had on its cash position. An entity that wishes to disclose additional information over and above the minimum required under the Listing Rules is encouraged to do so.

2. If this quarterly cash flow report has been prepared in accordance with Australian Accounting Standards, the definitions in, and provisions of, AASB 6: Exploration for and Evaluation of Mineral Resources and AASB 107: Statement of Cash Flows apply to this report. If this quarterly cash flow report has been prepared in accordance with other accounting standards agreed by ASX pursuant to Listing Rule 19.11A, the corresponding equivalent standards apply to this report.

3. Dividends received may be classified either as cash flows from operating activities or cash flows from investing activities, depending on the accounting policy of the entity.

4. If this report has been authorised for release to the market by your board of directors, you can insert here: “By the board”. If it has been authorised for release to the market by a committee of your board of directors, you can insert here: “By the [name of board committee – eg Audit and Risk Committee]”. If it has been authorised for release to the market by a disclosure committee, you can insert here: “By the Disclosure Committee”.

5. If this report has been authorised for release to the market by your board of directors and you wish to hold yourself out as complying with recommendation 4.2 of the ASX Corporate Governance Council’s Corporate Governance Principles and Recommendations, the board should have received a declaration from its CEO and CFO that, in their opinion, the financial records of the entity have been properly maintained, that this report complies with the appropriate accounting standards and gives a true and fair view of the cash flows of the entity, and that their opinion has been formed on the basis of a sound system of risk management and internal control which is operating effectively.