Thor Energy plc (LON:THR, ASX: THR, OTCQB: THORF) has reported on its activities for the Quarterly period July to September 2025.

Andrew Hume, CEO and Managing Director, Thor Energy Plc, commented:

“This past quarter, covering July through September 2025, has been fundamentally transformative and strategically important for Thor Energy. We have successfully achieved several major corporate milestones, sharpening our focus entirely on high-potential natural hydrogen and helium exploration, while simultaneously strengthening our balance sheet through the strategic monetisation of legacy assets.

“Operationally, our flagship HY-Range Project (RSEL 802) in South Australia produced exceptionally positive results. Following the completion of our licence-wide geochemical survey, data analysis announced early in the quarter showed outstanding geochemical results. We recorded a high percentage of elevated hydrogen values across the licence, locally exceeding 1,000ppm and reaching up to 3,000ppm at one sampling point, significantly higher than typical background atmospheric values of 0.5ppm. Crucially, the data yielded elevated helium readings of up to 27ppm, providing good evidence of a working helium system. Based on these compelling results, we have successfully high-graded four principal focus areas – Mallala, Locheil, Crystal, and Mt Lock – which will guide our future exploration efforts and final drill target selection.

“In line with our renewed strategic focus, we took decisive steps to streamline our portfolio to enhance our financial flexibility. We made significant progress in executing agreements for our non-core assets, starting with the completion of the sale of 75% of our US uranium assets to Metals One Plc in August 2025. Furthermore, in September, we successfully signed a binding term sheet for A$6.6m with Tivan Limited for the sale of our 75% remaining interest in the Molyhil Tungsten-Molybdenum Project. The resulting cash inflow expected over the next 12 months and beyond will materially bolster our capital resources, allowing us to invest significantly more in advancing HY-Range and thereby reducing the need for shareholder dilution. Separately, post-quarter-end, our subsidiary, Standard Minerals, advanced its collaboration in the US, signing a binding term sheet with DISA to potentially generate revenue from uranium and critical metals recovery from waste dumps using HPSA technology.

“On the corporate front, I was pleased to formally take on the role of CEO and Managing Director in July 2025. This planned transition enables Alastair Clayton to resume the position of Non-Executive Chairman, providing dedicated executive leadership suitable for the Company’s scale.

“In the post-period, EnviroCopper Limited, of which Thor owns 24% secured an external investment of A$3.5m to help facilitate in-situ recovery at the Kapunda and Alford copper projects in South Australia.

“The momentum this quarter remains strong. Having concluded the previous quarter with A$1,459,000 in cash, the subsequent monetisation efforts have led to an increased quarter-end cash balance of $1,598,000, despite operational outflows. Further large cash inflows are expected in the coming quarters as the Molyhil sale is expected to conclude, subject to contractual conditions. These inflows will be instrumental in funding our planned work programmes. We are eager to progress swiftly towards exploration drilling at HY-Range in the coming months, building on these foundational successes and solidifying Thor’s position in the clean energy economy.”

HY-RANGE PROJECT – RSEL 802 – SOUTH AUSTRALIAN NATURAL HYDROGEN AND HELIUM

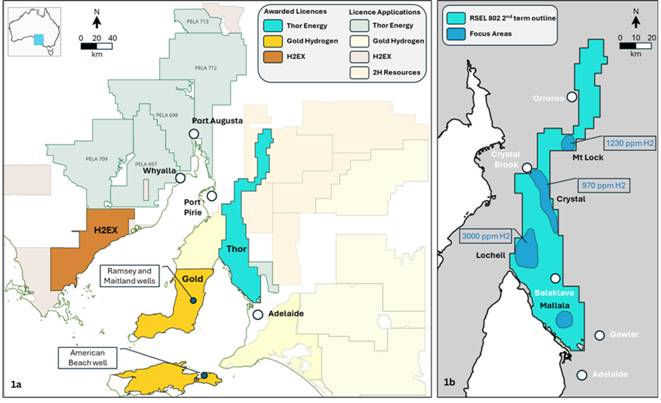

During the quarter, the Company reported outstanding results from a geochemical sampling programme: “Outstanding Geochemical Results at HY-Range Project”. Analysis of the data yielded very positive results, with a high percentage of elevated hydrogen values in numerous areas of the licence, locally exceeding 1,000ppm in several locations, and up to 3,000ppm at one sample point (compared to typical background atmospheric values of 0.5ppm). Locally elevated helium readings were also recorded up to 27ppm (compared to typical background atmospheric values of 5ppm). Whilst soil gas sampling can be inherently prone to anthropogenic hydrogen contamination and sample bias, the distribution of the values strongly correlates with mapped geological features. It supports the natural origin of these highly elevated readings, as shown in Figure 1a and 1b. The detection of elevated helium is unambiguous and demonstrates that a working helium system is in place.

Figure 1a illustrates the location of RSEL 802 (HY-Range) in the context of nearby Petroleum Exploration Licences (PELs) and licence applications (PELA’s), as well as nearby down-hole hydrogen/helium occurrences.

Figure 1b illustrates the four priority focus areas (Blue polygons) in the context of RSEL 802 licence (2nd term outline- black polygon).

Molyhil, W, Cu, Mo NT, Australia

A major non-dilutionary funding outcome was achieved through the execution of a Term Sheet with ASX-listed Tivan Limited (ASX: TVN) (“Tivan“) for the sale of the FRAM Joint Venture (Thor 75%), which holds the Molyhil Tungsten-Molybdenum-Copper Project in the Northern Territory. The agreement provides Thor with total consideration of A$6.56 million payable to Thor through its subsidiary Molyhil Mining Limited, structured through an initial deposit, completion payment, and three annual deferred payments, payable in cash or Tivan shares at Tivan’s election.

The transaction represents a significant step in monetising Thor’s non-core assets, significantly strengthening the Company’s balance sheet while providing a non-dilutionary funding pathway for its exploration and development programs at the HY-Range natural hydrogen and helium project in South Australia.

Uranium and Vanadium (USA)

During the quarter, Thor Energy announced the execution of a Sale and Purchase Agreement with London-listed Metals One PLC for the sale of a 75% interest in its U.S. subsidiaries, Standard Minerals Inc. and Cisco Minerals Inc. These subsidiaries hold Thor Energy’s non-core uranium and vanadium projects located in Colorado and Utah, USA.

Under the terms of the SPA, Met1 acquired a 75% interest in Standard and Cisco. An exclusivity fee of £100,000 (approximately A$205,000) was paid to Thor following execution of the initial Term Sheet. On completion of the SPA, Met1 issued the Company £1,000,000 (approximately A$2,050,000) worth of ordinary shares, calculated using a 15-day volume-weighted average price (VWAP) of Met1’s shares prior to execution of the SPA.

As part of the agreement, Thor granted Met1 an exclusive 12-month option to acquire the remaining 25% interest in Standard and Cisco. The purchase price for this remaining interest will be determined either by mutual agreement or by an independent third-party valuation. During the 12-month option period, Met1 will fund all exploration activities across the mineral claims.

Furthermore, a key development this quarter was the execution of a binding agreement with DISA Technologies Inc. a U.S.private-equity-backed materials technology company, to process historically abandoned uranium mine waste dumps at Thor’s Colorado uranium projects. Under the Term Sheet, Thor’s U.S. subsidiary, Standard Minerals Inc., in which Thor now holds a 25% interest, will receive a gross revenue share from any saleable uranium and critical minerals concentrates recovered using DISA’s patented High-Pressure Slurry Ablation process. Recently, DISA received its final U.S. Nuclear Regulatory Commission Service Providers License to remediate abandoned uranium mine waste. This paves the way for a deployment of DISA’s patented technology on the Colorado Projects in the future.

Importantly, no capital or operating costs are payable by Thor or Standard, with DISA funding all permitting, evaluation, processing and remediation activities. The agreement provides Thor a potential non-dilutionary pathway to near-term revenue from U.S. uranium and critical minerals production, while also supporting environmental remediation of legacy mine sites.

EnviroCopper (via 24% equity holding) Kapunda, SA, Australia

In the post-period, Thor announced the signing of an agreement for Future Equity and Collaboration between private company EnviroCopper Limited in which Thor is the largest individual shareholder at just over 24%, and an international company whereby the Investor has agreed to invest A$3.5m into ECL’s Kapunda and Alford ISR Technology and Copper Projects in South Australia. The Investor may elect to convert the A$3.5m investment into 972,222 shares in ECL at A$3.60 per share, Thor currently owns 1,157,143 shares in ECL.

Alford East Cu, Au, SA, Australia

No work undertaken

CORPORATE, FINANCE, AND CASH MOVEMENTS

Corporate

During the period, Mr Andrew Hume, the Managing Director, was appointed to the Chief Executive Officer role and the Executive Chairman, Alastair Clayton, resumed his previous role as Non-Executive Chairman.

Cash Movement

Net cash outflows from Operating and Investing activities for the quarter of A$781,000, which included outflows of A$97,000 directly related to exploration activities. Cash inflows from financing activities for the quarter were A$943,000, providing an ending cash balance of A$1,598,000.

Cashflows for the quarter include payments of A$201,000 to Directors, comprising the CEO-Managing Director’s salary and the Non-Executive Directors’ salaries.

The Board of Thor Energy Plc has approved this announcement and authorised its release.