Tempur Sealy International, Inc with ticker code (TPX) have now 10 analysts in total covering the stock. The consensus rating is pointing to ‘Buy’. The target price High/Low ranges between 52 and 34 calculating the mean target price we have $45.60. Now with the previous closing price of $37.84 and the analysts are correct then we can expect a percentage increase in value of 20.5%. The 50 day moving average now sits at $40.29 and the 200 day moving average is $30.58. The company has a market cap of $6,512m. Company Website: https://www.tempursealy.com

The potential market cap would be $7,848m based on the market consensus.

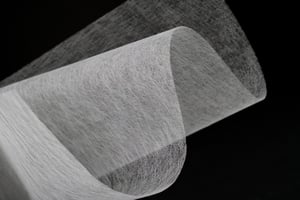

Tempur Sealy International, together with its subsidiaries, designs, manufactures, markets, and distributes bedding products in the United States and internationally. It provides mattresses, foundations and adjustable foundations, and adjustable bases, as well as other products comprising pillows, mattress covers, sheets, cushions, and various other accessories and comfort products under the Tempur-Pedic, Sealy, Stearns & Foster, and Cocoon by Sealy brand names. The company sells its products through approximately 700 company-owned stores, e-commerce, and call centers; and third party retailers, including third party distribution, hospitality, and healthcare. It also operates a portfolio of retail brands, including Tempur-Pedic retail stores, Sleep Outfitters, Sleep Solutions Outlet, Dreams, and SOVA, as well as licenses Sealy, Tempur, and Stearns & Foster brands; technology; and trademarks to other manufacturers. Tempur Sealy International was founded in 1846 and is based in Lexington, Kentucky.

The company has a dividend yield of 1.17% with the ex dividend date set at 22-2-2023 (DMY).

Other points of data to note are a P/E ratio of 15.28, revenue per share of 28.14 and a 9.65% return on assets.