Oriole Resources PLC (LON:ORR), the AIM quoted gold exploration company focused on West and Central Africa, has provided an update on its 90%[1] owned Mbe gold project in Cameroon, where it has received the first results from the ongoing 2,950m maiden diamond drilling programme at the MB01-N target.

Highlights

· The first two drill holes at MB01-N have both returned significant gold intersections including:

MBDD026

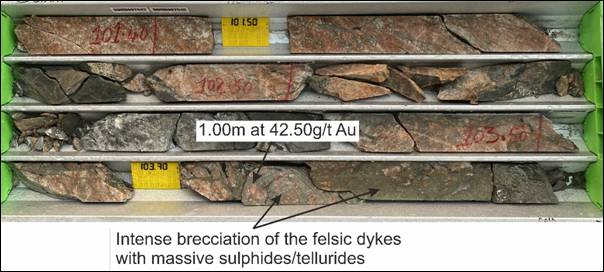

o 21.70m at 3.13g/t Au from 86.80m, including 7.20m at 8.19g/t Au and containing 1.00m at 42.50g/t Au

o 4.00m at 1.52g/t Au from 41.80m

MBDD025

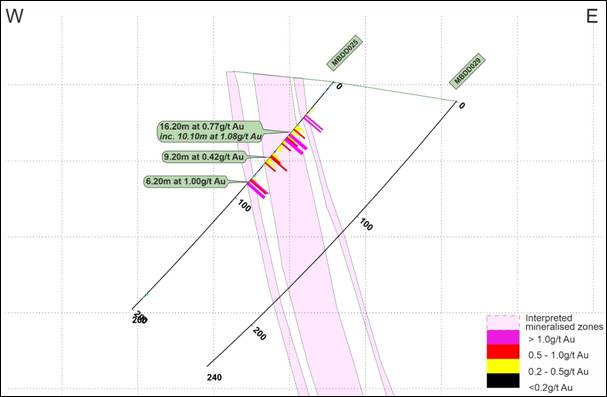

o 16.20m at 0.77g/t Au from 37.20m, including 10.10m at 1.08g/t Au

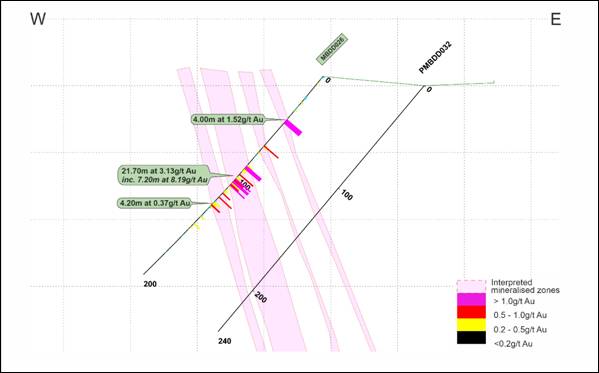

· The initial geological and structural interpretation indicates that MB01-N shows many similarities with MB01-S, further supported by the comparable mix of narrow high-grade intervals within wider lower-grade envelopes.

· The high-grade mineralisation is controlled by NNW-trending breccia zones formed by intersecting structures and therefore the mineralised zones within the two holes, which are located approximately 200m apart, may be linked and continuous along strike.

· The fully funded MB01-N drilling programme is approximately 46% complete, with six holes drilled, a seventh underway and is expected to be finished in Q1-2026.

Chief Executive Officer of Oriole Resources, Martin Rosser, said: “Results from the first two holes at the MB01-N target have delivered tremendous substantial widths of gold mineralisation and, as seen at the nearby MB01-S deposit, include some high-grade veins. It is an excellent start to 2026, and we eagerly look forward to reporting results from the next set of holes.“

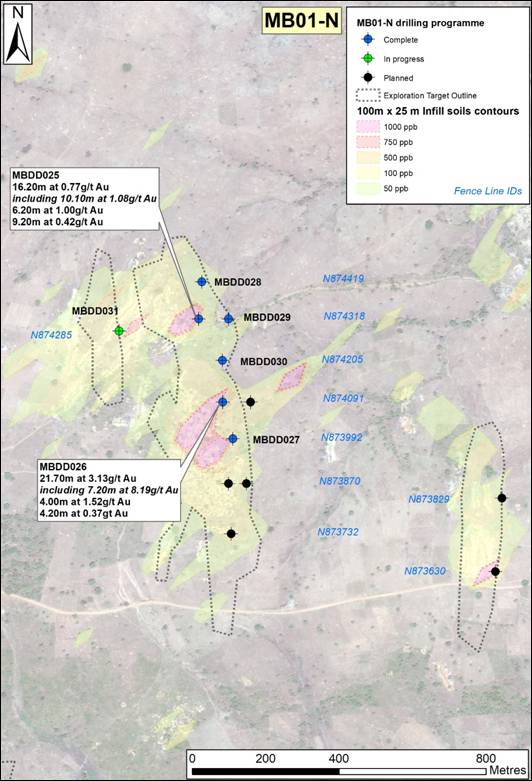

Figure 1. Diamond drilling progress at the MB01-N target with selected best results from MBDD025 and MBDD026. All holes are planned to be drilled towards 270˚ (bearing from grid north) and at an inclination of 50˚. Drilling fence line IDs are in blue text. The data is overlain on gold-in-soil contours, and the 2025 Exploration Target outline is delineated.

Further Details

The Programme, which commenced in November 2025, has been planned to test the MB01-N target, which is located 700m to the northeast of the MB01-S deposit, where the Company has previously reported a maiden JORC Inferred Mineral Resource Estimate of 24.8Mt at a grade of 1.09g/t Au for 870,000oz contained gold (see announcement dated 21 October 2025).

The programme is progressing well and is currently at 46% completion, with six holes (MBDD025-030) drilled and a seventh (MBDD031) underway. The Company today reports the results from the first two diamond drill holes from MB01-N (MBDD025 and MBDD026). A total of 13 mineralised intersections (Table 1) were returned, with narrow higher-grade zones and wider envelopes of pervasive, lower-grade material, as seen at the MB01-S target. The best example of this is from hole MBDD026, which returned the highest grading individual interval of 1.00m at 42.50g/t Au that sits within a broader zone of 21.70m at 3.13g/t Au from 86.80m downhole depth. In these first two holes at MB01-N, the discovery rate stands at more than one intersection every 15m and all mineralised intervals have been reported within 100m vertical depth from surface. A review of the QAQC samples has confirmed that the data falls within acceptable limits of error.

Table 1. Selected intersections from MBDD025 and MBDD026 using a 0.20g/t Au lower cut-off grade. Results > 1g/t Au are highlighted in bold.

| Hole ID | From (m) | To (m) | Grade (g/t Au) | Intersection* |

| MBDD025 | 28.20 | 31.20 | 0.94 | 3.00m at 0.94g/t Au |

| and | 37.20 | 53.40 | 0.77 | 16.20m at 0.77g/t Au |

| including | 40.20 | 50.30 | 1.08 | 10.10m at 1.08g/t Au |

| and | 56.80 | 57.90 | 0.23 | 1.10m at 0.23g/t Au |

| and | 61.00 | 70.20 | 0.42 | 9.20m at 0.42g/t Au |

| and | 82.20 | 88.40 | 1.00 | 6.20m at 1.00g/t Au |

| including | 83.30 | 84.40 | 2.45 | 1.10m at 2.45g/t Au |

| MBDD026 | 41.80 | 45.80 | 1.52 | 4.00m at 1.52g/t Au |

| including | 41.80 | 42.80 | 2.16 | 1.00m at 2.16g/t Au |

| and | 67.60 | 69.70 | 0.56 | 2.10m at 0.56g/t Au |

| and | 86.80 | 108.50 | 3.13 | 21.70m at 3.13g/t Au |

| including | 100.30 | 107.50 | 8.19 | 7.20m at 8.19g/t Au |

| including | 103.50 | 104.50 | 42.50 | 1.00m at 42.50g/t Au |

| and | 112.70 | 115.70 | 0.26 | 3.00m at 0.26g/t Au |

| and | 118.70 | 119.70 | 0.87 | 1.00m at 0.87g/t Au |

| and | 123.70 | 127.90 | 0.37 | 4.20m at 0.37g/t Au |

| and | 138.50 | 139.70 | 0.22 | 1.20m at 0.22g/t Au |

| and | 145.90 | 146.90 | 0.42 | 1.00m at 0.42g/t Au |

* Intersections greater than 1.00m, calculated using a 0.20g/t Au lower cut-off grade and no more than 5.00m consecutive internal dilution or 35% total internal dilution. Stated as drilled widths – true widths are not currently known.

The overall geological and structural controls at MB01-N are similar to MB01-S, with the dominant lithologies consisting of the orthogneiss-amphibolite basement rock, which in turn has been intruded by numerous shear-hosted granitic felsic dykes and late mafic dykes.

The mineralisation is predominantly structurally controlled by post felsic intrusion, shear-related extension and brittle failure that has formed conjugate fracture sets and NNW-trending zones of brecciation, subsequently exploited by gold-rich hydrothermal fluids. The mineralisation typically occurs within steeply dipping shear corridors, with mineralisation enhanced by brittle failure of the felsic intrusions.

Figure 2. Simplified cross section of fence line N874091 with results from MBDD026 and interpreted mineralised zones. PMBDD032 is a planned hole that is yet to be drilled.

Figure 3. Drill core for the highest grading interval, 1.00m at 42.50g/t Au, showing intensely brecciated felsic dyke with sulphide/telluride mineralisation.

Figure 4. Simplified cross section of fence line N874318 with results from MBDD025 and interpreted mineralised zones. MBDD029 has been drilled but results are pending.

MB01-N has a JORC Exploration Target of 15Mt to 20Mt at 0.77 to 0.94g/t Au for 370,000oz to 605,000oz contained gold, and offers significant upside to the total JORC Resource potential of the Mbe project. The Programme has been designed to maximise conversion from an Exploration Target to JORC Resource.

Upon completion of the Programme, targeted for late Q1-2026, the Company’s partner BCM International Limited will acquire a 50% interest in the Mbe licence.