Shares in City of London Investment Group with EPIC code: LON:CLIG has stepped up 3.74% or 16.35 points during today’s session so far. Buyers have so far held a positive outlook during the trading session. The period high has peaked at 460 dipping to 445. The amount of shares exchanged has so far reached 3,150 whilst the average number of shares exchanged is 28,122. The stock 52 week high is 479.52 some 42.52 points difference from the previous close and the 52 week low at 264 a difference of some 173 points. City of London Investment Group now has a 20 simple moving average of 446.26 and now its 50 day simple moving average now at 437.56. Market capitalisation for the company is £229.75m at the time of this report. The share price is in Great British pence. Mcap is measured in GBP. This article was written with the last trade for City of London Investment Group being recorded at Tuesday, January 12, 2021 at 11:45:01 AM GMT with the stock price trading at 453.35 GBX.

Shares of Drumz found using EPIC: LON:DRUM has gained 4.35% or 0.03 points during the course of today’s session so far. Traders are a positive bunch throughout the trading session. The high for the period has peaked at 0.6 and a low of 0.57. The total volume of shares exchanged so far has reached 1,983,394 with the daily average number around 3,488,646. The 52 week high is 1.2 which is 0.63 points in difference to the previous days close of business and a 52 week low sitting at 0.4 a difference of some 0.17 points. Drumz now has a 20 moving average of 0.47 and also a 50 day MA at 0.48. This puts the market cap at £2.09m at the time of this report. The share price is in GBX. Mcap is measured in GBP. This article was written with the last trade for Drumz being recorded at Tuesday, January 12, 2021 at 11:46:35 AM GMT with the stock price trading at 0.6 GBX.

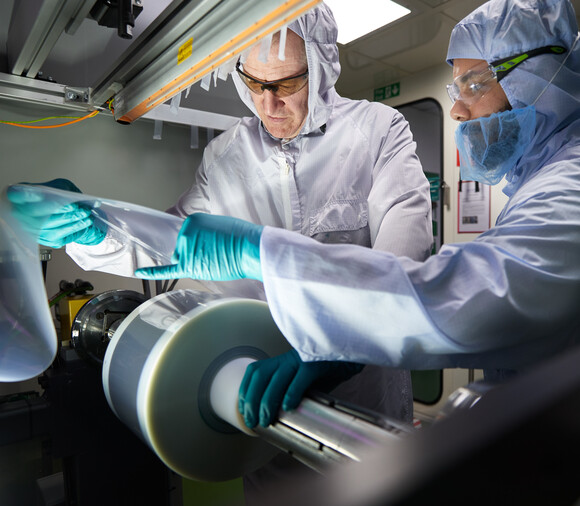

Shares in Johnson Matthey with EPIC code: LON:JMAT has stepped up 1.32% or 35 points during the course of today’s session so far. Buyers have stayed positive while the stock has been in play. The period high has peaked at 2693 and hitting a low of 2646. The total volume of shares traded by this point was 91,396 while the average shares exchanged is 812,218. The 52 week high is 2992 amounting to 346 points difference from the previous days close and putting the 52 week low at 1614 is a variance of 1032 points. Johnson Matthey has a 20 SMA of 2590.12 with a 50 day SMA of 2462.76. This puts the market cap at £5,188.63m at the time of this report. The share price is in Great British pence. Mcap is measured in GBP. This article was written with the last trade for Johnson Matthey being recorded at Tuesday, January 12, 2021 at 11:51:28 AM GMT with the stock price trading at 2681 GBX.