Johnson Matthey Plc (LON:JMAT) has announced that it has signed a definitive agreement to sell 100% of its Medical Device Components business (MDC) to Montagu Private Equity (Montagu) for cash consideration of US$700 million (£550 million) on a cash free debt free basis.

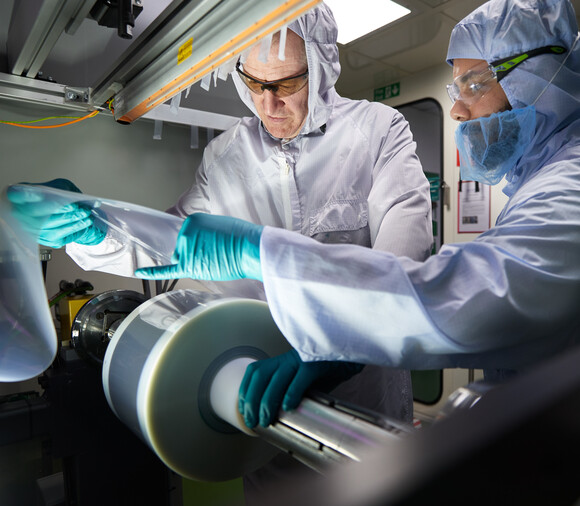

The MDC business produces components for medical device manufacturers globally with a focus on precious metal alloys and nitinol. The business serves a global customer base and operates manufacturing sites in the USA (San Diego), Mexico (Mexicali), and Australia (Tullamarine).

With our sale of MDC announced today and a separate sale of our Battery Systems business, we have concluded the divestment programme for our Value Businesses that was originally announced in May 2022 as one of our key strategic objectives. This brings the aggregate net proceeds from the divestment of Value Businesses to significantly more than our target of £300 million.

In line with our stated capital allocation policy, it is the board’s current intention to return to shareholders £250 million of the net proceeds of the sale of MDC by way of an

on-market share buyback programme (conditional upon completion). The balance of the net proceeds will be used to repay some of JM’s existing debt and for other general corporate purposes.

The sale proceeds will be payable in cash at completion, which is subject to regulatory approval. The transaction is expected to complete around Q3 2024.

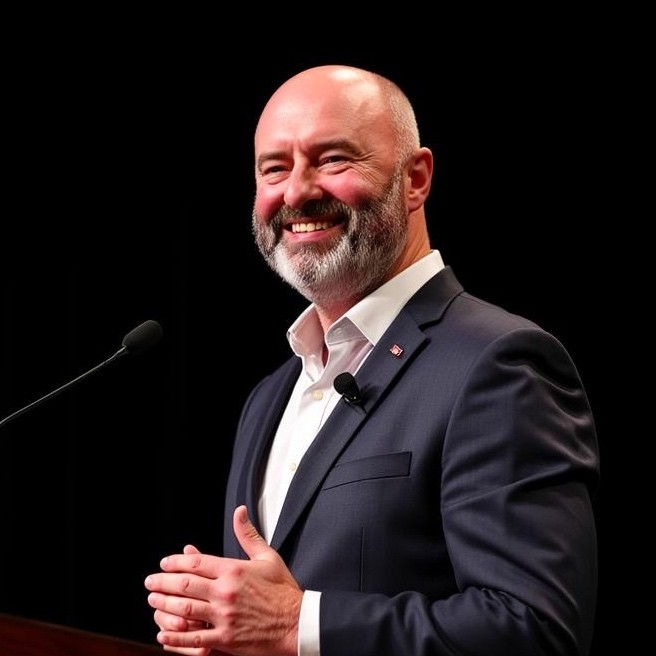

Liam Condon, Chief Executive, Johnson Matthey, commented:

Today’s announcement represents a significant milestone in our disposals programme announced in May 2022. As a JM business, MDC has delivered technological differentiation and good growth to the critical health sector. We welcome Montagu’s plans to continue the investment and growth plans at MDC.

We are pleased that this concludes our Value Businesses disposal programme which will deliver benefits to JM shareholders in terms of value realisation, simplification and increased focus on our growth businesses, where JM has a proven ability to win.

| Notes: | |

| · | Value Businesses divestment programme set out in May 2022 as part of the group’s strategic milestones includes the sale of Diagnostic Services, Battery Systems and Medical Device Components. |

| · | The sale agreement is in respect of the whole of Johnson Matthey’s Medical Device Components business, including assets, technology and licences, as well as related assets. |

| · | This transaction constitutes a Class 2 transaction for Johnson Matthey under the UK Listing Rules. |

| · | The gross assets that are the subject of this transaction amounted to £60 million as at 30th September 2023. For the financial year ended 31st March 2023, these assets generated reported profit before tax of £17 million. |

| · | Proceeds after tax and divestment costs for the disposal of MDC are expected to be c.£450 million. |