KEFI Gold and Copper plc (LON:KEFI), a gold and copper exploration and development company focused on the Arabian-Nubian Shield with a pipeline of projects in the Federal Democratic Republic of Ethiopia, and the Kingdom of Saudi Arabia, has provided an update on financial close and operations at the Company’s high-grade/high-recovery Tulu Kapi Gold Project.

Loan Documentation Signed & Equity Update

Further to the announcement of 20 October 2025 and the subsequent arrangement of the US$100M equity funding, the Company is delighted to confirm that the final documentation with respect to the US$240M Loan Facility is fully signed.

The balance of the US$100M equity-risk capital, being US$30M of subordinated streams and royalties and US$20M of Ethiopian Preference Shares is undergoing final documentation. Signing of the fully integrated final funding package remains on track for February 2026. Additional offerings of this type, which are not dilutive at the plc or asset level, totalling $36 million are being considered to potentially boost cash reserves, which in turn would also fund exploration and social programmes.

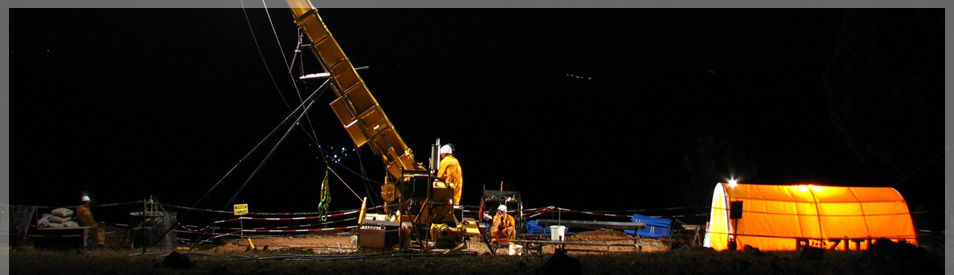

Operational Developments

Following the placing of US$20M in December 2025, which completed the balance of the equity funding required for Project launch, a number of works have commenced or advanced this month, including:

| · | Compensation payments have started for the first phase of community resettlers |

| · | Land clearing commenced to construct housing for resettlers |

| · | Plant construction contractor has mobilised his team and is currently focused on procurement |

| · | Electricity transmission works have started at zonal centre Ghimbi, for connection to Tulu Kapi |

Operations will continue to be advanced over the coming weeks in conjunction with full financial close.

KEFI Founder and Executive Chairman, Harry Anagnostaras-Adams, commented:

“It is all systems go in Ethiopia. I am delighted to confirm the banking syndicate have now signed binding final documentation for the agreed US$240M debt funding. We expect any outstanding documentation to be entered into on the identified and agreed equity component to be finalised and entered into next month, in turn enabling the balance of funds drawdown from the US$100M equity component. As previously stated, whilst committed, the Company will draw the debt funding later in the year which minimises debt servicing payments.

“We are delighted to be moving into full financial close and drawdown of funding at a time when the gold price is trading above US$4,700 per ounce and Ethiopia undergoing transformational private sector-led growth, as evidenced by the IMF’s recent report on Ethiopia (real GDP Growth 9.3% for 2025-2026 and 8.6% 2026-2027).

“I look forward to providing further updates in the near term.”