GSK plc (NYSE: GSK), a stalwart in the healthcare sector, stands as one of the prominent players in the drug manufacturing industry. With a market capitalization of $98.49 billion, this UK-based pharmaceutical titan engages in the research, development, and production of a wide array of vaccines and specialty medicines. As investors evaluate GSK’s financial performance and market position, several key metrics provide insight into its investment potential.

**Price Performance and Valuation Metrics**

GSK’s current stock price of $48.81 places it near the upper end of its 52-week range of $32.08 to $48.97. This stability is supported by its forward P/E ratio of 10.48, suggesting that investors are valuing the company’s future earnings potential reasonably. However, the absence of trailing P/E, PEG, and other valuation metrics due to unspecified data implies a need for further scrutiny into its reported earnings and growth forecasts.

**Revenue and Profitability Insights**

A notable highlight in GSK’s financial performance is its revenue growth of 6.70%, accompanied by a robust EPS of 3.56. These figures underscore the company’s ability to generate steady income and maintain operational efficiency. Moreover, an impressive return on equity of 41.52% signals effective management and a strong capacity to reinvest profits into business expansion. The company’s free cash flow, totaling approximately $3.75 billion, further enhances its financial flexibility, allowing for potential investments, acquisitions, or shareholder returns.

**Dividend Yield and Payout Ratio**

For income-focused investors, GSK offers a dividend yield of 3.46%, which stands out in the healthcare sector. The company’s payout ratio of 47.40% indicates a balanced approach to rewarding shareholders while retaining sufficient earnings for future growth initiatives. This sustainable dividend strategy can be attractive to investors seeking both income and long-term capital appreciation.

**Analyst Ratings and Price Targets**

Investor sentiment around GSK is reflected in its analyst ratings, with 2 buy, 5 hold, and 1 sell recommendation. The average target price of $49.35 presents a modest potential upside of 1.10% from the current price level. The target price range of $40.00 to $58.00 suggests varied expectations among analysts, reflecting differing views on GSK’s growth prospects and market dynamics.

**Technical Indicators**

From a technical perspective, GSK’s stock is positioned above its 50-day moving average of $46.18 and its 200-day moving average of $40.64. The relative strength index (RSI) of 56.27 indicates neutral momentum, while the MACD of 0.70 versus the signal line of 0.74 suggests a slight bearish trend. These indicators provide a mixed technical outlook, emphasizing the importance of monitoring stock performance in conjunction with broader market conditions.

**Strategic Collaborations and Innovations**

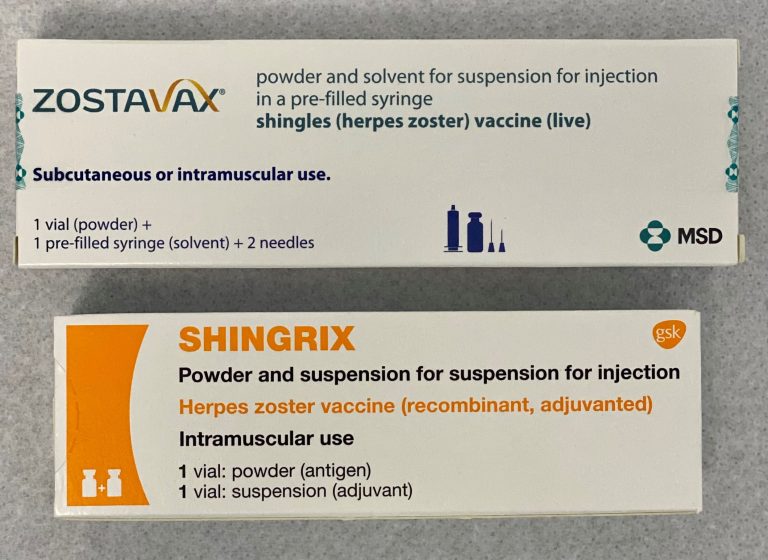

GSK continues to strengthen its market position through strategic collaborations, such as its partnership with CureVac for developing mRNA vaccines and its alliance with AN2 Therapeutics, Inc. for TB therapies. These initiatives highlight GSK’s commitment to innovation and addressing global health challenges, potentially driving future revenue streams.

GSK’s storied history, dating back to its founding in 1715, underscores its resilience and adaptability in the ever-evolving healthcare landscape. As investors consider their portfolios, GSK presents a compelling case with its blend of stable financial performance, strategic partnerships, and consistent dividend payouts. As always, potential investors should conduct thorough due diligence and consider how GSK fits within their broader investment strategy.