GSK plc which can be found using ticker (GSK) now have 4 market analysts covering the stock. The analyst consensus now points to a rating of ‘Hold’. The target price High/Low ranges between 63.75 and 35.5 calculating the mean target price we have $44.11. Given that the stocks previous close was at $35.95 and the analysts are correct then there would likely be a percentage uptick in value of 22.7%. The 50 day MA is $34.98 and the 200 day moving average is $35.27. The total market capitalization for the company now stands at $74,835m. You can visit the company’s website by visiting: https://www.gsk.com

The potential market cap would be $91,821m based on the market consensus.

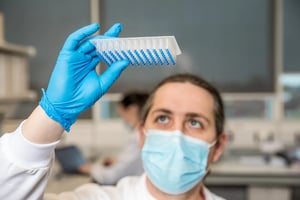

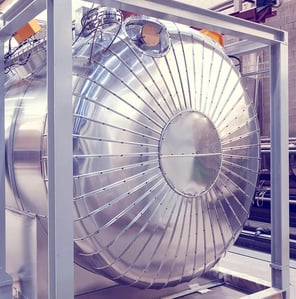

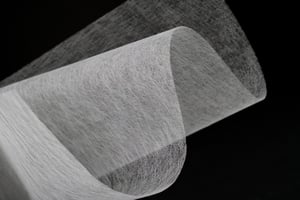

GSK plc, together with its subsidiaries, engages in the research, development and manufacture of vaccines and specialty medicines to prevent and treat disease in the United Kingdom, the United States, and internationally. It operates through four segments: Pharmaceuticals, Pharmaceuticals R&D, Vaccines, and Consumer Healthcare. The company offers pharmaceutical products comprising medicines in the therapeutic areas, such as infectious disease, HIV, immunology and respiratory, and oncology. The company was formerly known as GlaxoSmithKline plc and changed its name to GSK plc in May 2022. GSK plc was founded in 1715 and is based in Brentford, the United Kingdom.

The company has a dividend yield of 4.12% with the ex dividend date set at 23-2-2023 (DMY).

Other points of data to note are a P/E ratio of 13.54, revenue per share of 14.57 and a 6.57% return on assets.