GSK plc (NYSE: GSK), a stalwart in the global healthcare sector, continues to capture investor interest with its robust portfolio and a potential upside of 8.89%. With a market capitalization of $76.65 billion, this UK-based pharmaceutical giant remains a key player in the drug manufacturing industry, focusing on vaccines, specialty medicines, and general treatments.

Currently trading at $37.97, GSK’s stock price reflects a slight dip of 0.26 points or 0.01%, yet it remains within its 52-week range of $32.08 to $44.26. This positioning offers a promising window for investors considering the stock’s valuation and growth prospects.

One of the standout metrics is GSK’s Forward P/E ratio of 8.03, signaling potential value for investors seeking growth at a reasonable price. Although the trailing P/E and other valuation metrics like the PEG ratio and Price/Book are unavailable, the Forward P/E provides a glimpse into future earnings expectations. The company boasts a commendable Return on Equity (ROE) of 27.10%, underscoring its efficiency in generating profits from shareholders’ equity.

GSK’s recent revenue growth of 2.10% may appear modest, yet it reflects stability in a competitive market. The earnings per share (EPS) stands at 2.07, supporting the company’s strong financial foundation. Additionally, the free cash flow of over $5.16 billion underscores GSK’s ability to reinvest in research and development while maintaining shareholder returns.

For dividend-seeking investors, GSK offers a yield of 4.25% with a payout ratio of 80.20%, indicating a solid commitment to returning profits to shareholders. This attractive yield positions GSK as a reliable income-generating investment in the healthcare sector.

Analyst ratings present a mixed outlook with one buy, five holds, and two sell recommendations. The target price range from analysts spans from $35.25 to $58.00, with an average target of $41.34, suggesting a potential upside of 8.89% from current levels. This range reflects cautious optimism as GSK navigates market challenges and opportunities.

Technical indicators show the stock trading slightly below its 50-day moving average of $38.95 but above the 200-day moving average of $36.98. The RSI (14) at 58.50 suggests the stock is approaching overbought territory. Meanwhile, the MACD of -0.41 and a signal line of -0.45 indicate a bearish trend in the short term, presenting possible volatility.

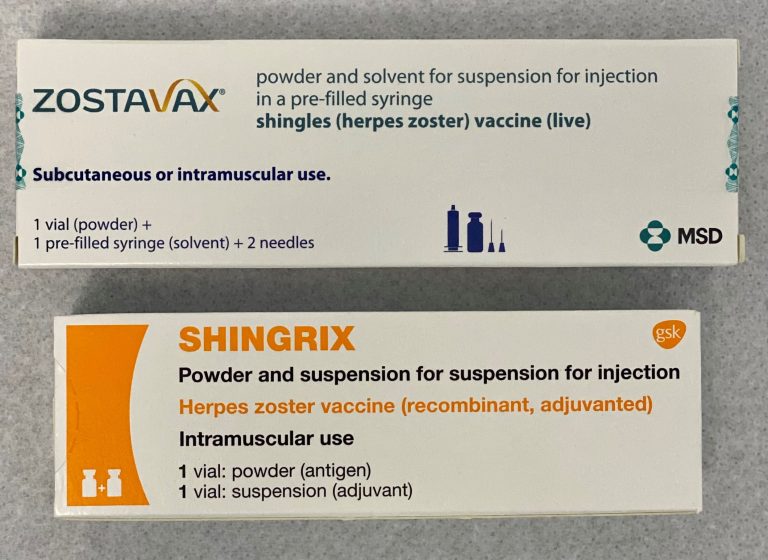

GSK’s strategic initiatives, including its collaboration with CureVac to develop mRNA vaccines, highlight its commitment to innovation in tackling infectious diseases. This partnership, alongside GSK’s diversified product offerings in critical areas such as oncology and respiratory diseases, bolsters its long-term growth potential.

Founded in 1715 and headquartered in London, GSK has evolved significantly, rebranding from GlaxoSmithKline plc to GSK plc in May 2022. Its deep-rooted history and ongoing transformation reflect a dynamic approach to addressing global health challenges, supporting its stature as a formidable entity in the global healthcare landscape.

Investors should weigh these insights and consider GSK’s strategic trajectory and market positioning when evaluating its potential as a long-term investment in the healthcare sector.