Great Western Mining Corporation Plc (LON:GWMO), a strategic and precious metals exploration and development company, has provided an update on its planned drilling programme at key targets in the Walker Lane belt of Nevada, USA.

· Drilling commenced at West Huntoon ahead of schedule on Thursday 2 October and the first drill hole was nearing target depth on Friday 3 October.

· This is the first hole in a 1,800-metre reverse circulation (RC) drilling programme at the high-priority Rhyolite Dome and West Huntoon prospects.

· Great Western’s dedicated operational and technical team is overseeing the campaign to maximise efficiency and data quality.

· Drilling is expected to continue through October, with assay results to follow.

Great Western Mining Chairman Brian Hall commented: “I am very pleased to advise shareholders that our fully funded drill programme has now commenced ahead of schedule, with the first hole nearing completion at West Huntoon. This marks the beginning of an exciting campaign to unlock the copper and precious metals potential of our claims in this highly prospective region. With drilling advancing at our high-priority targets at West Huntoon and work at Rhyolite Dome to follow at key locations defined by recent IP data, we are well positioned to deliver meaningful results.

“Shareholders can look forward to strong news flow through Q4, both from this drill programme and from assay results on our soil sampling at the high-grade Pine Crow/Defender Tungsten prospects. We look forward to providing further updates as this programme progresses.”

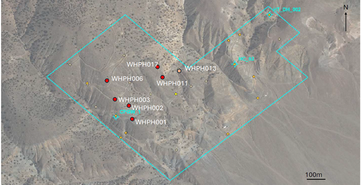

Figure 1: Planned drill hole locations at West Huntoon

Figure 2: Drill rig on site at West Huntoon