Egdon Resources plc (LON:EDR) and Union Jack Oil plc (LON:UJO) have advised the submission of an appeal against the refusal by Lincolnshire County Council in March 2022 of an extension of time to the existing planning permission for the drilling and testing of a conventional exploration well at the North Kelsey site in PEDL241.

Egdon holds a 50% interest and is operator of PEDL241.

Union Jack holds a 50% economic interest in PEDL241.

The appeal documentation has been submitted to the Planning Inspectorate (“PINS”) and the appeal will now be validated by PINS before an inspector is appointed and a timetable defined. The expectation is that the appeal will be decided under the Written Representation Procedure, a process where PINS will consider written evidence from the appellant, the local planning authority and other interested parties.

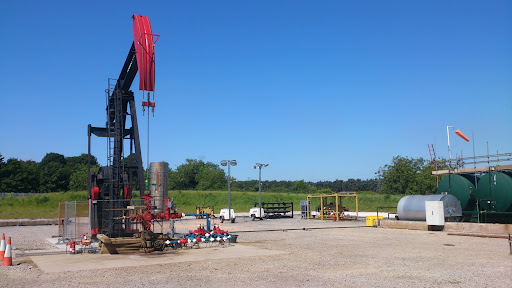

North Kelsey is a conventional oil exploration prospect on trend with, and analogous to the Wressle development which lies approximately 15 kilometres to the northwest. The prospect has been mapped from 3-D seismic data and has the potential for oil in four stacked Upper Carboniferous targets.

Egdon estimates that gross Prospective Resources range from 4.66 to 8.47 million barrels of oil (mmbo), with a Mean Resource of 6.47 mmbo.

Egdon Resources plc (LON: EDR) is an established UK-based energy company focused on onshore exploration and production in the UK.

Egdon holds interests in 36 licences in the UK and has an active programme of exploration, appraisal and development within its portfolio of oil and gas assets. Egdon is an approved operator in the UK. Egdon was formed in 1997 and listed on AIM in December 2004.