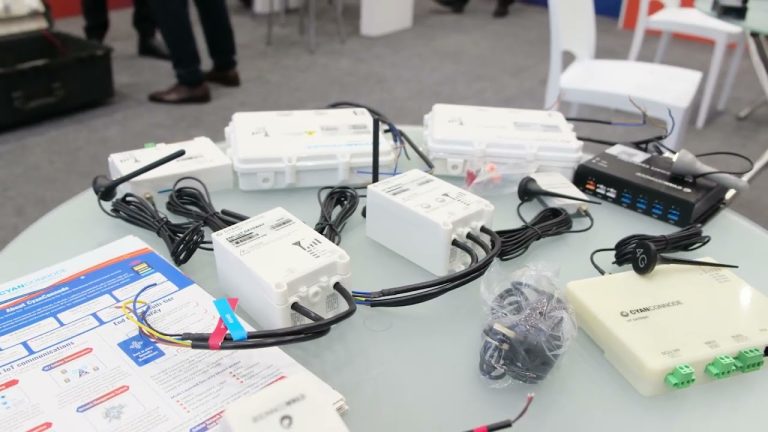

CyanConnode Holdings plc (LON:CYAN) a world leader in the design and development of Narrowband RF mesh networks that enable Omni Internet of Things (IoT) communications, is discussed by Co-fund manager, Gervais Williams of Miton UK Microcap Trust plc (LON:MINI) as part of a wide-ranging interview on the UK investment trust.

DirectorsTalk asked:

I am really interested in your views as to whether CyanConnode Holdings plc (LON:CYAN) share price is at a pivot point given their continued recent progress. They’ve posted a 60% and fourth consecutive calendar year rise in revenue. They refer to having made a lot of investment now to support their expected revenue growth and market expansion, particularly in India and the MENA region?

Gervais William’s commented:

That’s right. Really, what’s interesting about CyanConnode is, actually, this isn’t so much of a turnaround situation. The management team have been there for some years now, they’ve built sales, considerable growth in sales. I think they’re one of the market leaders in terms of robust smart meter rollouts. They happen to be a market leader in India where there’s a very substantial program. It’s been a little bit frustrating that they’ve been waiting for contracts from India which haven’t arrived. [Orders for 2.7m modules were won in India during FY24 an increase on 2.3m modules won in FY23, Ed.]

Even so, the company has continued to grow by bringing other contracts from elsewhere, doing some local contracts as well. Specifically, it could grow considerably. Already it’s grown from sales from $3 million perhaps in 2019 to $24 million last year, and maybe $45 million in sales pendulum for this year to March ‘25.

So, this is a business which has already grown considerably but what’s interesting is we’re now moving into cash generation. We’re now moving into perhaps more numerous contracts and the share price is very, very overlooked. It hasn’t recovered at all with the rest of the small cap sectors yet. So, if we are lucky enough to get further contracts and if they do start to generate cash and hopefully more significant amounts of cash in future years, then we see the opportunity for these kinds of companies to really be in very attractive returns at a time perhaps when global markets are not doing much.

For the full interview and examples of UK stocks thriving in the current market conditions please see the following link. https://www.directorstalkinterviews.com/gervais-williams-explores-microcap-investments-trends-uk-and-us-video/4121167132