CyanConnode Holdings plc (LON:CYAN), a global provider of IoT communication and smart metering solutions, has announced a trading update for the six months to 30 September 2025.

This has been a successful period, beginning with DigiSmart Networks Private Limited (DigiSmart), the Group’s subsidiary in India securing its first contract as an Advanced Metering Infrastructure Service Provider (AMISP). This landmark contract for c.£70 million (at constant currency), awarded in April 2025 by the Government of Goa, materially strengthened the Group’s contracted order book, which remains robust at approximately £157 million at current exchange rates (previously: £180 million, including Goa which was won early in April 2025). The reduction primarily reflects currency translation effects of around 9%, with the balance attributable to deliveries made and revenue recognised during the period.

While revenue from the Goa Project has not yet commenced, revenues from smart metering communications systems and related services across India and the Rest of World (RoW) contributed to revenues increasing by 31% to £7.4 million (H1 FY2025: £5.6 million). On a constant-currency basis, revenue growth would have exceeded 40%.

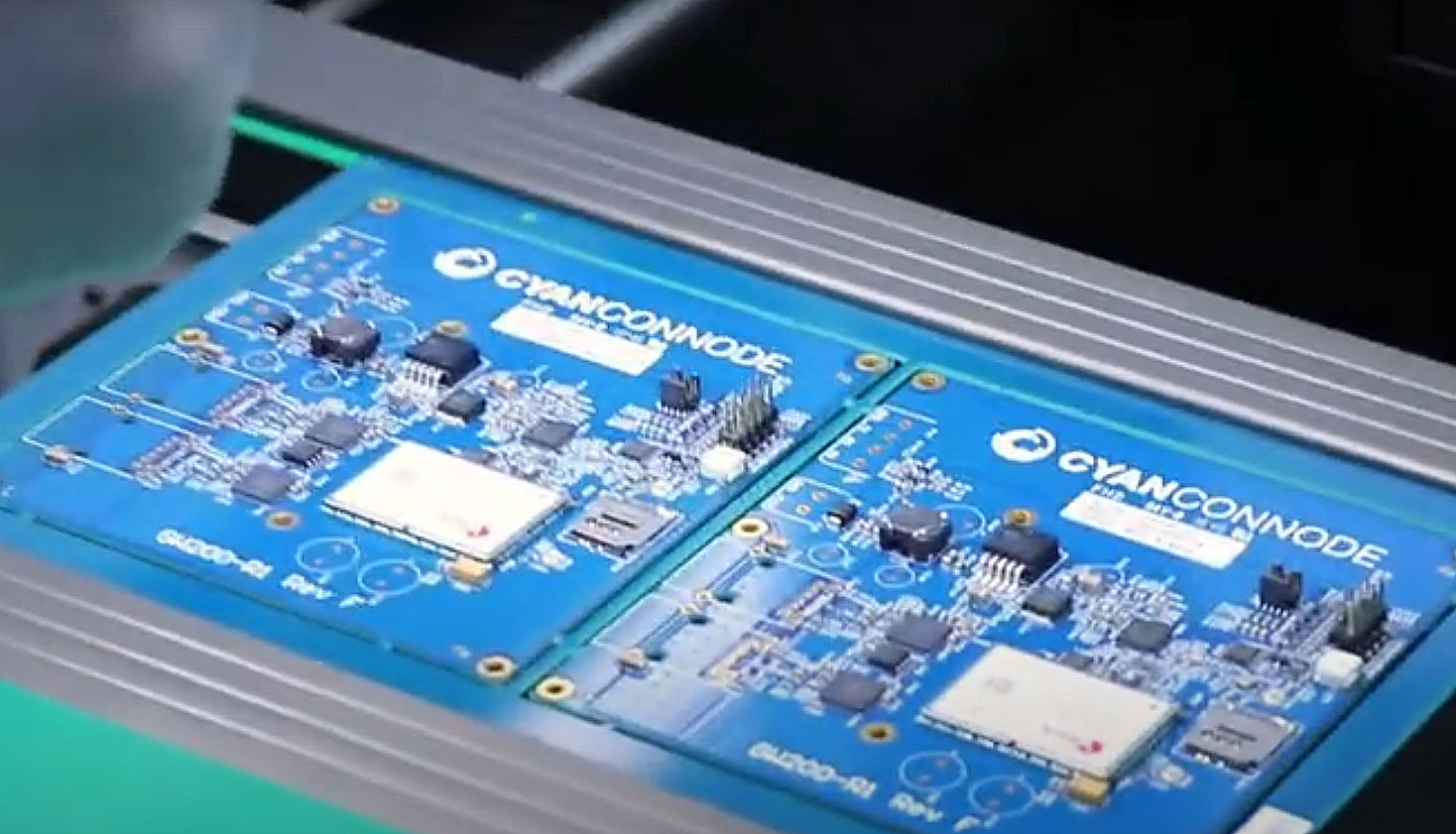

Modules Shipped in India

The number of Omnimesh Modules shipped provides a clear indicator of operational momentum, reflecting the rate of smart meter installations across the 17 projects in which the Company is engaged. During H1 FY2026, shipments increased sharply to 893,000 modules, compared with 377,000 in the same period last year.

As at 30 September 2025, more than 5 million modules have been shipped in India alone, with a further 9 million Omnimesh modules remaining in the order backlog.

Through CyanConnode Private Limited, the Indian subsidiary company, the Group is well placed to bid for further smart metering projects as a sub-contractor providing communications systems.

DigiSmart – AMISP

The Goa contract is currently the Company’s only AMISP project and it is expected to commence this quarter. Given the project’s scale, it is anticipated to become a major contributor to Group revenues over the coming periods.

In October 2025, local media reported progress on the project’s rollout preparations, as referenced in the following article:

https://www.thegoan.net/goa-news/indexing-survey-pave-way-for-rollout-of-smart-meters/137363.html

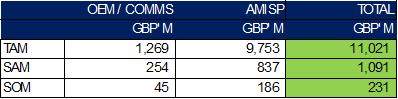

Addressable market in India

Looking ahead, the pipeline of opportunities in India remains substantial. The Total Addressable Market (“TAM”)1 for AMISP projects currently stands at approximately 104.9 million smart meters, representing an estimated value of £9.8 billion, which have been sanctioned but are yet to be awarded. DigiSmart’s Serviceable Available Market (“SAM”)2 comprises around 9 million meters, with an estimated value of £837 million. Within this framework, CyanConnode’s SAM for just communications (i.e. as a subcontractor) is estimated at a value of £254 million.

CyanConnode’s Serviceable Obtainable Market (SOM)3 over the next 18 months for communications alone (i.e. acting as a subcontractor) is expected to be approximately £45 million. For DigiSmart AMISP, the SOM over the same period is expected to be around £186 million, providing a substantial near-term pipeline to support continued revenue growth.

Based on an estimated market size of approximately 250 million smart meters, the values in the table below represent potential order values and are in addition to the Company’s existing contracted order book.

1. TAM (Total Addressable Market) – The total addressable market in India in relation to the Company’s products and services. 2. SAM (Serviceable Available Market) – The maximum portion of the TAM that the Company could serve, taking into account practical and operational constraints. 3. SOM (Serviceable Obtainable Market) – The share of the SAM that the Company is targeting to capture within the next approximately eighteen months. 4. AMISP values are based upon the Goa per-meter price.

Rest of World projects

In August 2025, the Company announced a follow-on order for a project in the Middle East North Africa (“MENA”) region for AED 5.8 million, which was delivered and revenue fully recognised during the period. The Company continues to pursue near-term opportunities in its RoW markets.

Outlook and Strategic Progress

During the period deployments have increased compared with the same period in FY25, with a majority of the revenue recognised in the period from projects expected to occur in the prior year, as these now deploy. With this increased momentum, we expect to continue to deliver in the second half of this financial year. The successful execution of existing projects, together with the commencement of the Goa AMISP contract, positions CyanConnode for a period of sustained growth and market expansion. The Group’s contracted outstanding order book valued at approximately £157 million provides multi-year revenue visibility.

With deployments accelerating and the Goa AMISP contract expected to commence during H2 FY2026, the Board anticipates that revenues for the full year will benefit from this momentum. While recognising that the precise timing of revenue recognition remains dependent on project schedules, the Board remains encouraged by the Group’s strong order book and pipeline visibility.

John Cronin, CEO of CyanConnode commented:

“We have completed a strong first half and have entered H2 FY2026 in a solid position. The Indian Government’s commitment to nationwide smart metering remains undiminished, as seen in the increased activity across our 17 projects. With continued momentum in India and steady international progress, we remain confident in the Group’s growth trajectory.”