Investor sentiment is heating up in the copper market as the US takes a softer stance on select technology tariffs, triggering a surge in prices and a ripple of optimism across global risk assets. The strategic exemption has re-energised traders and drawn attention back to metal markets with renewed vigour.

Copper futures rose to approximately $4.55 per pound on Monday, continuing a rally that gained steam last week. The move came as markets reacted favourably to former US President Donald Trump’s announcement exempting critical technology products from newly implemented “reciprocal” tariffs. This policy shift is being interpreted by investors as a sign of flexibility, signalling a potentially more measured approach to trade enforcement. The exemptions helped soothe fears of an escalating tariff war, with global risk assets rallying in tandem.

China’s Commerce Ministry cautiously welcomed the tariff exemptions, describing the move as a “small step” towards more constructive engagement. However, Beijing has continued to press Washington for a complete rollback of the broader 145% levy affecting a wider range of Chinese goods. The tone from both sides suggests a pause in hostilities and has introduced a degree of certainty that markets had been lacking in recent weeks.

With trade talks scheduled between the United States and several key partners this week—namely Japan, India, and South Korea—investors are closely watching for any policy shifts or trade alignments that could impact global metal flows. The copper market, highly sensitive to geopolitical signals and industrial activity, has responded swiftly to the evolving narrative.

Support for copper prices is also emerging from speculation that the United States might still consider metal-specific tariffs under the guise of national security. While this adds a layer of uncertainty, it also fuels bullish bets in the market, particularly on US-based futures. Traders are pricing in the possibility of tightened domestic supply if new barriers are introduced.

This evolving trade landscape has already widened the spread between US copper futures and those listed on the London Metal Exchange. The premium reflects concerns over America’s constrained copper smelting capacity, which could come under further pressure if import restrictions are tightened. In such a scenario, domestic producers may see increased demand while global players navigate a fragmented supply chain.

For investors, the key takeaway is clear: the copper market is entering a period of heightened sensitivity to both political decisions and trade developments. As governments recalibrate their tariff strategies, opportunities may arise for those positioned to navigate the volatility. With both short-term catalysts and long-term structural factors at play—such as electrification and green energy demand—the outlook remains robust for copper, particularly in the US market where policy dynamics are adding a unique layer of upside potential.

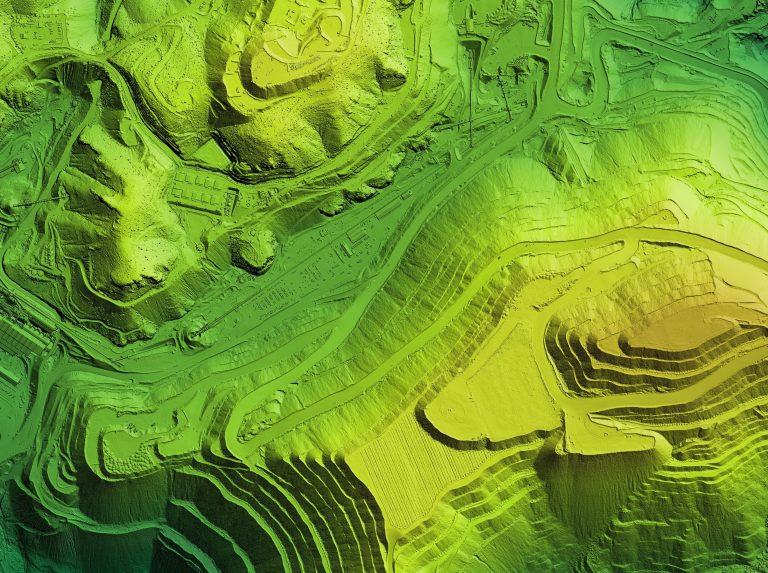

ARC Minerals Ltd (LON:ARCM) is a dynamic exploration and prospect generation company, forging partnerships with major mining companies, in its quest to discover and develop Tier 1 copper deposits.