Sequoia Economic Infrastructure Income Fund Limited (LON:SEQI) has announced its monthly factsheet and commentary for September 2025

The NAV per share for SEQI, the largest LSE listed infrastructure debt fund, increased to 93.67 pence per share from the prior month’s NAV per share of 92.48 pence, representing an increase of 1.19 pence per share.

| pence per share | |

| 31 August NAV | 92.48 |

| Interest income, net of expenses | 0.65 |

| Asset valuations, net of FX movements* | 0.52 |

| Subscriptions / share buybacks | 0.02 |

| 30 September NAV | 93.67 |

Gains in asset valuations, net of FX movements, were primarily driven by the early repayment of the loan to Infinis Energy at par value, crystallising pull-to-par benefits, together with successful settlements in the full recoverability of the Bulb Energy loan and the sale of Jetpeaks.

No expected material FX gains or losses as the portfolio is approximately 100% currency-hedged. However, the Company’s NAV may include unrealised short-term FX gains or losses, driven by differences in the valuation methodologies of its FX hedges and the underlying investments – such movements will typically reverse over time.

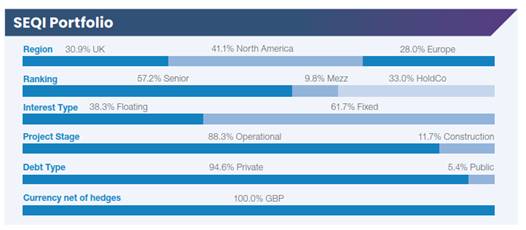

Well positioned to benefit from current high interest rates; 61.7% of the portfolio is in fixed rate investments as of September 2025.

Market Summary

Interest Rate Announcements and Inflation

| · | During September, the U.S. Federal Reserve implemented its first interest rate cut since December last year, lowering the policy rate by 0.25% to 4.0%. The yield on 10-year U.S. Treasuries fell by 0.10% to 4.15% by month-end, with short-term yields declining more sharply as markets priced in expectations of further cuts before year-end. |

| · | In the U.K., the Bank of England maintained base rates at 4.0%, as expected, given limited fiscal headroom, persistent inflationary pressures, and uncertainty around the fiscal outlook ahead of the Autumn Budget. Against this backdrop, the yield on 10-year UK Gilts remained at 4.7%. |

| · | In the Eurozone, the 10-year German Bund yield remained stable at 2.7%, with the European Central Bank holding its policy rate at 2.0% in September. This decision reflected continued sluggish growth in the bloc and inflation remaining at a steady rate. |

| · | The Investment Adviser observed modest movements in base rates during the month. The valuation of most fixed-rate investments increased marginally, due to the roll forward, or “pull-to-par” effect, as bonds moved closer to maturity. |

| · | In the near term, the easing of trade tensions is expected to help reduce inflationary pressures. However, pre-tariff inventory building has complicated the assessment of tariffs’ true short-term impact on both inflation and growth. Central banks continue to walk a difficult tightrope, seeking to prevent recession while avoiding a resurgence of inflation. |

| · | The pace and size of any interest rate changes will vary across the Company’s different investment jurisdictions. In the U.S., market participants currently expect at least one additional interest rate cut before the end of the year. In the U.K., inflation remains above target levels, and the Bank of England is now widely expected to hold rates at current levels through early 2026. In the Eurozone, the European Central Bank is similarly anticipated to maintain its current rate stance, with policy broadly on hold unless inflation abates further. |

Tariff Impact & Geopolitical Analysis

| · | During September, the U.S. and China extended their tariff truce, delaying further duties while Washington imposed targeted tariffs on timber, furniture, and household goods from mid-October. |

| · | The E.U. suspended retaliatory measures against the U.S. for six months and advanced proposals to reduce industrial tariffs and stabilise automotive trade. The U.K. and U.S. continued to expand their Economic Prosperity Deal, cutting tariffs on key sectors such as automobiles, steel, and aerospace, though certain U.K. goods and services sectors remain excluded. |

| · | The Investment Adviser has assessed tariff risk in the portfolio as low, given the limited direct exposure to sectors such as shipping, ports and aviation. Moreover, the Company’s exposure to the U.S. has declined by 4.7% over the past six months, and its loans to defensive sectors, which are typically less sensitive to the business cycle, remains high, at 53.5%. |

| · | Looking ahead into Q4, trade policy remains an ongoing source of potential volatility. While markets may continue to react to tariff-related announcements, the scale of reaction is unlikely to match the turbulence seen earlier in 2025. |

Portfolio Update

Revolving Credit Facility and Cash Holdings

| · | As of 30 September 2025, the Company had drawn £33.2 million on its revolving credit facility of £300.0 million and had cash of £84.1 million (inclusive of interest income), due to significant early repayments at month-end from Project Nimble and Tracy Hills, and net undrawn investment commitments of £99.1 million. The revolving credit facility is utilised for liquidity management and bridging purposes. |

| · | In anticipation of the two prepayments, the Company increased leverage in the months leading up to September 2025. Whilst it has since de-levered, the Company also maintains a strong near-term pipeline for capital redeployment, with further updates to follow as new transactions close. |

Portfolio Composition

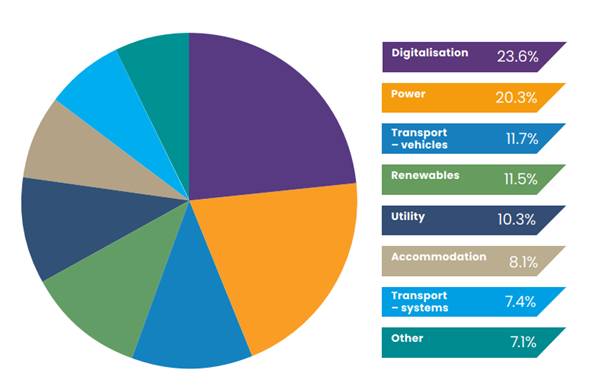

| · | The Company’s invested portfolio consisted of 50 private debt investments and 3 infrastructure bonds, diversified across 8 sectors and 28 sub-sectors. |

| · | 57.2% of the portfolio is comprised of senior secured loans reflecting the Company’s defensive positioning. |

| · | The portfolio pull-to-par, which is incremental to NAV as loans mature, was 3.1 pence per share as of September 2025, down from 3.8 pence per share during August, as gains on Infinis Energy were crystallised through early repayment and revaluation effects. |

| · | It had an annualised yield-to-maturity (or yield-to-worst in the case of callable bonds) of 9.69% and a cash yield of 7.19% (excluding deposit accounts). |

| · | The weighted average loan life is 3.2 years as of September 2025. |

| · | Private debt investments represented 94.6% of the total portfolio, allowing the Company to capture illiquidity yield premiums. |

| · | Sequoia Economic Infrastructure Income Fund’s portfolio remains geographically diversified with 41.1% located across the U.S., 30.9% in the U.K. and 28.0% in Europe. |

Portfolio Highly Diversified by Sector and Size

Share Buybacks

| · | The Company bought back 1,873,688 of its ordinary shares at an average purchase price of 77.32 pence per share in September 2025. |

| · | The Company first started buying back shares in July 2022 and has bought back 230,139,325 ordinary shares as of 30 September 2025, with the buyback continuing into October 2025. This share repurchase activity by the Company continues to contribute positively to NAV accretion. |

New Investment Activity during September 2025

| · | Senior loan for €2.8 million to Grange Backup Power Ltd, an Irish power asset supporting data centre operations. In total, the Company has committed €60.0 million to this loan, which offers a yield-to-maturity of 8.92%. |

| · | Senior loan for €2.7 million to Project Crystal, a leading provider of diagnostic imaging and radiotherapy services through an extensive network of clinics across Germany. The business benefits from a stable regulatory environment, the essential nature of its services in delivering high-quality medical care, and significant barriers to entry. In total, the Company has committed €29.5 million to this loan, which carries a yield-to-maturity of 6.44%. When swapped into the Fund’s base currency, this is equivalent to a yield-to-maturity of approximately 8.1%. |

Investments that repaid during September 2025

| · | Full repayment of $66.0 million from Tracy Hills and an early repayment fee. The borrower is a residential infrastructure project in California. |

| · | Full repayment of €53.0 million from Project Nimble, a Netherlands-based data centre. |

| · | Full repayment of Techem bonds for €10.1 million, a leading provider of energy services headquartered in Eschborn, Germany. |

| · | Full sale of the Jetpeaks loans for an upfront amount marginally higher than last valuation plus potential deferred consideration. |

| · | Partial sale of Brightline East LLC bonds for $4.7 million, and an additional $3.1 million just after September month-end. The borrower is a privately owned passenger rail project in Florida. |

Non-performing Loans

| · | Sequoia Economic Infrastructure Income Fund continues to work towards maximising recovery from the non-performing loans in the portfolio (equal to 0.5% of NAV). There are no additional announcements of non-performing loans this month. |

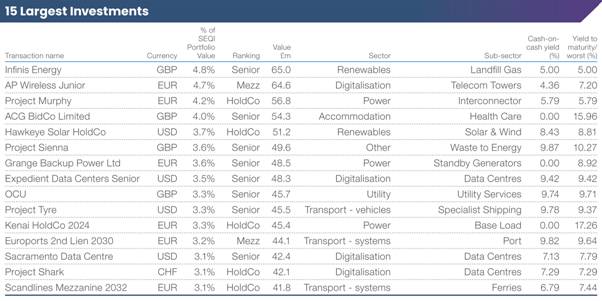

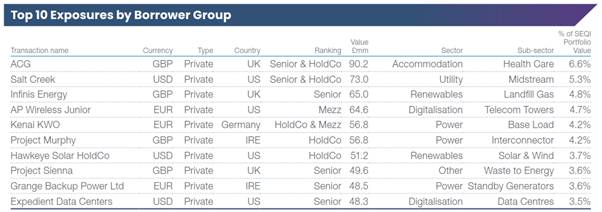

Top Holdings

Valuations are independently reviewed each month by PwC.

Full list of SEQI’s Portfolio Holdings and SEQI Monthly Factsheet: