James Cropper plc (LON:CRPR) Chief Executive Officer David Stirling caught up with DirectorsTalk to discuss the company’s half-year financial results and strategic progress, highlighting growth in advanced materials and operational improvements in the paper division.

Q1: First off David, congratulations on a solid set of results. Could you just talk us through the financial highlights?

A1: What James Cropper Plc set out to do was primarily improve the top line in the Advanced Materials, make our Paper division more profitable and get the debt position consistent with our cash flows over the coming years. We’ve made really good progress in the nine months or so since we set those objectives.

Revenue in the Advanced Materials has grown 30%. We’ve improved the Paper operating loss, less of a loss, despite a slightly lower revenue and we have significantly improved the debt position from 3.3 times EBITDA 12 months ago to 1.3 times. Admittedly, with the benefit of some exceptional sales of non-core assets, etc., but much more comfortable levels of debt within the business right now.

So, good solid performance and together our EBITDA has improved significantly, almost 50% in the period.

Q2: This period’s been about focus delivery on your strategic objectives as you’ve just mentioned. What progress has been made and how is that feeding in operationally?

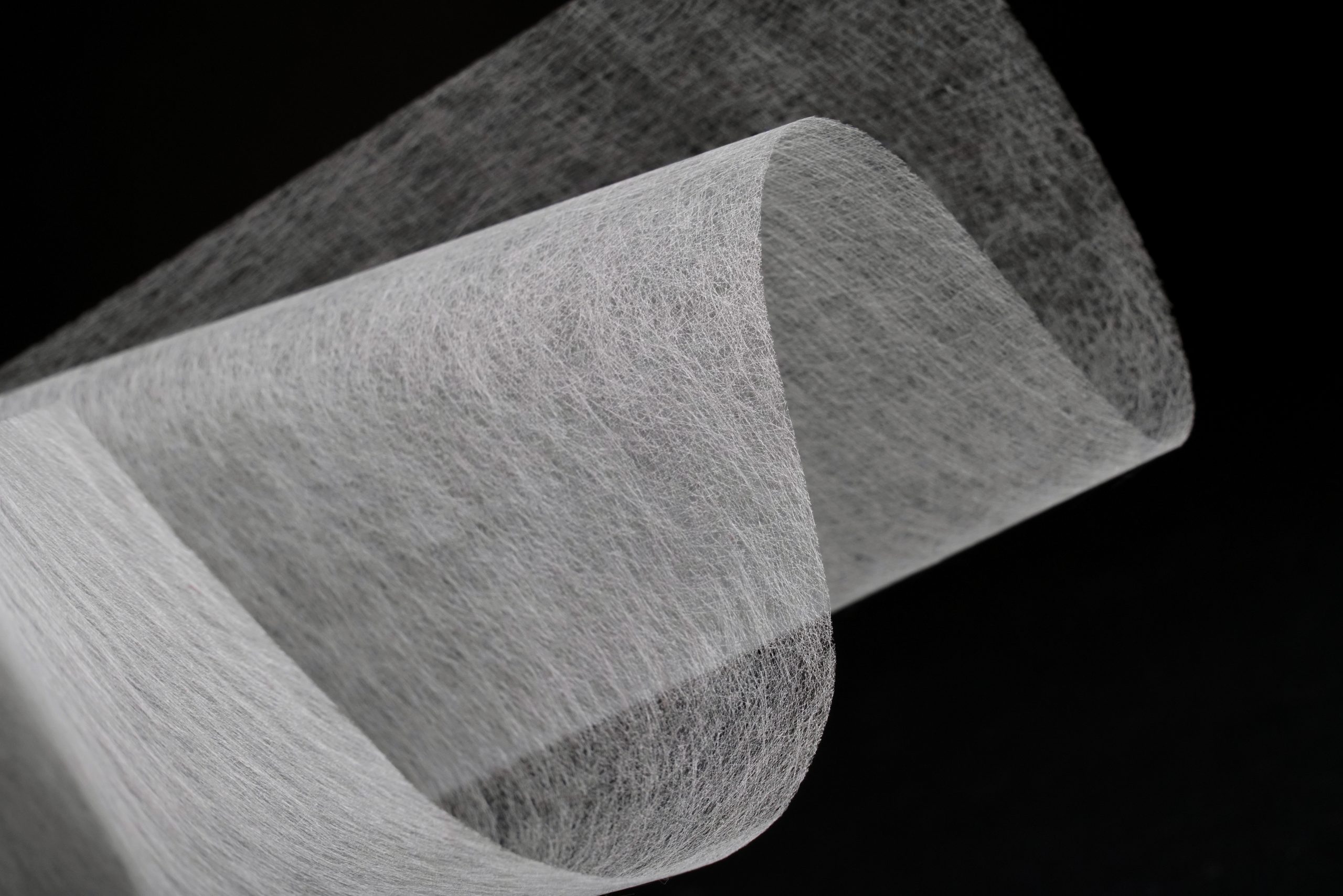

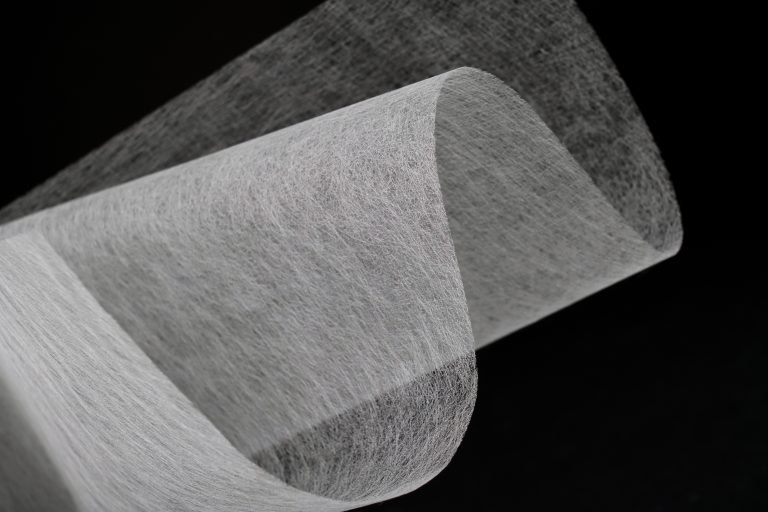

A2: The progress is about doing many things better. It’s not about one silver bullet. So, if I can talk firstly about the Advanced Materials business, the imperative there is about growth. The business actually is well run, it’s profitable, operationally in a good position and we’ve got some capacity within the asset base to grow. We are doing that through a number of pillars.

Firstly, we think about our business in two different categories, established and then nascent. The nascent are things like energy transition, green hydrogen, carbon capture, fuel cells, battery technology, etc., is the main parts of that. The established business are things like sports and leisure, aviation, defence, construction, medical, which have got lower growth rates but are somewhat more predictable.

So, we’ve got different actions to try and grow the markets in these areas, but essentially trying to leverage a good technology and a good portfolio product into more customers in those markets.

On the Paper side, there’s a series of actions going on around operational efficiency and that’s still going on so we’ve seen some of that in the first half. We’re doing more of that at the moment really to get the best from our people and our asset base in a business where the volumes have dropped significantly over the past four years.

So, we need to be the right size, we need to be agile, and we need to be a lot more aggressive in the market and getting that stability within operations has been the key. We’re seeing some of the benefits already on a lower revenue. We’ve got a better operating result, and we expect that to continue as we go forward.

Q3: Just turning to Advanced Materials. Revenue came in slightly ahead of expectations, what was driving the growth across your markets?

A3: We’ve had good growth in both the established and the nascent markets so both slightly ahead of expectations.

I would say in both cases, we have benefited slightly from timing. Sometimes these individual shipments are quite big, and they can make a difference in a short period. It is only six months, the comparator so I think we’d expect that growth rate to ameliorate slightly as we head into the year-end just because of the timings and projects.

Underlying, it is good technology well placed in markets which are growing.

Q4: Now, in Paper and Packaging, you’ve grown revenue despite losing a major customer. How has the improvement programme helped and what’s been the response to the new Coloursource range?

A4: So, revenue was actually down very slightly. We’ve grown the kind of underlying position in lots of other customers which have offset the loss of that other customer so actually a very pleasing outcome because the impact was quite hard and sudden within the business.

Again, benefiting a little bit from timing of the activities of some of the other customers but I think the underlying position is that we’re doing a lot of good business development work in some key areas and rebalancing our portfolio. If you go to our Capital Markets Day presentations, you’ll see me talk about peak one, peak two, peak three businesses and that’s starting to move in the right direction.

The Coloursource range was something that we have, along with an exclusive partner, launched into primarily the UK market, but there are global customers as well. It’s very early days, but that’s positioned to regain business that we lost through the other channel. Initial indications are good. Let’s see where we are in six months’ time.

Q5: Finally, what can investors expect from James Cropper in the months ahead?

A5: We’re talking more of the same, I think. The brokers have got us down for a significant, around about 20% growth in earnings EBITDA, and certainly higher than that in the profit.

As I said, we’ve got that strategy of growth in Advanced Materials, sorting out the operating losses in Paper and I think the key thing I’m looking for in over the next six months is for that Paper business to pass through the break-even point at some time in the fourth quarter. I think that will be a significant milestone, setting us up nicely for 2027 year-end.