In Goa, the electricity department has begun fieldwork that signals the start of a larger transition. Surveys are underway to prepare for a state-wide rollout of smart meters, aligned with India’s national Revamped Distribution Sector Scheme. Over 800,000 meters are expected to be installed under a DBFOOT model, where private partners design, build, finance, own, operate, and eventually transfer the infrastructure. Phase one focuses on government buildings and substations, then moves to commercial and domestic users. Importantly, the cost of the meters will be recovered directly from consumers through tariff adjustments.

The separation of capital outlay from utility balance sheets, combined with predictable tariff-based recovery, reduces financial friction for discoms and strengthens the case for rapid adoption. That directly benefits companies positioned not only to manufacture and install meters but also to operate and maintain them under long-term service contracts.

What is unfolding in Goa is a microcosm of a broader trend. Across Asia-Pacific, the number of smart meters installed is set to climb from around 857 million in 2024 to 1.3 billion by 2030, with India expected to contribute significantly to that growth. The country’s 250 million smart meter target by 2026 may not be met on time, but the direction is clear and irreversible.

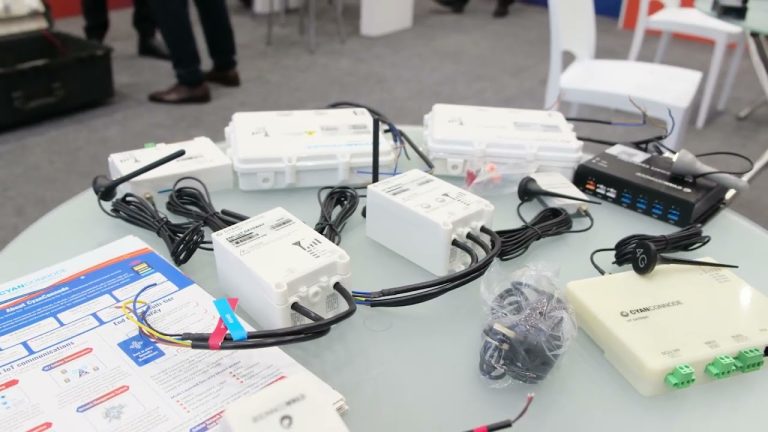

CyanConnode Holdings plc (LON:CYAN) is a world leader in the design and development of Narrowband RF mesh networks that enable Omni Internet of Things (IoT) communications.