GSK plc (NYSE: GSK) stands as a formidable player in the global healthcare sector, deeply embedded in drug manufacturing with a strong focus on vaccines, specialty medicines, and general medicines. Operating from its London headquarters, GSK’s extensive reach across the United Kingdom, the United States, and other international markets reinforces its influence in the industry.

Currently priced at $38.28, GSK’s stock reflects a slight dip of 0.03% with a price change of -1.30. Investors should note this small fluctuation as part of the broader market dynamics. The stock’s 52-week range of $32.08 to $44.26 suggests a relatively stable performance, indicating potential resilience amid market fluctuations.

Valuation metrics reveal a forward P/E ratio of 7.86, positioning GSK as a potentially undervalued opportunity compared to industry peers. The absence of other conventional valuation metrics like trailing P/E, PEG, and Price/Book indicates a focus on forward-looking earnings expectations, which may appeal to growth-oriented investors.

GSK’s financial health is underscored by a revenue growth of 2.10% and a robust return on equity of 27.10%, highlighting effective capital utilization. The EPS of 2.07 supports the company’s profitability narrative, while its impressive free cash flow of over $5.16 billion provides a solid foundation for sustaining operations and fulfilling strategic initiatives.

GSK’s dividend yield of 4.17%, coupled with a payout ratio of 79.84%, offers a compelling case for income-focused investors. The dividend policy reflects a commitment to returning value to shareholders while maintaining a balance with reinvestment needs.

Analyst ratings paint a mixed picture with 1 buy, 5 hold, and 2 sell recommendations. This diverse sentiment is captured in the target price range of $35.25 to $58.00, with an average target of $41.72, suggesting a potential upside of 8.98%. Such figures may entice investors looking for moderate growth in a stable industry.

Technical indicators further inform the investment decision. The 50-day moving average of $39.02 and the 200-day moving average of $37.12 provide context for GSK’s current trading position. An RSI of 62.92 indicates a stock approaching overbought territory, warranting cautious optimism. Meanwhile, the MACD of -0.20 and a signal line of -0.18 suggest a bearish trend, aligning with the recent price dip.

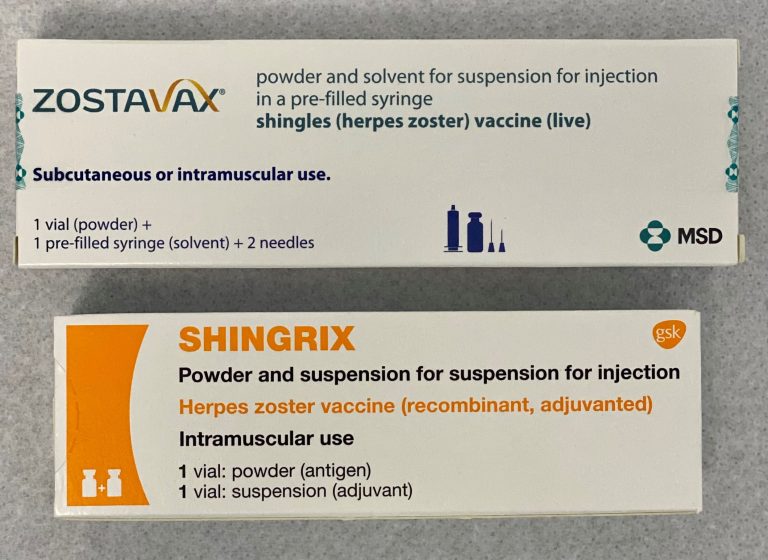

In its 308-year history, GSK has evolved, adapting to industry demands and technological advancements. The company’s collaboration with CureVac to develop mRNA vaccines exemplifies its commitment to innovation and addressing global health needs. Investors should consider GSK’s strategic positioning in the healthcare sector, its dividend appeal, and the potential for capital appreciation, making it a stock worth watching closely.