Mark Clubb, Executive Chairman of Team plc (LON:TEAM), commented on the likely rise in future taxation saying, “wise investors should protect their savings now, as financial advice will become even more valuable”.

Mark noted: Sitting outside the UK I found it quite ironic when the Prime Minister claimed that a Labour government would cost each household £2,000 in extra tax, only for the Spectator to estimate his own government’s spending plans at £3,000 per household on the same basis.

John Stepek’s analysis suggests that future taxation is likely to increase.

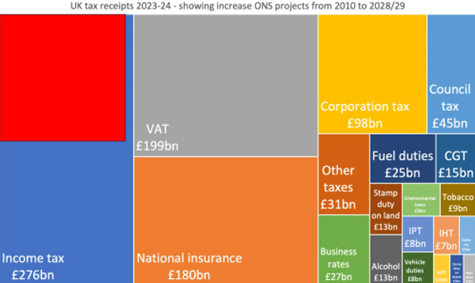

This point is further emphasized in Dan Neidle’s Tax Policy Associates blog, which shows that the £2,000 figure is insignificant compared to the overall increase in UK taxation projected by the ONS from 2010 to 2028.

Wise investors should protect their savings now, as financial advice will become even more valuable.