Shares in Johnson Matthey company symbol: LON:JMAT has risen 2.02% or 64 points in today’s trading session so far. Investors have remained optimistic during the trading session. The period high was 3232 dropping as low as 3162. The total volume of shares exchanged so far has reached 204,955 with the average number of shares traded daily being 717,674. The stock 52 week high is 3232 amounting to 67 points in difference on the previous days close and a 52 week low being 1614 a difference of some 1551 points. Johnson Matthey now has a 20 moving average of 3077.7 and the 50 day MA at 2905.17. The market cap now stands at £6,249.19m at the time of this report. All share prices mentioned for this stock are traded in GBX. Mcap is measured in GBP. This article was written with the last trade for Johnson Matthey being recorded at Tuesday, March 2, 2021 at 2:21:29 PM GMT with the stock price trading at 3229 GBX.

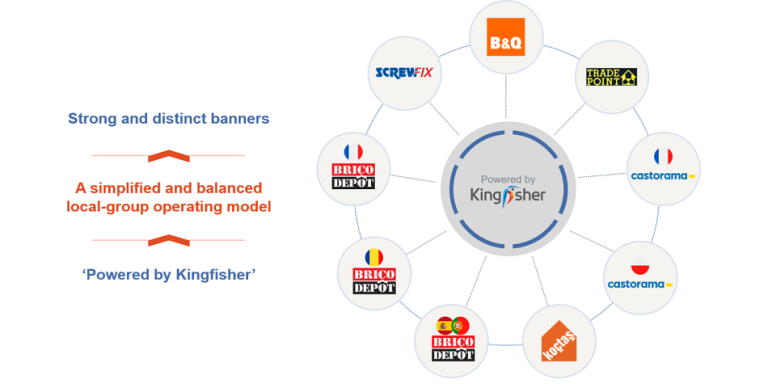

Shares in Kingfisher with EPIC code: LON:KGF has gained 2.21% or 5.9 points during today’s session so far. Buyers seem confident during the session. The period high has peaked at 274 and a low of 264.3. The total volume of shares exchanged so far has reached 1,407,198 with the average number of shares traded daily being 8,391,606. The stock 52 week high is 326.2 equating to 59.3 points different to the previous business close and a 52 week low sitting at 101 making a difference of 165.9 points. Kingfisher now has a 20 simple moving average of 278.65 and now the 50 day simple moving average now of 279.37. The current market cap is £5,758.35m at the time of this report. All share prices mentioned for this stock are traded in GBX. Mcap is measured in GBP. This article was written with the last trade for Kingfisher being recorded at Tuesday, March 2, 2021 at 2:21:40 PM GMT with the stock price trading at 272.8 GBX.

Shares of KRM22 EPIC code: LON:KRM has risen 4.71% or 1.98 points throughout the session so far. Traders have remained positive throughout the session. The high for the period has peaked at 43.98 dipping to 43.98. The total volume of shares exchanged through this period comes to 5,657 with the daily average traded share volume around 3,807. A 52 week share price high is 51.5 around 9.5 points difference from the previous days close and the 52 week low at 20 a difference of some 22 points. KRM22 now has a 20 SMA at 41.4 and now a 50 day simple moving average now of 41.18. The current market capitalisation is £11.75m at the time of this report. All share prices mentioned for this stock are traded in GBX. Mcap is measured in GBP. This article was written with the last trade for KRM22 being recorded at Tuesday, March 2, 2021 at 2:18:59 PM GMT with the stock price trading at 43.98 GBX.

The share price for Lookers company symbol: LON:LOOK has gained 4.72% or 1.9 points throughout the session so far. Traders have stayed positive throughout the trading session. Range high for the period so far is 46.05 dropping as low as 42. The number of shares traded by this point in time totalled 2,585,748 with the daily average traded share volume around 1,845,960. The 52 week high price for the shares is 47 equating to 6.6 points in difference to the previous days close of business and a 52 week low sitting at 10.54 is a variance of 29.86 points. Lookers has a 20 SMA of 41.2 with a 50 day moving average now of 41.54. Market capitalisation is now £165.05m at the time of this report. The share price is in Great British pence. Mcap is measured in GBP. This article was written with the last trade for Lookers being recorded at Tuesday, March 2, 2021 at 2:17:40 PM GMT with the stock price trading at 42.31 GBX.